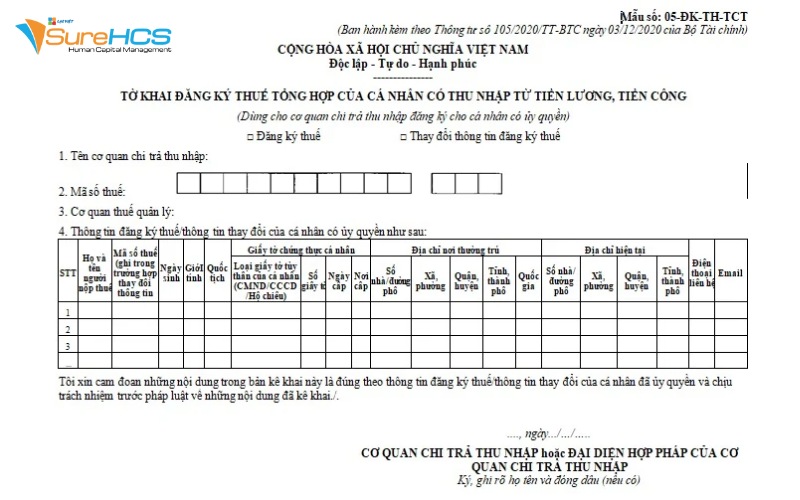

The following are instructions on filing a tax registration for individuals filing personal income tax (except for individual business); according to the form 05-DK-TCT circular 105/2020/TT-BTC on 03/12/2020.

Model no. 05-DK-TCT for personal use not business registration filing tax directly to the tax

- Item 1. Name registrant tax: Write clear, complete in capital letters personal name registration tax.

- Item 2. Information tax agents: a complete Record of the information of the tax agent in the case of tax agent contract with the taxpayer to carry out the registration procedure tax on behalf of taxpayers as prescribed in the Law on tax Administration.

- Item 3. Day, month and year of birth of the individual: specifies the day, month and year of birth of the individual tax registration.

- Item 4. Gender: Work on 1 in 2 car Male or Female.

- Item 5. Nationality: specifies the nationality of the individual tax registration.

- Item 6. Papers of the individual: Record the full information papers individual's tax registration as prescribed.(ID number, number of CCCD or passport number with date of issue and place of issue).

- Item 7. Address of place of permanent residence: a complete Record of the information about the address where the resident of individuals have been recorded on the book; or in the national database of residential, including:

– House number/street, village, hamlet.

– Ward.

– District.

– A province or city.

– National.

- Item 8. Current address: a complete Record of the information about the current whereabouts of the individual in the order as above.(only records when this address is different to address where the resident).

- Item 9. Phone contact email: Recording telephone number, email address (if available).

- Item 10. The agency paid income at the time of registration tax: Record agency paid income (DN, company,...) are working at the time of registration tax (if any).

The “agents” tax: Only in the case of agents, the tax declaration for the tax payer.

**Note: For personal filing personal income tax through the pay income and have the authorization for authority to pay income tax registration (COMPANIES, institutions...) will use the form 05-DK-TH-TCT

The management, tracking, data updates PIT requires not only the accuracy but also need to sync with the system of salary, bonus and benefits of the business

To optimize this process, software management, welfare LV SureHCS C&B support automatic synthesis, calculation and deduction of personal income tax, which helps businesses easily export tax statements, track history of payments and ensure compliance with the legal provisions in a fast, accurate.

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business.

Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable.

Highlights:

- Statistics structure, unlimited storage more 40 types of employee information; Information management, reward and discipline.

- System accurate timekeeping up to the minute, review, the flexible, the case of late, leaving early, forget to scan the card,...

- Automatically aggregate payroll costsbonus and temporary quotes, PIT finalization of monthly, year.

- Arrears access increases, additional adjustments, track throughout the process of SI.

- Welfare programs, flexible with 5 types of wage feelings.

- Integrated AI answered welfare policies, public – wage accurate.

CONTACT INFORMATION:

Hotline: 0901 555 063

Email: [email protected] | Website: https://www.surehcs.com/

Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

According to the source TVPL