Payroll process is a collection of step business carried out to determine the pay exact income for employees, including: collecting attendance data, determine the salaries and allowances applicable mandatory deductions, check – approve payroll, pay, and storage reports. A standard procedure to help businesses save time, reduce errors and comply with the law, increase the satisfaction of employees.

In any organization, payroll process is always one of the most important activities of the human resource management. Pay not only income but also is the record, the motivation, and also is a measure of the confidence of employees, for business. A payroll process transparency exactly the right term will help hold the mounts, limitation disputes, enhance brand reputation recruitment.

Therefore, the construction of payroll process in the business, professional, sync from stitch attendance to pay, reports not only help save time and cost, but also create a solid foundation for the long-term development.

The same Lac Viet SureHCS learn in detail about the process, timekeeping, and payroll in this article.

1. Why enterprises need to understand the payroll process?

In every organization, payroll process not just works that pay income for the employee but also as a critical tool to maintain stability and internal mount. When this process is clearly formulated done correctly, the business will create a work environment of transparency, strengthen the trust of employees, at the same time minimize the legal risks.

In Vietnam, many businesses still wage calculation on Excel or based on timesheets are not synchronized easily lead to status, errors, delay in pay. Only a small error in the formula or mistaken data can also make employees feel rights affected thereby reducing the motivation and sticking. With those businesses that can scale from a few hundred to a few thousand workers, the risk is greater.

Meanwhile, the deployment process payroll professional to bring value markedly:

- Minimize errors and disputes between workers and business.

- Save significant processing time, especially when the combination of processes, timekeeping, and payroll and automation software.

- Ensure full compliance with regulations on social insurance and personal income tax, the policy other laws.

Can say, embrace properly apply payroll process in the business is the foundation to improving effective personnel administration retain talent.

- 10 payroll software hr most striking 2026 popular

- Payroll software according to KPI optimal performance management, and pay fair wages for business

- Payroll software 3P LV SureHCS C&B automation salary calculation accuracy, ease of deployment

- How to calculate overtime pay, night work according to the Decree 145/2020/ND-CP

2. Payroll process is what?

Payroll process is a set of sequential steps that the business carried out to determine the exact amount of money that each employee is on the receiving end of pay period. This process usually starts from the synthesis of attendance data, apply the rules of salary, allowances, deductions mandatory (such as insurance and tax) and finish by paying wages to employees.

Essentially, this process helps to ensure three factors:

- Accuracy: Employees receive the correct amount corresponding to the effort and work time.

- Transparency: the Business can clearly explain all the numbers on the payroll when needed.

- Compliance with laws: All deductions filing is done right according to the current regulations.

For example: A manufacturing company has 300 employees. Previously, the hr department takes an average of 7 days to process payroll in Excel. When applied to process payroll for employees based on integrated software from timekeeping to tax, this time reduced to 2 days, at the same time the percentage of errors is also reduced by more than 70%.

Therefore, construction of payroll process in the business is not only beneficial for personnel, but also help management control costs effectively enhance the credibility and professionalism in the eyes of the employee.

3. The steps in the payroll process standard for business

The following are the basic steps to build process payroll for employees as follows:

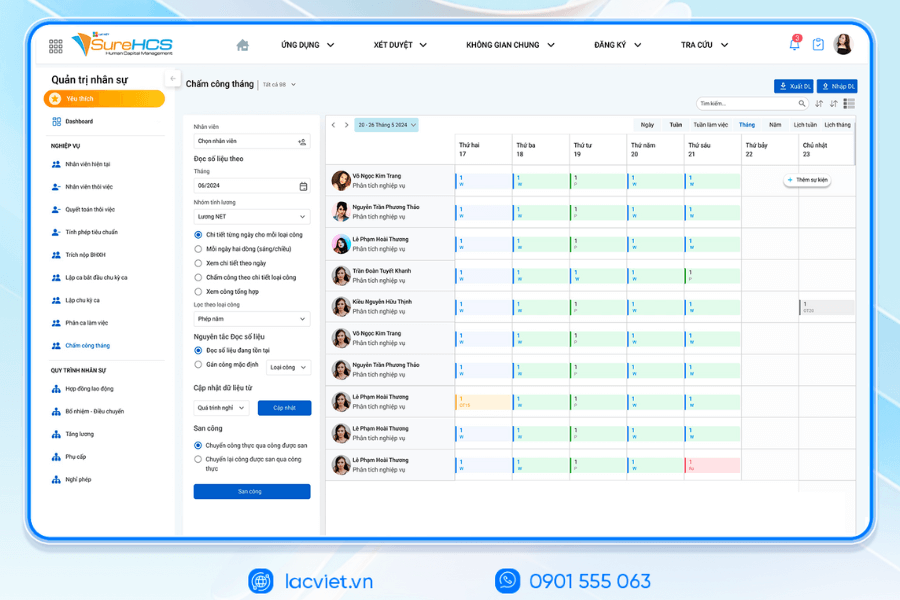

3.1. Collect attendance data for payroll accuracy

The first step in the process, timekeeping, and payroll is collecting data on the time actually worked by employees. This is an important basis to determine the number of days, hours, overtime, vacation, sick leave,... in order to calculate the income level of accuracy.

Businesses today often apply many methods of timekeeping various popular are:

- Machine fingerprint or face recognition.

- Magnetic cards, employee cards swiped through the system access control.

- Software HRM integrated online attendance, synchronized with the payroll system.

Errors frequently encountered in this step is the attendance data is not synchronized, the staff forgot to dot, or a device error. If not treated promptly, these small errors can lead to disputes when paid. Businesses should establish clear rules and have software to control focus in order to minimize this risk.

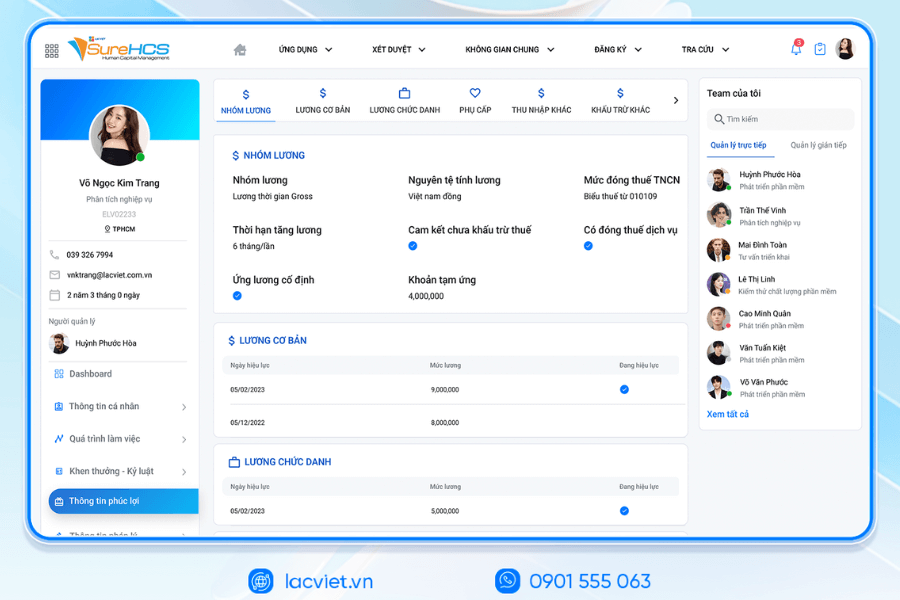

3.2. Define salary structure, allowances

After having had the attendance data, the next step of the payroll process for employees is to determine the structure of income. The income of employees usually include:

- Basic salary: under a contract of employment, base, premiums, calculate the allowances, deductions.

- Mature level: as level of responsibility, gasoline, telephone, dress ca.

- Commission/bonus: applying for the position of business, or when you reach KPI.

- The account other support: customize your corporate policy.

The design salary structure must be consistent with the labor law is clearly stated in the employment contract to ensure transparency. A salary structure clear not only help payroll process in the business smoothly, but also motivate employees, help them get the recognition from the business.

3.3. Apply policies, wages, bonuses, deduction

In this step, business conduct detailed calculation of the income of employees is based on attendance data, and salary structure was determined. At the same time, the policies, rewards, penalties, deductions also apply.

Cụ thể:

- Account plus: salary, overtime, bonuses, commissions.

- Mandatory deductions: social insurance, health insurance, unemployment insurance, individual income tax.

- Voluntary deductions: for example, contributing funds, trade unions, welfare programs internal.

Illustrative example: employee A has A base salary of 15 million. After public of 2 million and rewards performance 3 million, the total income is 20 million. Business will be conducted deduction of 10.5% coverage (about 2.1 million), personal income tax (if any). The result, real wages received by employees A longer period of 17.5 million.

So, apply policy, wage, deduction regulations will help the business ensure payroll process in the business place transparent comply with the law creating the trust for the employee.

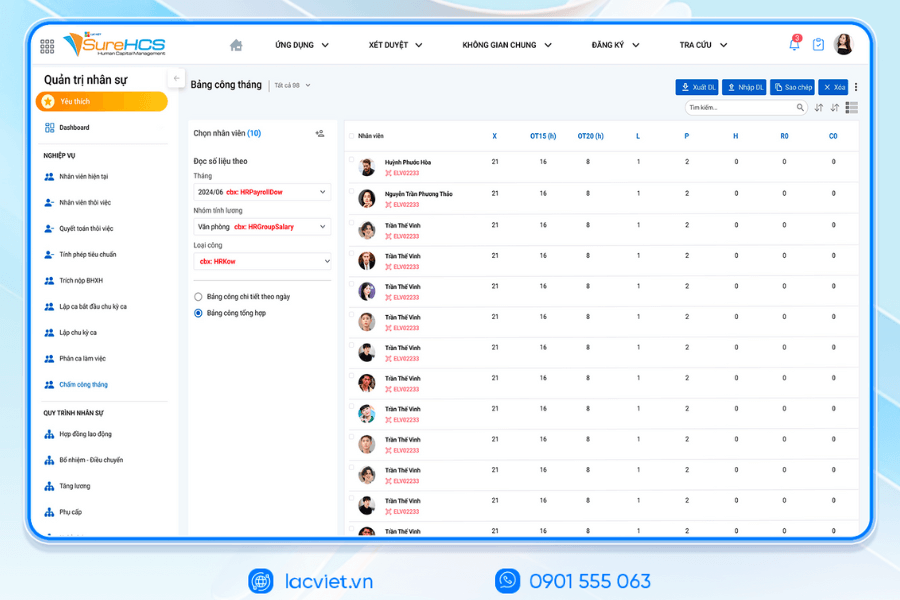

3.4. Check, check, approve payroll

After completing the calculation, the hr department need to set up payroll details for each employee. This is important to ensure accuracy before switching to the stage to pay.

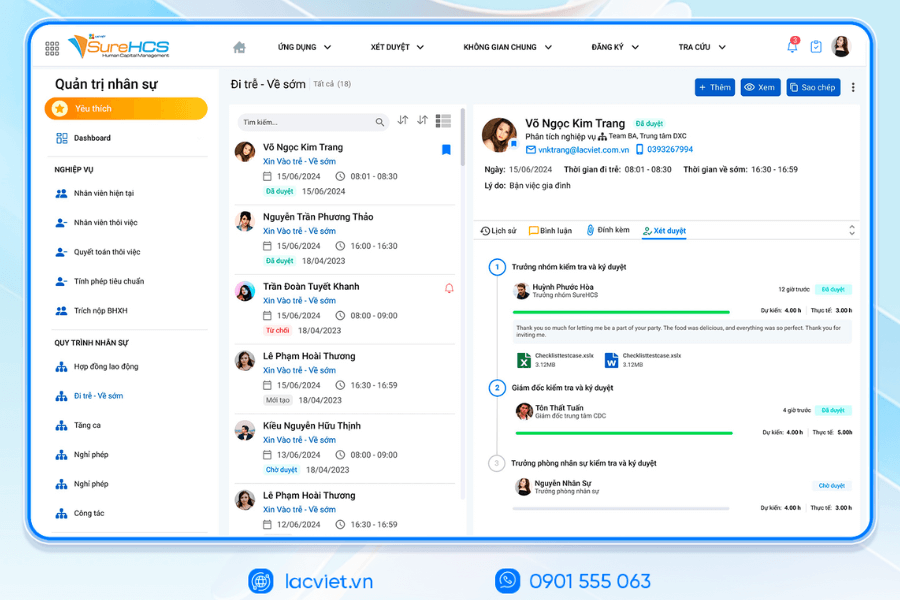

In fact, many business application approval process:layered

- Hr/C&B: test preparation salary table.

- Accounting department: collate budget confirmed the validity.

- Board of directors: final approval before making payment.

If you skip this step, the risk of error is very high, especially in business, there are hundreds or thousands of employees. The test as not only limit the disputes, but also to show the professionalism and transparency in payroll process in the business.

3.5. Paying wages to employees

When payroll was browsing, business, proceed to step pay wages to employees. This is the stage directly impact the experience of workers, by just delay or errors also can affect the psychological and attachment.

The form of paid downloads:

- Bank transfer: most used for fast, transparent and easy to store vouchers.

- Cash: suitable for small businesses or employees unskilled workers.

- Electronic wallet or account number: new trends, convenient, modern.

Paid time right term is the determinant satisfaction. According to a survey by PwC, there are up to 44% of employees feel that reduce sticking when business is slow wage more than 2 times during the year. This suggests that, to maintain stability in pay is an important part of the payroll process in the business.

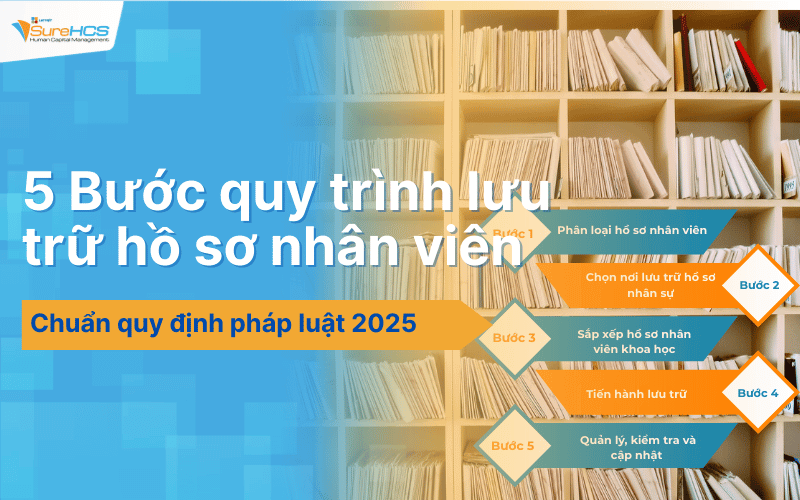

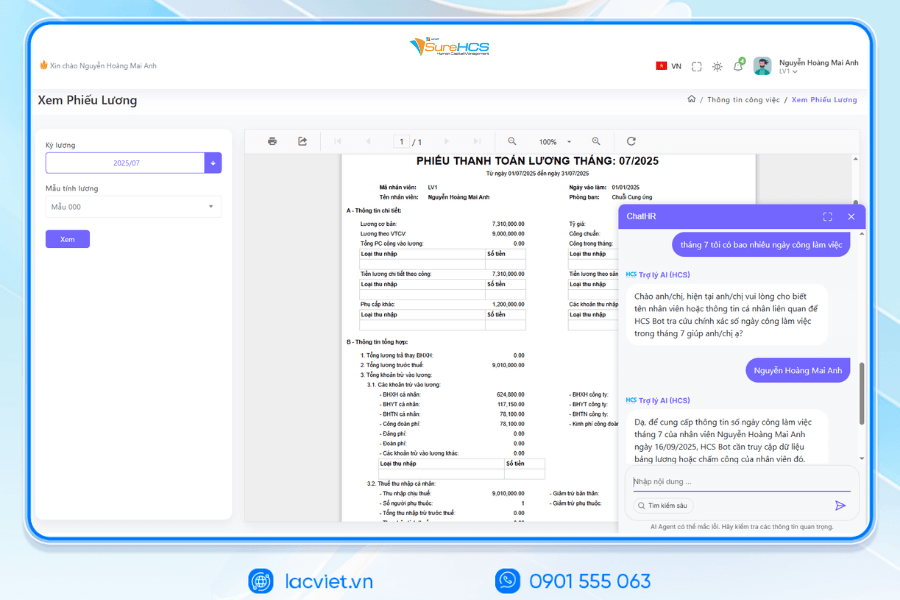

3.6. Reporting, data storage, wage

The final step in the payroll process is to make summary reports, and data storage. This is not only a mandatory requirement to serve the audit work, which is also important tools to help leaders, cost analysis, planning, budget, personnel in the future.

The type of report commonly encountered:

- Cost report wage according to departments and projects.

- Report on personal income tax, social insurance.

- Report analysis personnel costs by month/quarter/year.

The data storage salaries by system software to help businesses easily lookup when you need information security personnel better than store craft. This is an important part for the process to becoming a professional, transparent optimization in the long term.

Thus, the entire payroll process for employees, including 6 steps from timekeeping to report was closed. Business fully applied science will save a lot of resources, ensure the fair and increase the confidence of employees for the organization.

4. The common challenges in payroll process

Although there were frame clear process, but when deployed in fact, many businesses still encounter no less difficult. These common challenges can be listed as:

- Flaws attendance data: This is the biggest cause led to the payroll wrong. An employee forgot attendance or timekeeping device error can drag to a series of deviations in the pay table. If not detected in time, the business will take a lot of time to adjust, to dispute with the employees.

- Difficult when calculating insurance, personal income tax: In Vietnam, policy, social insurance and personal income tax change frequently. This requires parts C&B have constant updates, apply exactly to each particular case. Just miscalculated a small number can also cause business is management agency fine or employee is not satisfied because the rights affected.

- Time consuming if handled: With these business have over 200 employees, managing payroll in Excel can spend all week per month. Not only is this misappropriation of resources, but also potential risks of errors formula or input errors.

- Difficult to expand as your business grows: A payroll process can be temporarily accepted with a small scale. But when the number of employees increased rapidly, businesses will have difficulty in the synchronization of data, cost control, maintaining transparency.

If the business has the accounting profession simply in need of it salary calculation through excel will be the preferred option. However, if the business is large-scale and complex business, then the application software on the management salary calculator will bring many advantages such as:

- 65000 lines is the maximum number that excel provides for users. With the scale of big business thousands of employees, they must set up multiple tables excel can manage enough. The stored information would file overwhelmed cause difficulties in the use, share. Not to mention when there are errors, then the review errors check also take much of the duration of the implementation. But for software, things can be solved easily and more quickly.

- Review on security, the software will be set up the distribution rights according to the function, so the user may not delete data when not allowed. Also for the excel file to share or transfer data if you accidentally deleted or disturbance information is very easy to make changes affect the results.

- When using excel, the user must manipulate the input and performs functions craft is take a lot of time and effort. Meanwhile, the mechanism of self-integration of software to help shorten the time, effort, and support users more easily.

Therefore, more and more organizations choose the application management software to optimize payroll process in the businessminimize risk, enhance operational efficiency.

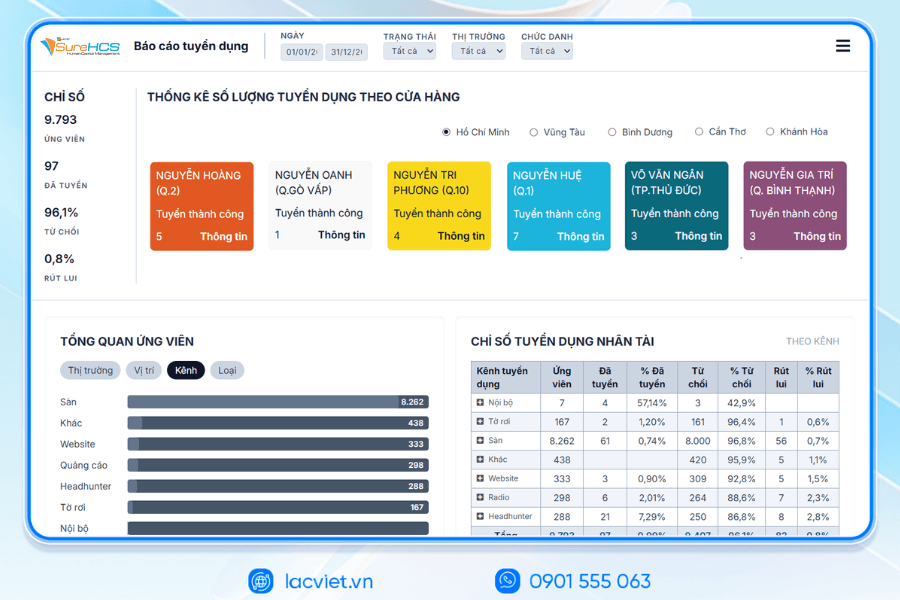

5. Optimal solutions payroll process with software, Lac Viet SureHCS C&B

To solve the above challenges, many businesses in Vietnam have selected training management software – payroll – benefits Lac Viet SureHCS C&B. This is a solution designed depth, in accordance with the peculiarities of personnel policy and the laws of Vietnam.

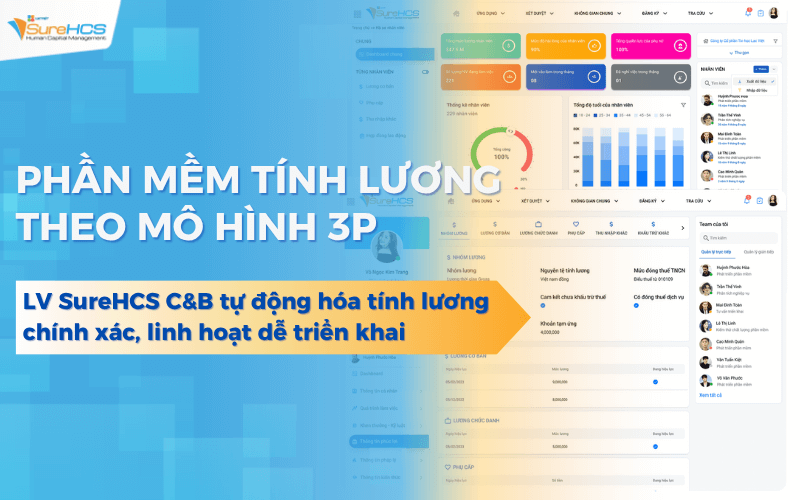

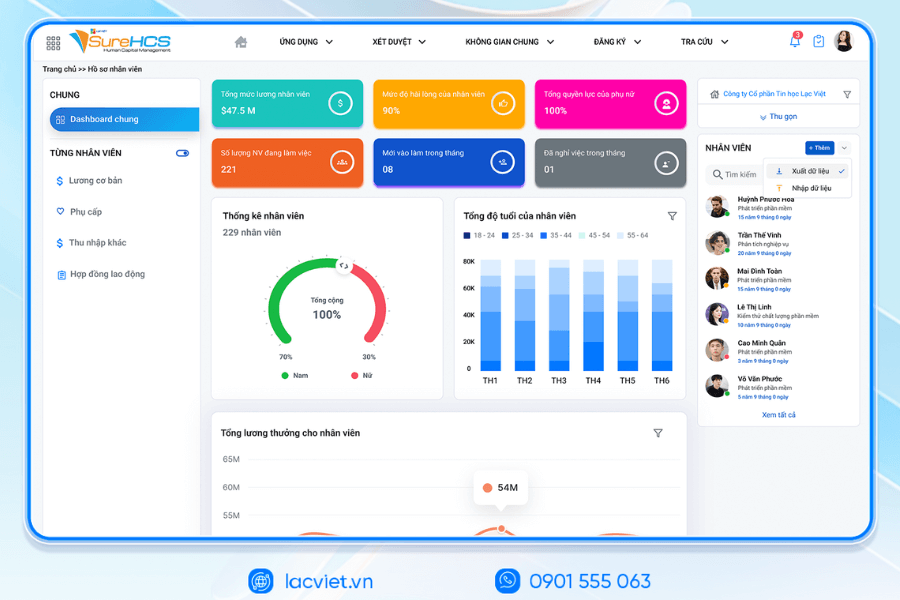

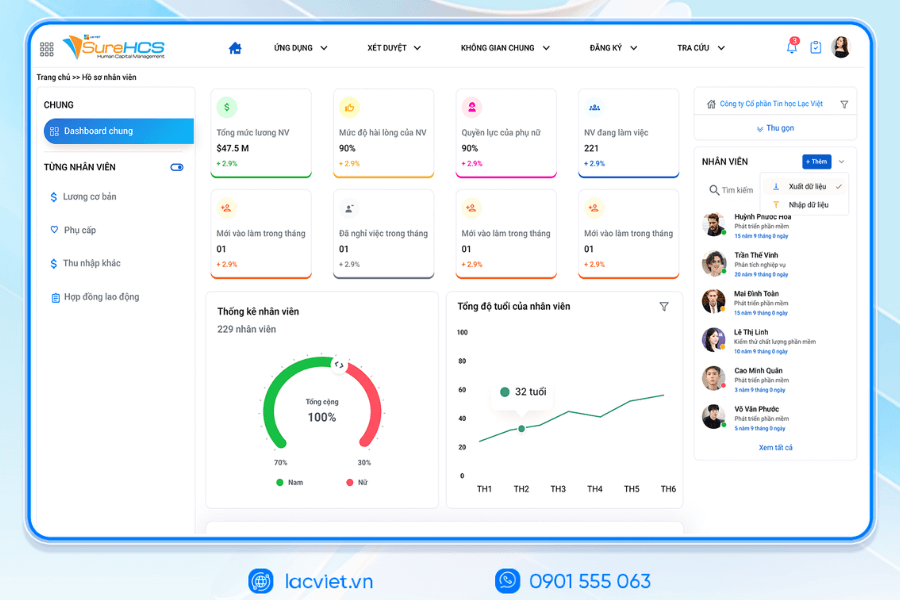

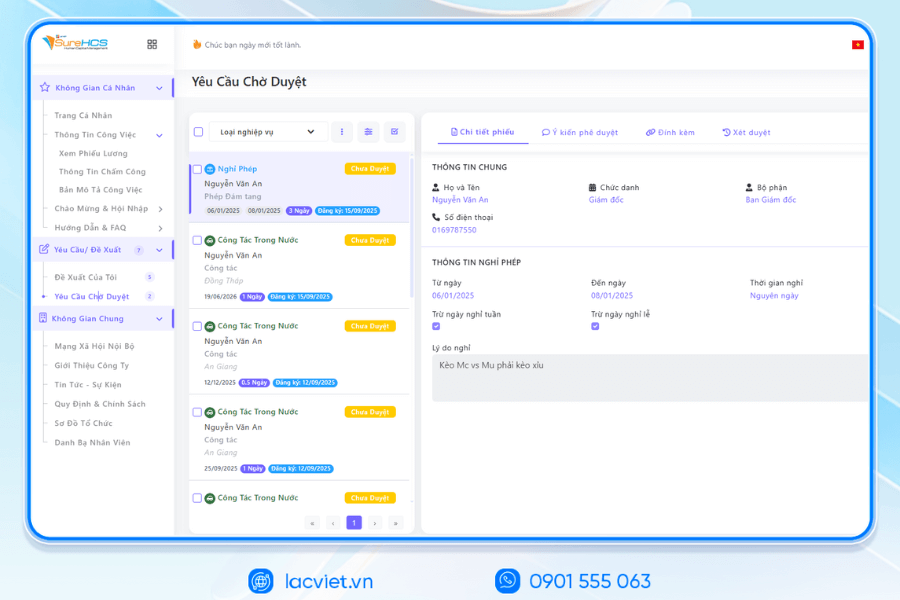

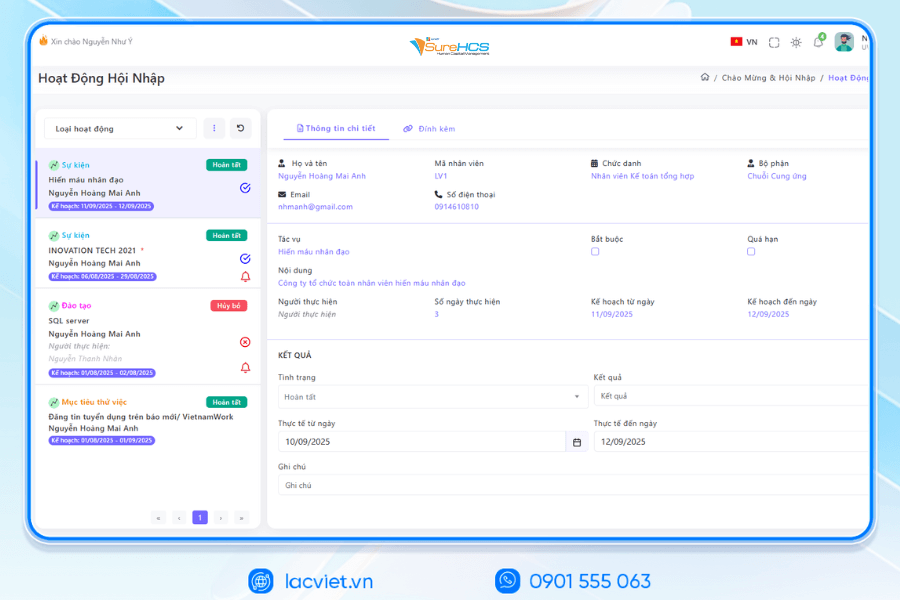

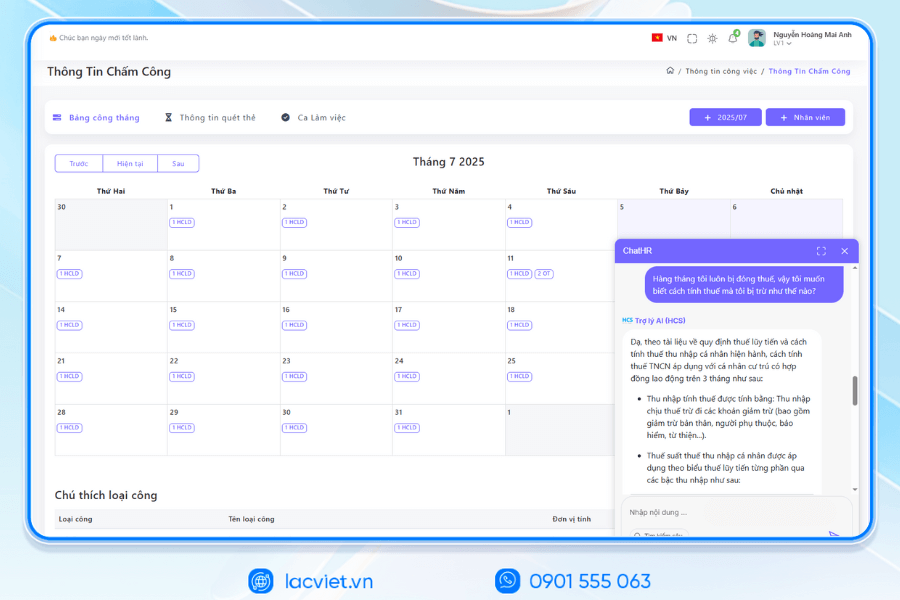

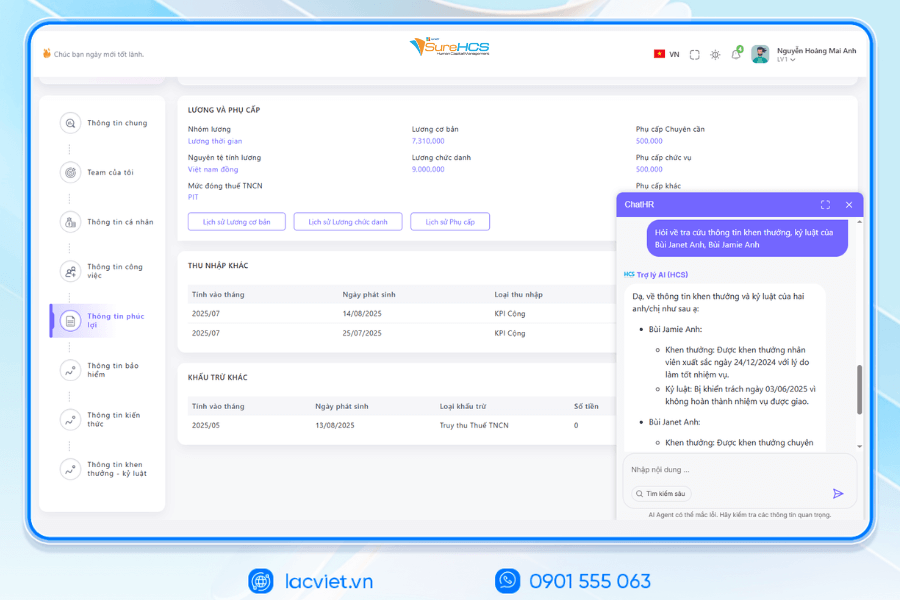

- Automate the entire process timesheets – payroll; SureHCS C&B business direct link data from attendance system into the payroll process. Thus, errors are removed, transparent data updated in real time.

- Payroll accuracy, compliance law; integrated software available the regulation of insurance, personal income tax, easy to update when changes are made. This ensures businesses always comply with the law, minimize the risk of violations.

- Save time, enhance productivity: Instead of take 5-7 days to synthesis and processing payroll, the business just a few hours with the automated system of SureHCS C&B. shortened Time to 70% helps to parts C&B focus more on the work other strategies.

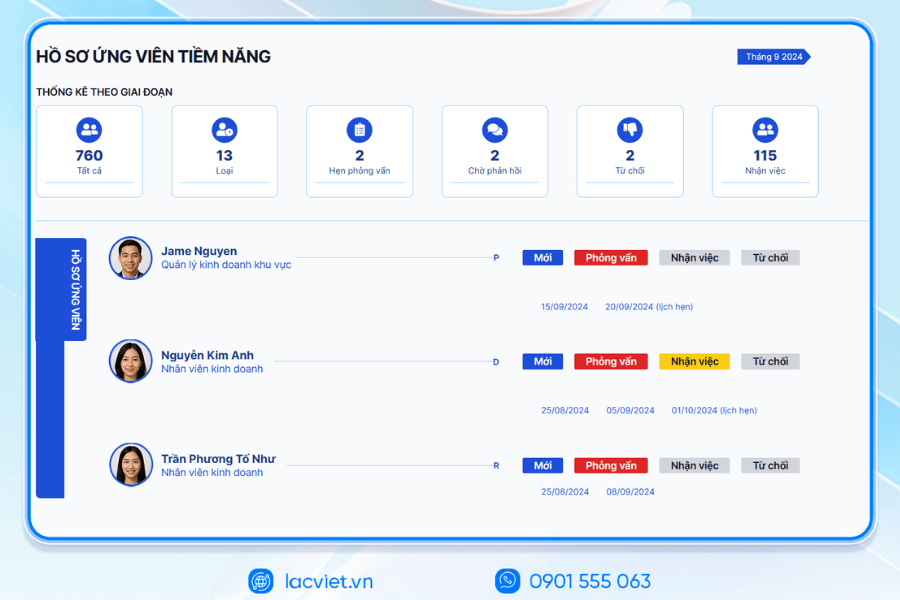

- Extended support to scale the business: Whether businesses have a few hundred or tens of thousands of employees, the software remains stable operation. This is especially useful for businesses that are expanding production or develop new branches.

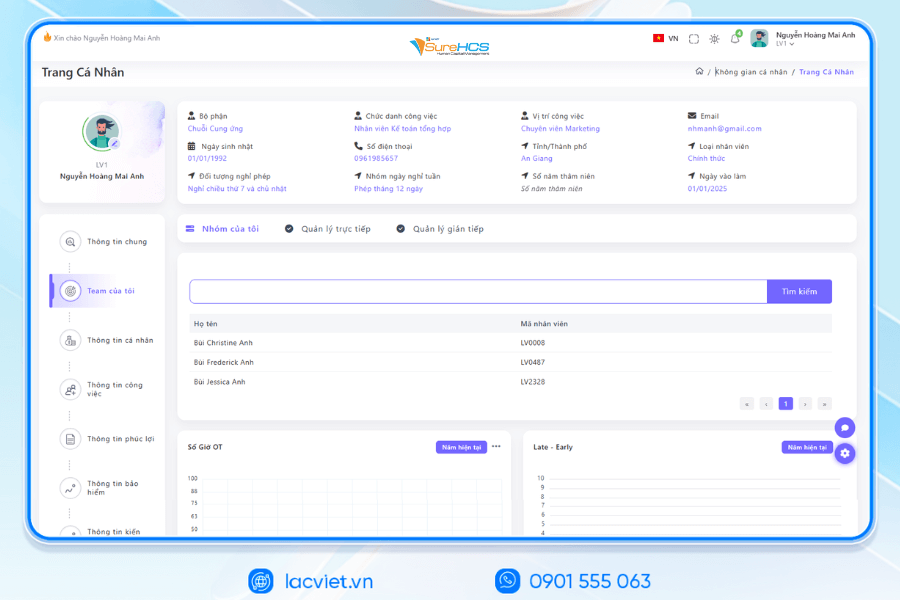

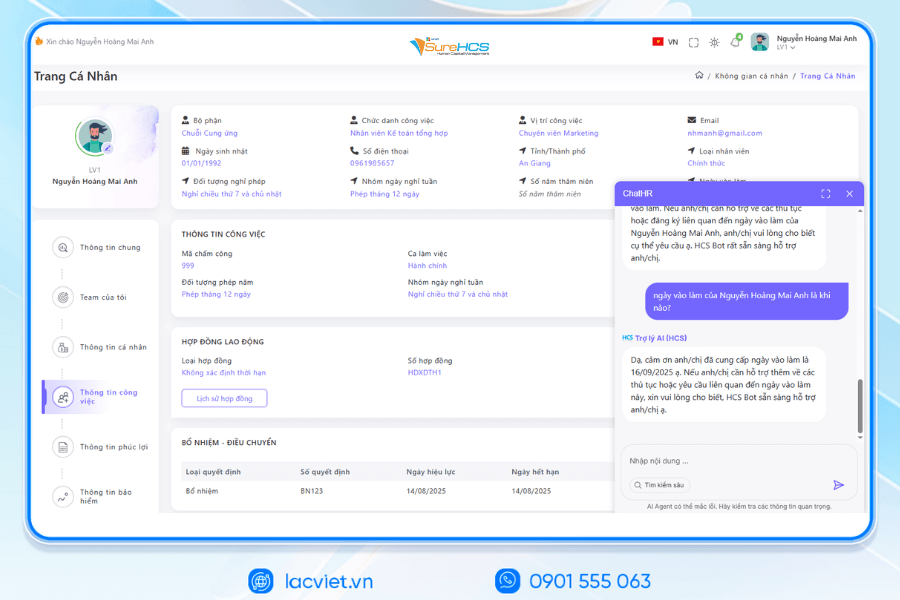

- Increase experience employees: Employees can easily lookup the salary, allowances, bonuses, deductions through the electronic portal or mobile app. Transparency is not only strengthens faith, but also raise the level of satisfaction long-term commitment to the business.

CONVERT THE NUMBER OF PERSONNEL WITH COMPREHENSIVE LAC VIET SUREHCS

LV SureHCS is the solution in hrm comprehensive (HRM) is developed by Lac Viet from 1998, now serves more than 1,000 businesses in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013. Platform help of optimized every aspect from recruitment to employment, improve the experience of staff and effective management of resources.

Feature highlights:

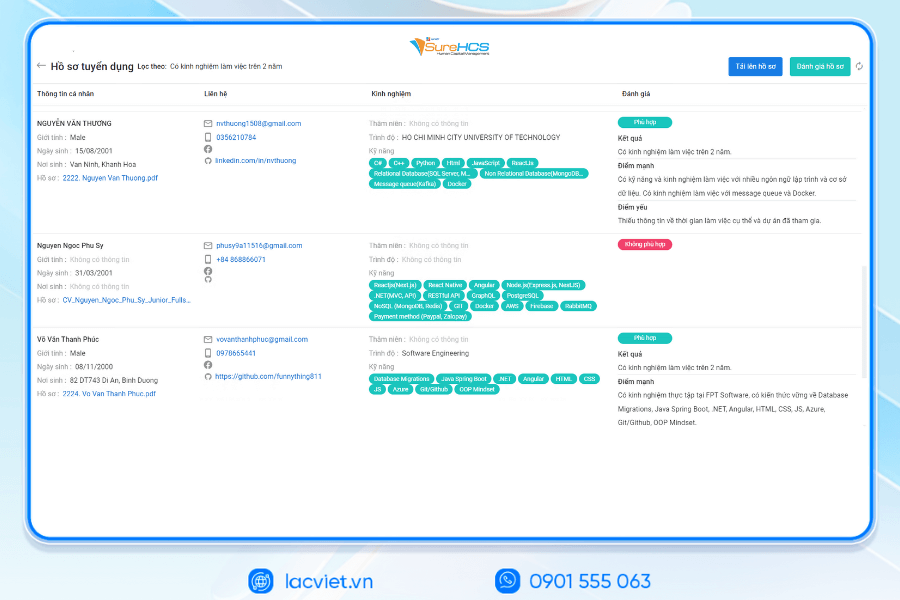

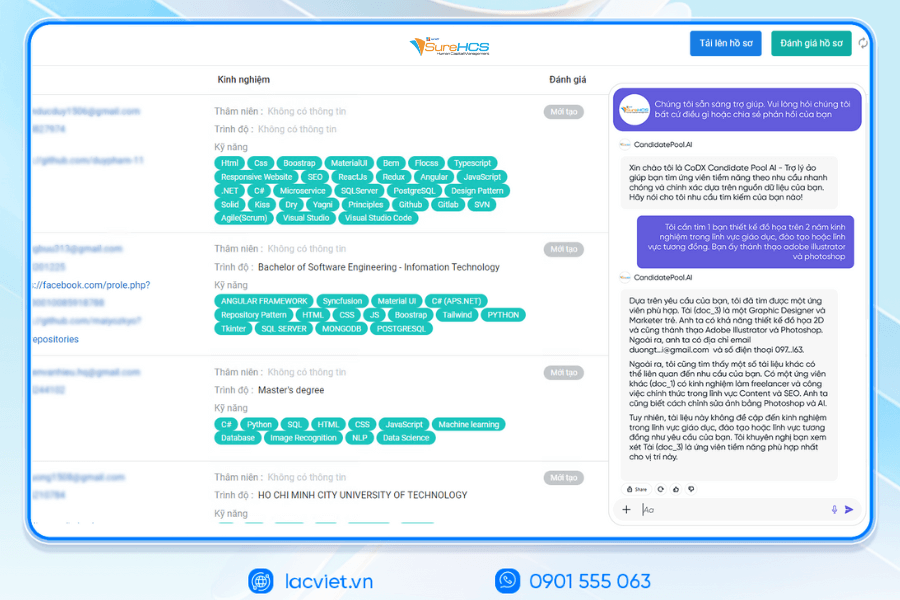

- Candidate Pool AI + AI Resume: automatic dissection CV any format, search for suitable candidates instant, a 70% increase quality, reduce recruitment time significantly

- Timekeeping software – payroll – C&B auto: integrated benefits, overtime, insurance, export report, payslip correct for business scale up to 10,000 employees

- Experience hr – wallet reward – ranking behavior – survey periodically: internal management, honor, mounted staff in real time.

- Assessment and capacity development: KPI/OKR flexibility, feedback 360°, the proposed route train personalization according to the evaluation results

- Internal training & LMS integrated AI: learning anytime, anywhere, content management, multi-modal with personalization from AI

- Dashboard BI + AI Advisor: real-time reports, suggestions leadership decisions based on data resources.

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SIGN UP TO RECEIVE DEMO NOW

BUSINESS IS WHAT WHEN DEPLOYING SOFTWARE LAC VIET SUREHCS?

- Comprehensive solutions from A‑Z cover the entire process of HR from recruitment, profile, attendance, payroll, benefits, training, reviews, experience staff

- Highly customizable & flexible connection to suit any scale, industry, easy to connect with ERP, finance, office of chemical

- Save cost & performance enhancement help to lose 40-60% of the cost of operating personnel, retain talent, improve the work efficiency

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

With Lac Viet SureHCS C&Bbusinesses not only have a tool wage calculation accuracy but also possesses a system of personnel administration comprehensive help optimize costs, increase transparency built environment professional work.

If your business is looking for a solution to standardize and automate the payroll process in the business, let's start today. Please contact us to get free advice or testing, software personnel management from Vietnam SureHCS to help you build hr systems, transparency, professionalism sustainable development.