Attractive salary no longer the only factor retaining talent. Modern businesses need to build a system remuneration policies and welfare basically, transparent and in accordance with the law to create the working environment, ideal, promote working efficiency and long-term connection.

However, many businesses, especially the small and medium companies, still struggling with The question: “what policies, what is required? How to design the system of remuneration sensible that no team cost?”. The article below of SureHCs will help you understand the nature of the remuneration policy and welfare, at the same time hint 6 policies required business need apply..

1. Balanced remuneration policies and welfare – the Secret rose mount, up the holiday

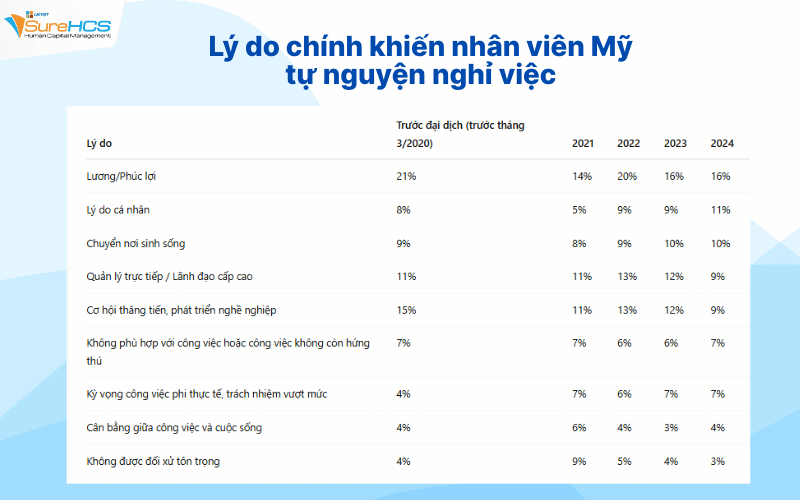

Follow report of Gallup in the year 2024, there 16% staff at the U.s. left the company to seek wage or welfare better. Remuneration policy – welfare, if designed properly, will become a “bridge” between your business goals and expectations of employees.

A system that benefits not only help retain good people, but also:

- Increase motivation and improve performance.

- Mounting employees with corporate culture.

- Optimal staffing costs by reducing the rate of the holiday.

More importantly, these policies should be built in a transparent, systematic, and comply with the law, to avoid the risk of labor disputes, which could affect the credibility and operating costs of the business.

2. Learn remuneration policy and welfare, what is?

Remuneration policy and welfare is the set of rules and modes that businesses apply to pay, record and take care of life for workers. This is an essential part in strategic human resource management modern.

Consisting of three main groups:

- Salary: Account fixed income business committed to pay monthly based on the contract of employment, qualifications, abilities or work location.

- Enjoy: Account added bonus to acknowledge achievement, the results of work, dedication, outstanding or special occasions such as holidays.

- Benefits: Support policies, in addition to salary, such as social insurance, health insurance, vacation, travel, periodic health examination, tuition assistance for children and...

3. [Update] The remuneration policy and welfare mandatory business need

To ensure legal compliance and create a working environment that fair, businesses need to build and implement the remuneration policy and welfare follows:

3.1 Regulation of working time

According to The Vietnam Labor law, working time standard no more than 8 hours/day and 48 hours per week. Businesses can choose to work 6 days/week (per 8 hour day) or 5 days/week (every day of 9.6 hours).

In addition, enterprises need to specify about:

- Flexible working hours: allows employees To adjust the start time and finish the job in the time frame given, for ensuring a sufficient number of hours of work standard.

- Overtime (overtime): Must have the consent of the employee and does not exceed 50% of the normal working hours in a day, a total of no more than 12 hours/day, 40 hours/month and 200 hours/year (in some exceptional cases, a maximum of 300 hours/year).

- Vacation time between the hours of: at Least a 30 minute break during the work shift during the day and 45 minutes for the night shift.

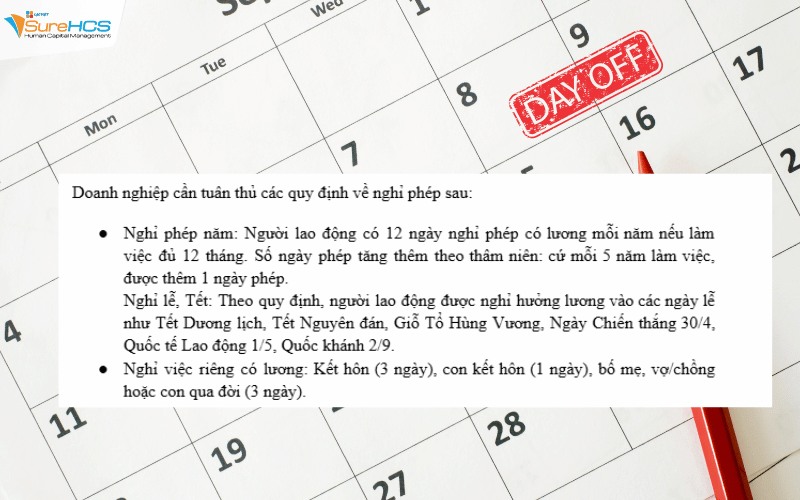

3.2 leave policy

Businesses need to comply with the provisions of leave following:

- Annual leave: The employee has 12 days of paid leave per year if working full 12 months. The number of days allowed to increase, according to seniority: for every 5 years of work, was added 1 day license.

Holiday: As a rule, workers are entitled to paid on holidays such as lunar new year, lunar new year, the death Anniversary Hung Vuong, victory Day 30/4, international Labor 1/5, 2/9. - Separate wage: married (3 days), child marriage (1 day), parents, spouse or child died (3 days).

3.3 insurance policies labor

Businesses are responsible for the type of compulsory insurance for workers, including:

- Social insurance (SI): Make sure the mode as sickness, maternity, accidents at work, retirement and death

- Health insurance (health INSURANCE): Service provider clinics for employees.

- Unemployment insurance (UI): Support workers to lose jobs.

The rate of insurance contributions are specific rules and business need to adhere to in order to ensure rights for workers.

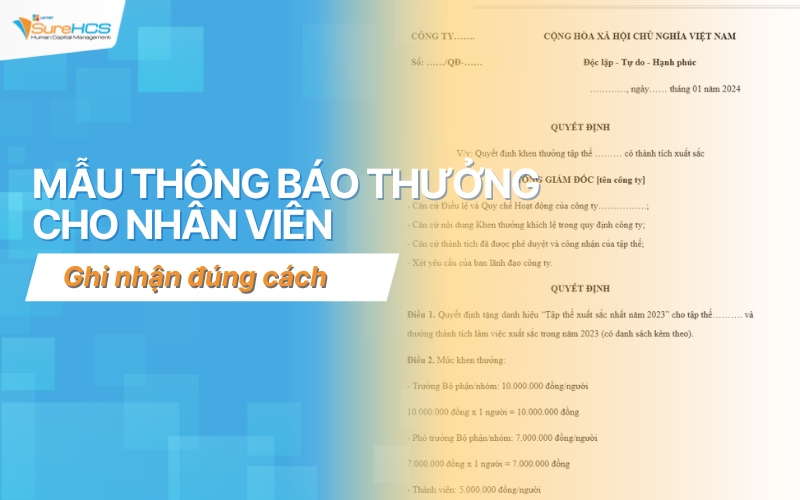

3.4 reward policies

Reward is important tool to motivate and recognize contributions of employees. Business should be built reward system based on:

- Job performance: Reward according to the results achieved against objectives.

- Initiative, improved: Recognition of new ideas, effective solutions due to staff suggestions.

- Seniority: Honoring employees have time to stick with the company long term.

Reward policies need transparent, fair, and be communicated clearly to all employees.

3.5 work free

When employees perform work in addition to its headquarters, enterprises need to support the account such as:

- Travel expenses: Airfare, train, car or petrol car if you use personal vehicles.

- Costs of stay: Rent hotels, motels in task time.

- Allowances work: Support food and drink, daily activities.

The work cost should be clearly defined in the internal business, ensure reasonable and consistent with reality.

3.6 minimum wage satisfactory

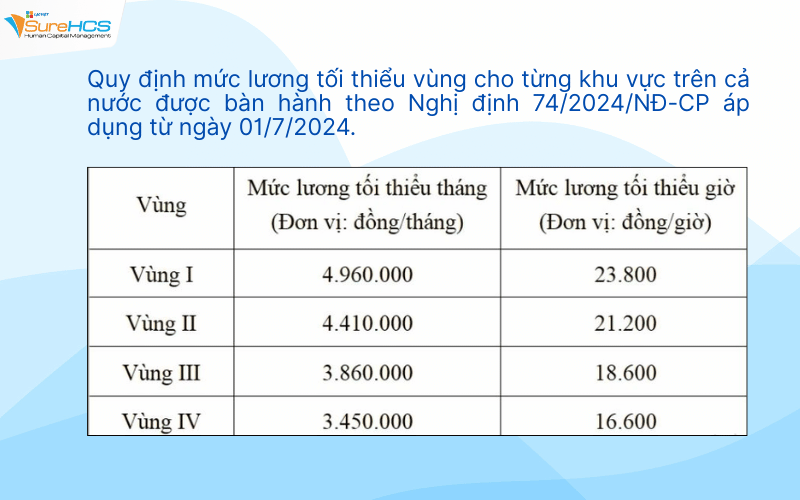

Businesses pay wages to the employee not less than the minimum wage prescribed by The government, based on:

- Region I: Apply to the big city and regional development.

- Regions II, III, IV: Apply to the rest area, with the minimum wage gradually reduced.

In addition to compliance with the minimum wage, businesses should build the wage system based on:

- Work position: Properties, requirements and responsibilities of the job.

- Individual capacity: Qualifications, skills and experience of staff.

- Market situation: The general wage of industry area.

4. Program design salary and benefits fulness with LV SureHCS C&B

In the context of the labor market increasingly competitive, the construction of a program, policy, payroll, and benefits transparent, flexible, lawfully and in accordance with corporate culture is the key factor to retain talent. However, a lot of businesses have trouble:

- Manage your dispersed information, easy to errors when calculating salary and bonus.

- Not updated with the new rules on insurance, working time, minimum wage.

- Difficult to analyze and adjust policy in a timely manner to suit each group of employees or business stage.

Solution LV SureHCS C&B is a right-hand resources to help businesses digitize the entire process C&B – from timekeeping, payroll, insurance, personal income tax, to manage, leave, allowances, benefits – all on a single platform.

Developed from more than 27 years of experience in the software industry personnel, SureHCS was serving 1,000+ businesses and 100,000+ users C&B, LV SureHCS C&B doesn't just help reduce the load of manual work, but also to optimize costs, increase transparency, ensure proper law and support the development of culture, welfare mounted.

Feature highlights:

- Automation from stitch collect attendance data, performance, to calculate salaries and bonuses.

- Sync policies on rewards and benefits, depending on the department, rank, or KPI.

- Limit errors thanks to its formula, flexibility, keep abreast of the provisions of current legislation.

- Track, update fast, the rights of each employee: insurance, sabbatical, maternity leave, allowances, travel,...

- Automatic warning when the employee insurance expiry, to the increase in salary, eligibility, annual leave,...

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business. Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable. Highlights: CONTACT INFORMATION: Hotline: 0901 555 063 Email: [email protected] | Website: https://www.surehcs.com/ Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Remuneration policies and welfare not only is the legal responsibility, but also the “levers” strategy helps businesses retain talent, enhance the performance and construction of cultural cohesion. Particularly in the context of competitive personnel increasingly harshly, designing and operating a system of C&B transparent, flexible, true law is that can't see the light. If you are looking for a comprehensive solution that helps digitize and optimize process management C&B – from timekeeping, payroll, to benefits and coverage – LV SureHCS C&B main is the ideal choice.

CONTACT INFORMATION:

- Solutions talent management & Human resources comprehensive LV SureHCS

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: [email protected] – Website: https://www.surehcs.com/

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, ho chi minh CITY. Ho Chi Minh