Sample payroll is an important document to help businesses manage wages, allowances, deductions and income actually received by workers in a transparent manner, in accordance with the law. Use the correct form payroll not only help business payroll accuracy but also reduce tax risks, insurance leads to labor disputes.

In this article Lac Viet SureHCS will provide the template, payroll, popular analysis applying the actual tutoring business guide to choose from suitable templates with scale, peculiar to operate.

1. Payroll staff what is?

Payroll staff is the document embodies the entire information about income, deductions and the amount actually received by the employee in a pay period (month, week, or according to the project). In fact, the pay table is usually made in the form of payroll Excel or management on payroll software, depending on the scale, the level of complexity of the business.

Learn a simple, payroll answer to the three most important questions:

- Business paid for?

- How much and for what reasons?

- After excluding the obligations under the regulations, the workers actually get, how much?

For new business establishment, the use of template employee payroll Excel help deploy fast, easy-to-edit. However, no matter in what form, payroll still need to ensure sufficient content, clear accordance with the law.

2. The mandatory component in a template, payroll standard

A sample of the pay table is full, easy to apply should ensure that the group following information.

2.1 basic information of the employee

This is the group information platform, helping businesses manage, control and data precision:

- They and employee name

- Employee code

- Departments

- Title or job position

This information helps to avoid confusion when a business has multiple employees with the same name, at the same time convenient for the synthesis of the cost paid by the departments and projects.

2.2 The earnings in the sample payroll

This is the business and employees care about the most. Typically include:

- Basic salary:

Is wage agreement in contract labor, making bases covered, the modes involved. - Allowances:

Can include extra level position, responsible, edible, ca, gasoline, telephone... Purchase policies of each business. - Other income:

Overtime, bonuses, commissions on sales.

Illustrative examples:

An employee whose basic salary 10 million allowances eat ca 730.000 copper, overtime 1 million, the total income before deductions is 11.730.000 copper.

The separation of each account to help businesses to control costs and staff understand the source of his income.

2.3 The deduction under the provisions

Under current regulations, the payroll should show you clearly the mandatory deductions:

- Social insurance, health insurance, unemployment insurance

- Personal income tax (if incurred)

- Other deductions under the agreement legally

The transparency of this account to help businesses avoid misunderstanding that “the wages deducted for no apparent reason”, at the same time ensure compliance with regulations of the tax authorities, and insurance. Reference: https://www.gdt.gov.vn

2.4 food get – only number of workers are most interested

Food pick is the final amount the employee receives after all income and minus the deductions.

Recipe popular:

Salary actually received = Total income – Total deductions

Business should present this indicator is clear, easy to look in the sample employee payroll Excel or payroll software. Here are important factors to help increase the trust of workers and limiting the dispute is not worth having.

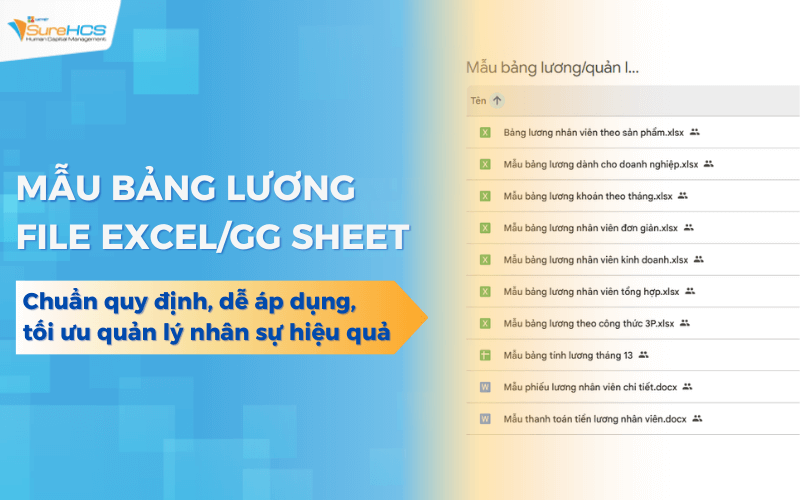

3. Synthetic samples payroll popular today

In fact, there is not a template, payroll, “standard only” apply to every business. The selection of the sample payroll depends on the particular job, the way labour organization and policy to pay the wages of each unit. Below is the sample payroll are in common use today, especially in the business in Vietnam.

3.1 Sample payroll over time

Sample payroll time is the most common form, usually applied to administrative staff, office managers, the working position according to the current administrative fixed.

Main characteristics

- Salaries are calculated based on the duration of work: by month, by day or by the hour.

- The main base is the number of the actual date, the number of overtime hours (if have).

- Usually presented in tabular form salary calculator Excel or integrated directly from the timekeeping system.

Limitations should be noted

- Difficult to accurately reflect the work efficiency if only based on time.

- If attendance management hasn closely, business development costs, wages are not commensurate with productivity.

3.2 Sample payroll by product or sales

Sample payroll this is usually applied to business production, sales, trading, where the work results can be measured directly by products or revenue.

Main characteristics

- Earnings of workers with direct mounting number of finished product or the sales reach.

- Payroll is often made clear: unit price, production, sales, commissions.

- Can combine basic salary + salary products/sales.

Restrictions

- Income volatility between the states, to cause psychological instability if the policy is not clear.

- Enterprises need to build a template, payroll, transparency, avoid arguing about how

3.3 Template, payroll, shift, crew, or flexible working

Sample payroll is popular in business, manufacturing, retail, logistics services, where employees work in shifts or flexible hours.

Main characteristics

- Salaries are calculated based on the number of work shifts, day shift – night shift, ca strengthened.

- May arise allowance, night shift allowance, toxic overtime.

- Payroll is usually fastened with attendance data details.

The important note

- Need to comply with strict rules on overtime, night shifts, according to The Labour code.

- If management by spreadsheet payroll Excel, business prone to errors when the number of ca complex.

3.4 Sample payroll according 3P

Payroll 3P is paid model modern is many businesses used to attach salary to the value of work and the working efficiency of workers.

3P included

- P1 – Position: Salary according to the job position.

- P2 – Person: Pay according to ability, personal experience.

- P3 – Performance: Salary according to the results, performance work.

Characteristics of the sample payroll according 3P

- The pay table is separated clearly each component P1, P2, P3.

- P3 often fluctuations in performance reviews.

- Ask data input the correct consistency.

With this model, the use of template employee payroll Excel only suitable in the early stages. When the rating system and data increasingly complex business should consider support tool in order to avoid confusion between the components of salary.

3.5 Template, payroll exchange by month

Payroll exchange according to months, usually applied for the position have the volume of work clear, measurable by the beginning of the or output, such as: construction, commissioning, technical services, warehousing and transportation.

Characteristics of the sample payroll exchange

- Wage agreement is fixed for a certain amount of work in months.

- May be accompanied by conditions of quality, progress, or KPI.

- Do not depend entirely on the number of days the reality.

Note when applied

- Need specified criteria, completed the work in order to avoid disputes.

- Sample payroll must clearly express the exchange, terms of payment and deductions (if any).

3.6 Template employee payroll business

Staff the business is to group objects income volatility, so that template, payroll should be made clear the account fixed and variable.

The common structure of templates employee payroll business

- Basic salary or wage guarantee.

- Roses in sales or profits.

- Enjoy exceeding targets, rewards according to sales program.

- Deductions as prescribed.

In fact, many businesses start with template employee payroll business Excel. However, when the policy commission, multi-tier or changed frequently, the management will take a lot of time potential risks flaws.

3.7 spreadsheet Template monthly salary 13

13th month salary is the additional income common, usually are paid at the end of the year to acknowledge the engagement and contributions of workers. Sample spreadsheet 13th month salary to help enterprises aggregate, calculate, and pay this account in a transparent manner, consistent.

Characteristics of the sample table 13th month salary

- Bases are usually based on the average salary, basic salary or gross income of the employee during the year.

- Can be applied in proportion to the time actually worked (for example: full 12 months enjoy 100%, 6 months enjoy 50%).

- Not mandatory by law, but need specified in regulation compensation or labor agreement.

In fact, many businesses still set up sample tables 13th month salary on the salary calculator Excel. However, when the amount of the big or there are many ways different, the synthesis crafts arising flaws.

DOWNLOAD TEMPLATE EMPLOYEE PAYROLL EXCEL FILE STANDARD FULL AT HERE

4. Enterprises often encounter the problem when the payroll?

In fact, a lot of businesses start with template employee payroll Excel because it is easy to do, low cost. However, when the number of personnel increases or wage policies become more complex issues began to arise. Here are the most common difficulties.

4.1 errors of data due to data entry craft

When using payroll Excel, the data must still be entered manually or copied from various sources, such as timesheets, table overtime, payoff table. Just a small error in the formula or enter a wrong number, the resulting wage can be significant discrepancies.

Consequences for business

- Pay or overpay wage directly affects the cost.

- Employees lose faith in the transparency of wage policy.

- The hr department take a lot of time reviewing, interpreting, adjustable.

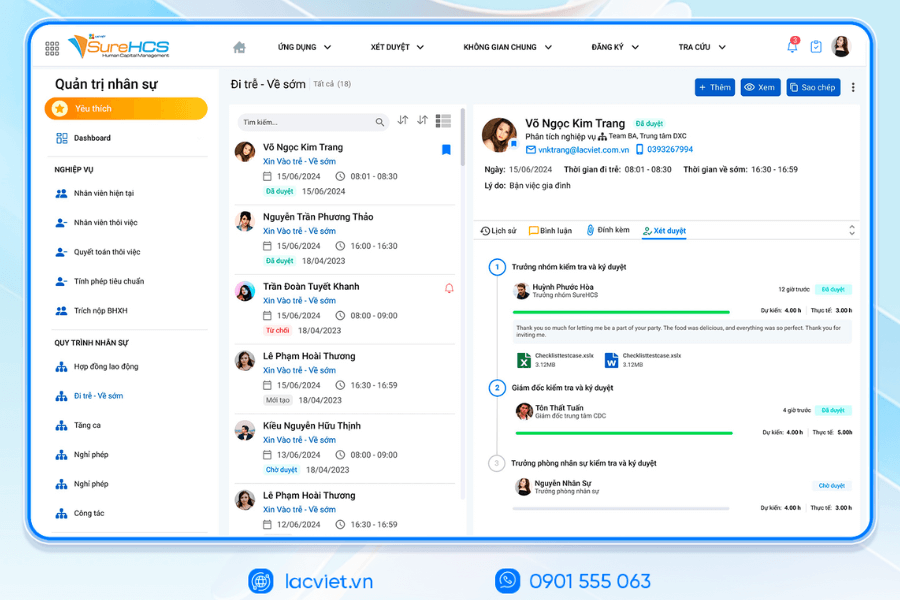

4.2 Sample payroll is not in sync with timesheet data

A very common problem faced is the sample payroll is set up integral to the timekeeping system. Data working hours, overtime, leave to enter back into the pay table.

Problems arise

- The difference between the actual and the payroll.

- Easy-going controversy when staff collate payroll with timesheets.

- Every pay period have to check again from the beginning, causing pressure for parts HR – C&B.

4.3 Difficult to meet the requirements of inspection

When business is labor inspection, test, tax or settlement, social insurance, payroll is one of the most important records need to provide.

If the template payroll Excel:

- Discrete storage in each file, each month.

- No history edit clear.

- The lack of consistency between the wage and labor contracts, and insurance data.

Business will have difficulty in the explanation, even faced with the risk of arrears or administrative penalties. Under the guidance of the social insurance office, business to keep records of wages in full, have the ability to access when needed.

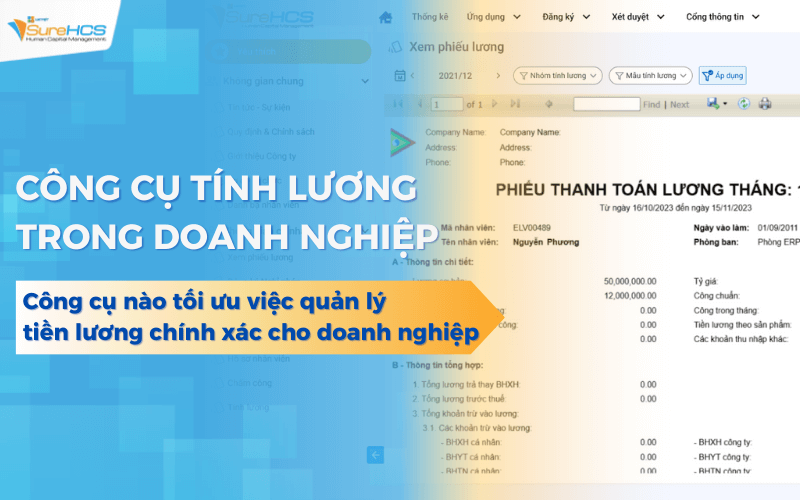

5. When business should upgrade from payroll Excel to software, LV SureHCS C&B?

Not every enterprise should also immediately transferred to the software. However, you should consider an upgrade when appear the following signs:

- Number of employees increases quickly with each pay period takes several days to process.

- Policy on salary, allowances, overtime increasingly complex.

- Often arise flaws although checked many times.

- Take more time to explain wage for employees.

- Trouble synthetic data service report, check.

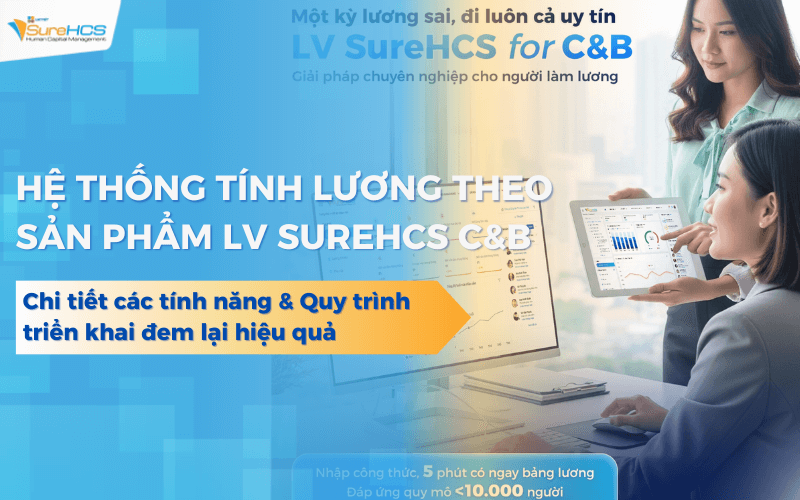

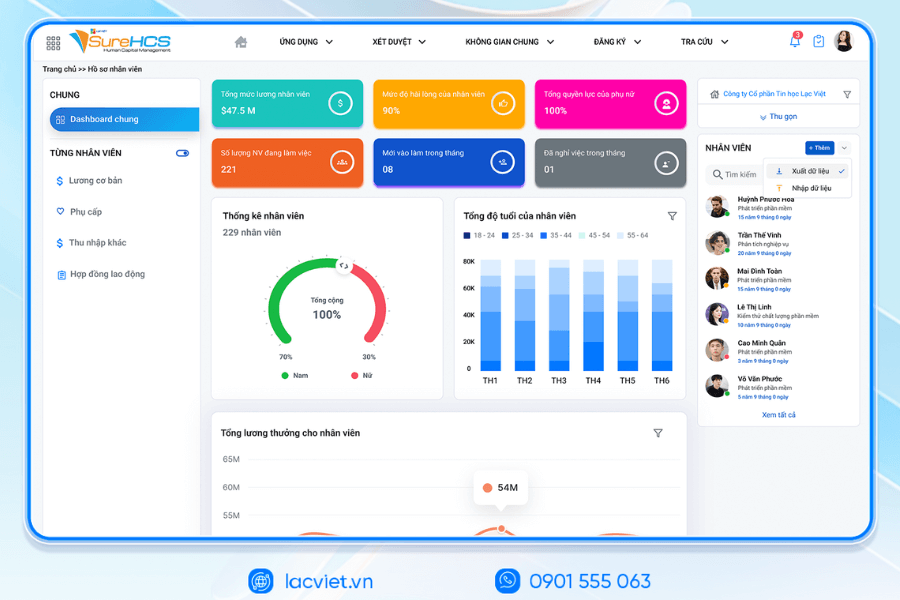

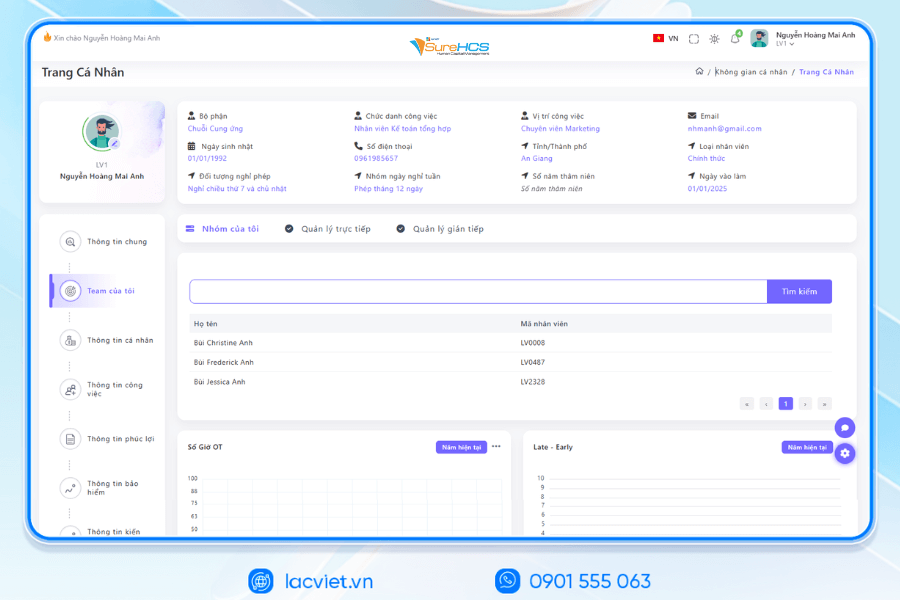

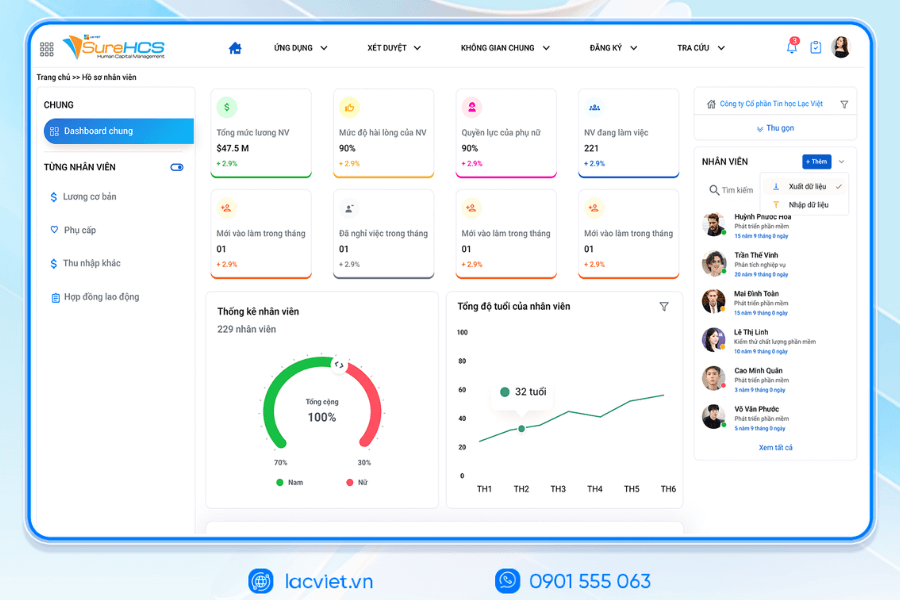

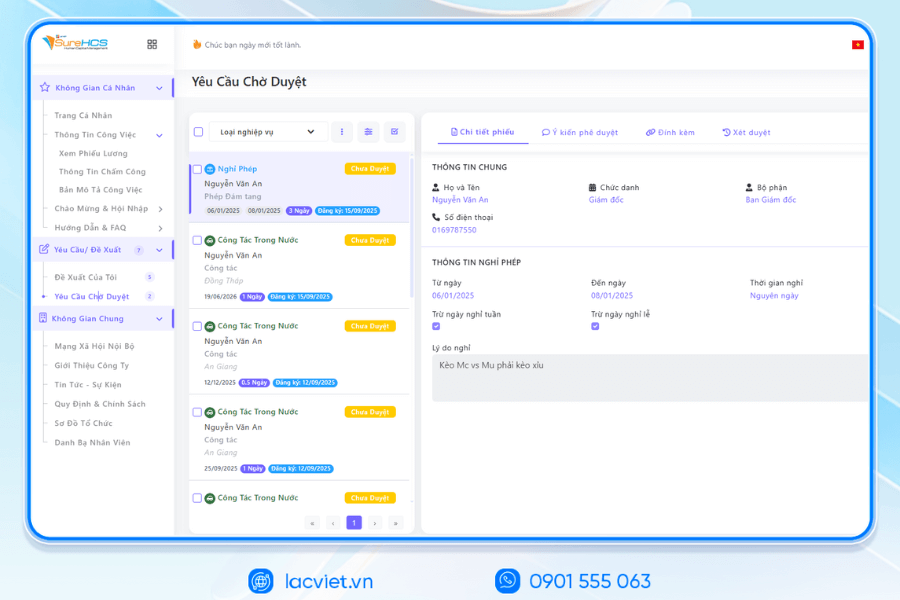

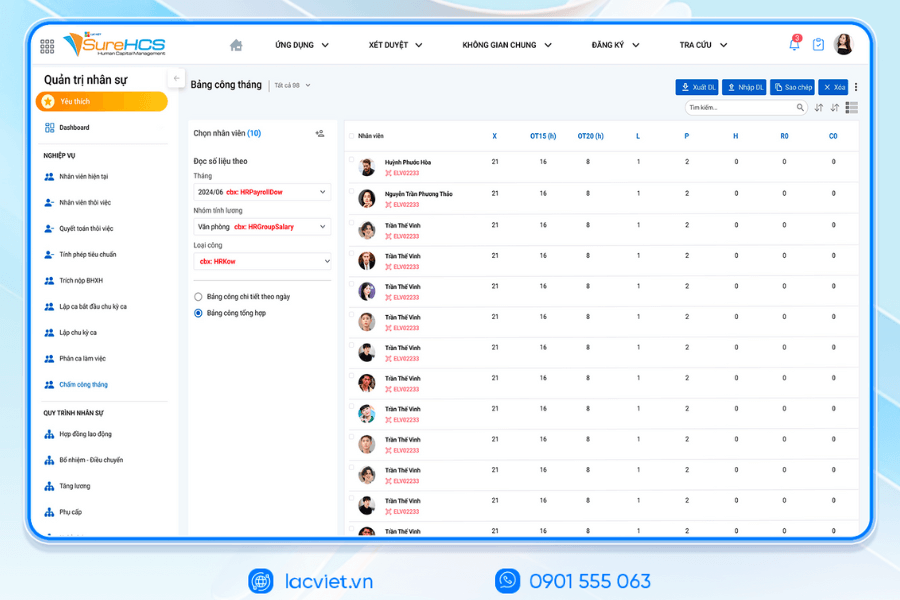

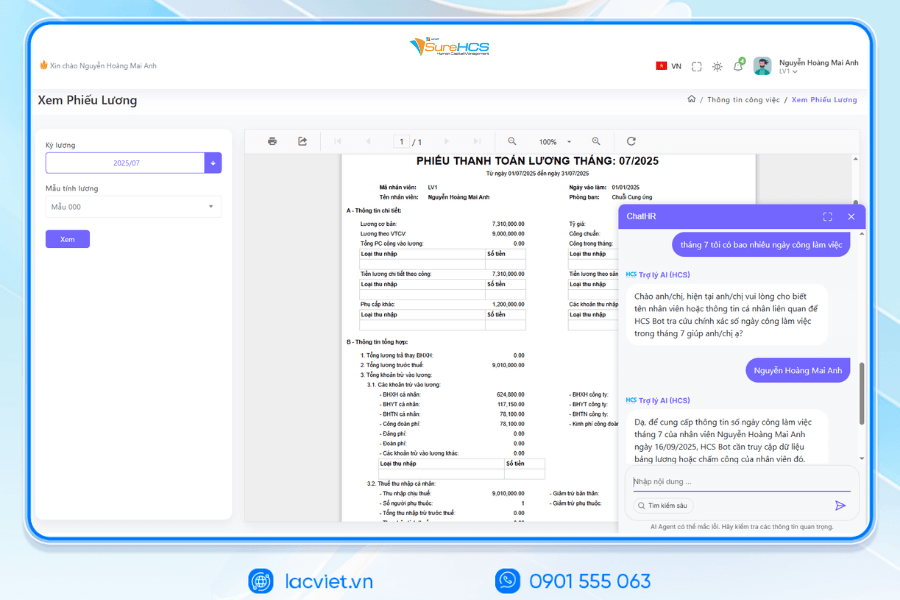

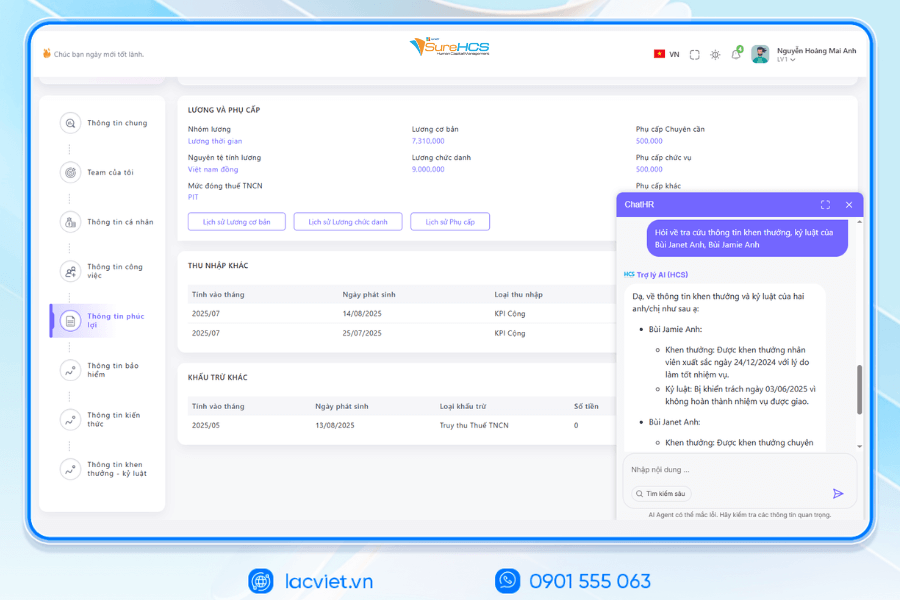

In the context of many businesses still are manager salaries with a template, payroll or payroll Excel arising flaws, take more time to control and difficult to meet the requirements of the test is unavoidable. SureHCS C&B is software attendance management – payroll is developed exclusively for Vietnamese businesses to help automate the entire process from recording the time worked to payroll, insurance and income actually received.

LAC VIET SUREHCS – PLATFORM, HUMAN RESOURCE MANAGEMENT, C&B CUSTOM-INTENSIVE FOR BUSINESS

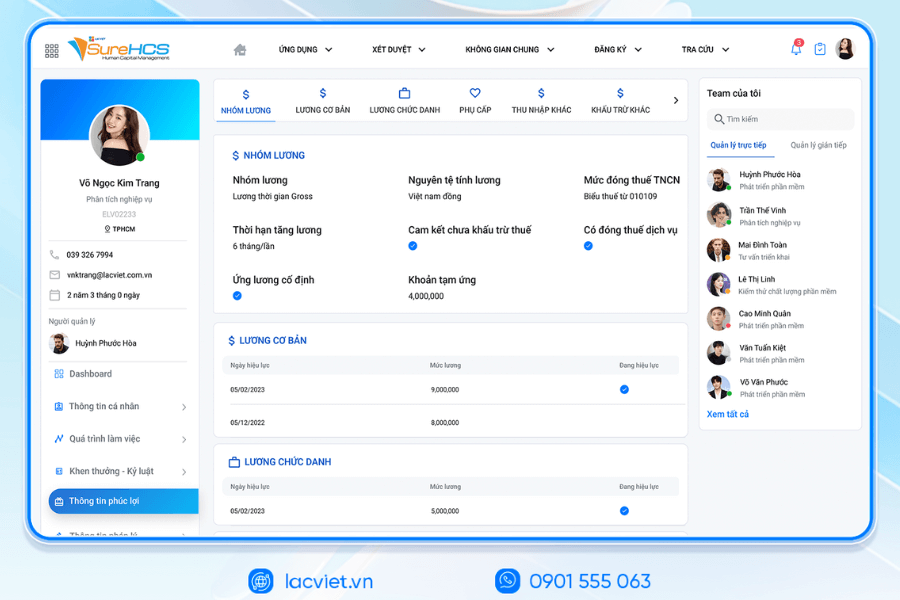

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

Feature highlights:

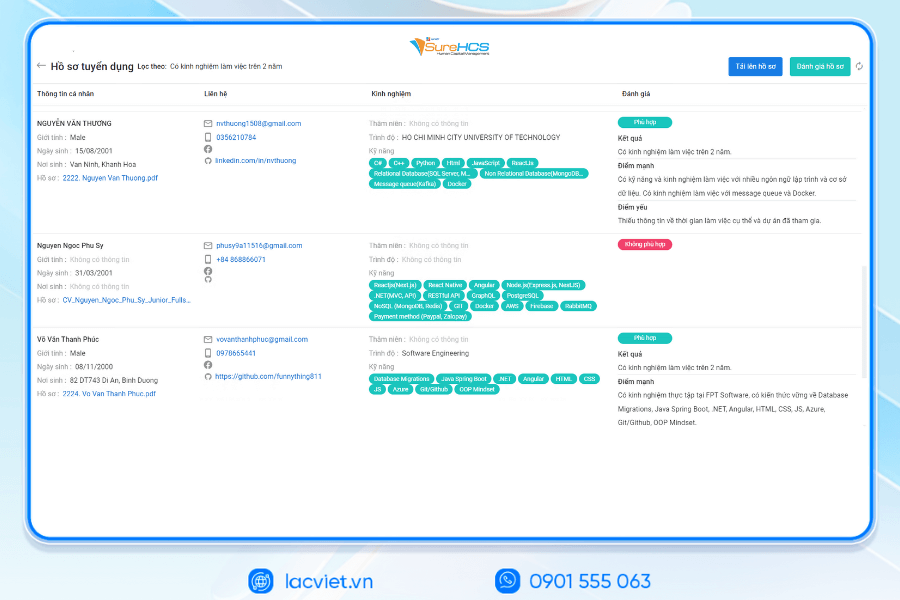

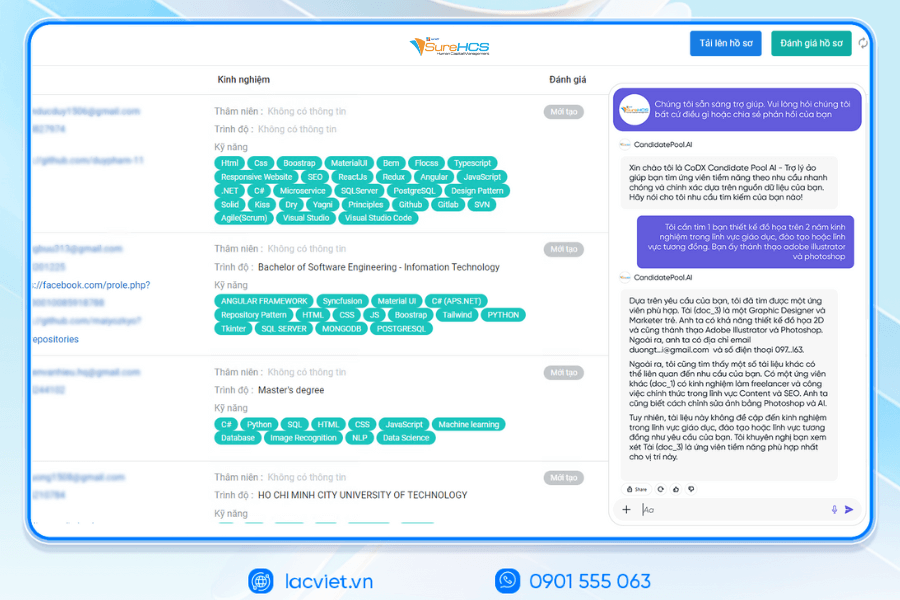

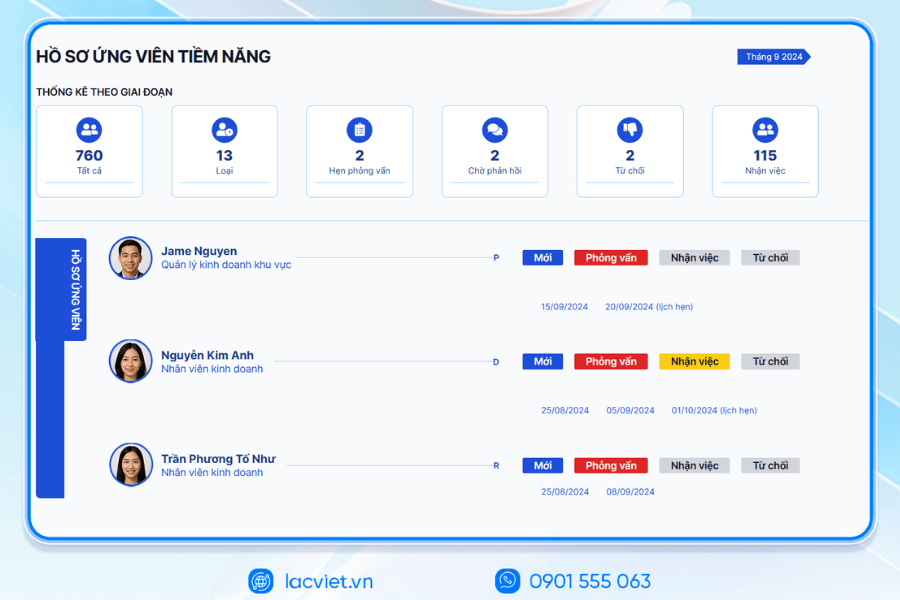

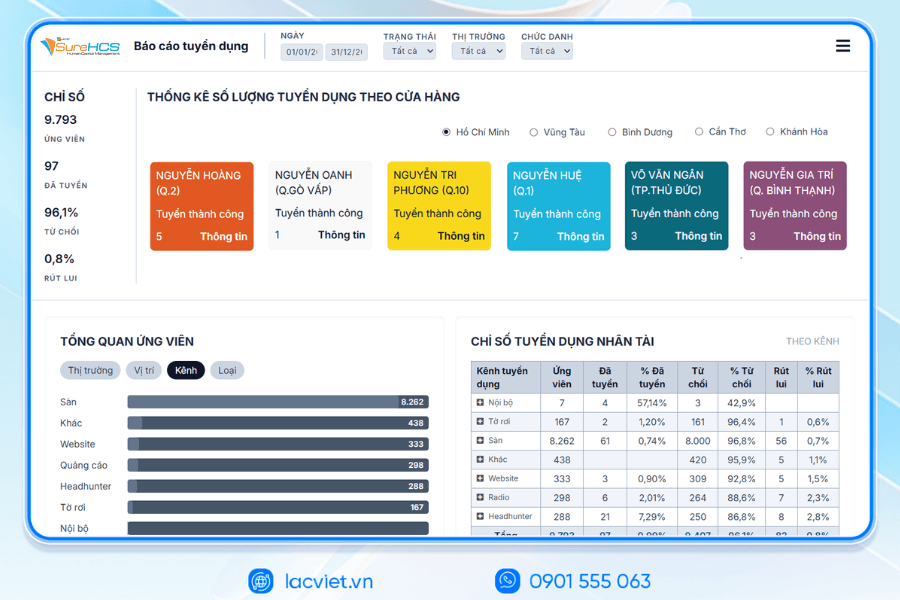

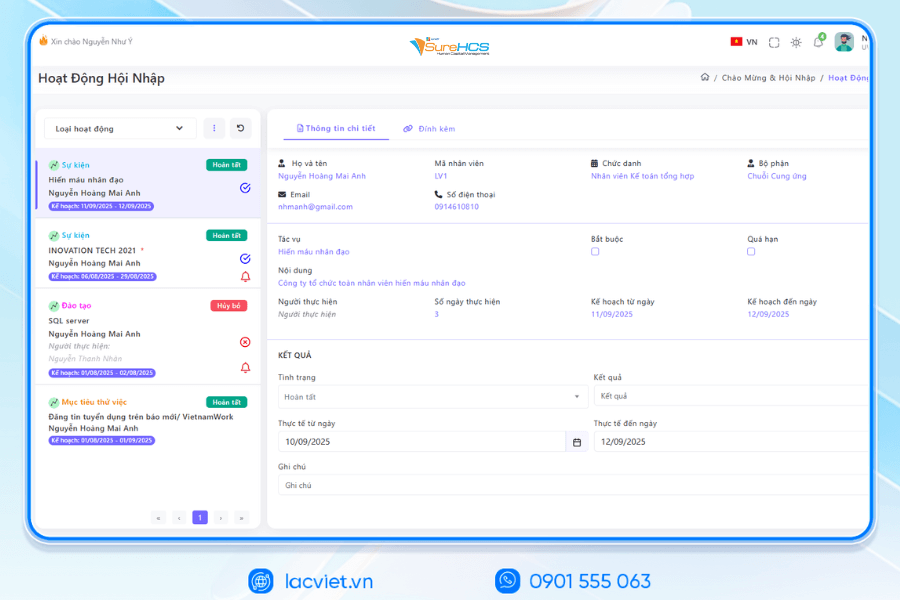

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

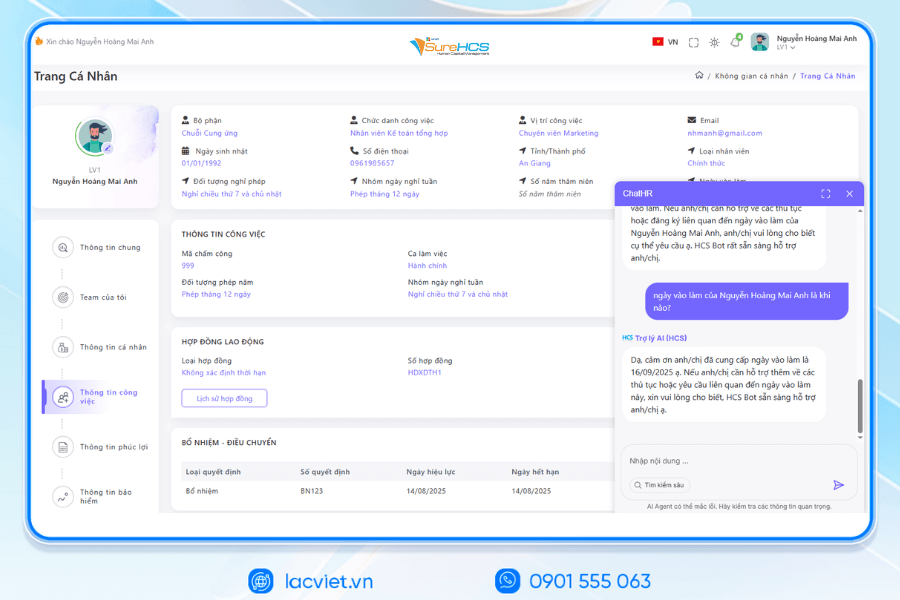

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

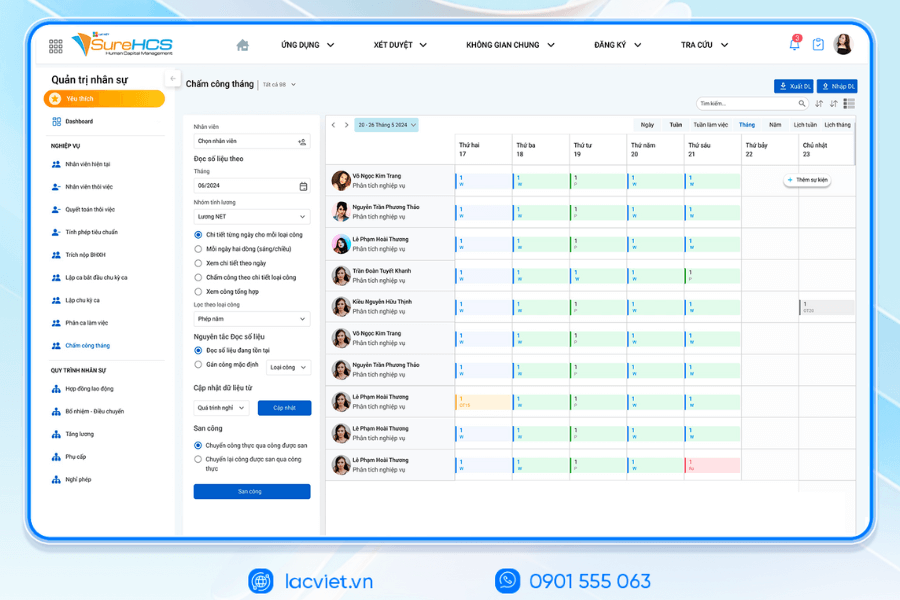

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

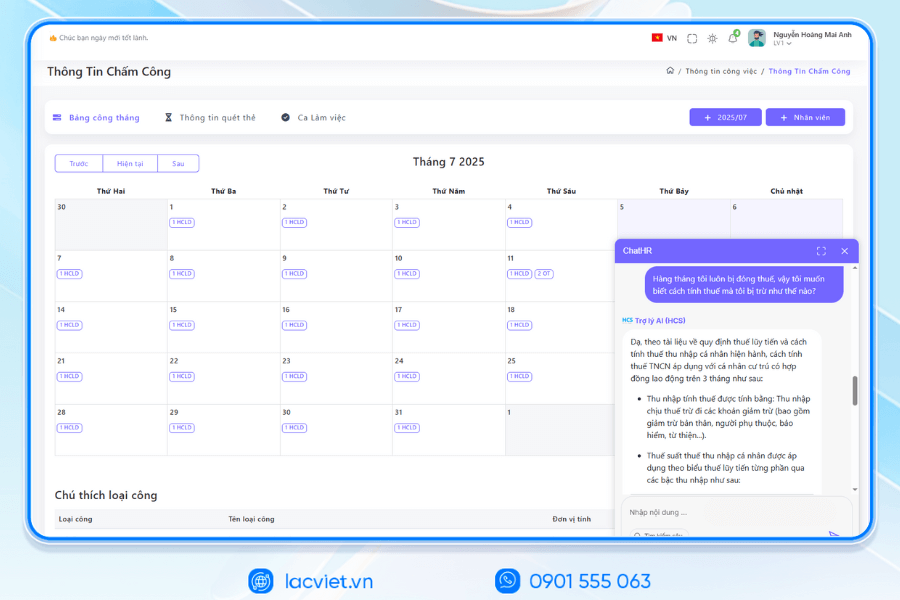

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile Successful Plastic, Long Thanh, Phu Hung Life, the airports of Vietnam (ACV), the enterprise division of SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to over 10,000 personnel

- Corporations, businesses, multi-subsidiary, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depths according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need to automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Instead of handling on template employee payroll Excel, enterprises can standardize the data, reduce errors, cost control, payroll more efficiently, while improving transparency and experience for workers.