The form of pay is the way businesses pay income to employees based on time worked, the results of work or value to contribute. Currently, the form of paid downloads in the business, including: paid according to the time (per month, per hour), paid according to the product, pay equity and paid according to the model 3P.

In personnel administration, choosing the form of payroll suitable not only decided to personnel costs, but also directly affects work motivation, performance, the ability to retain workers. In fact, many businesses still pay out of habit or adopt a form for every position, leading to a cost increase, but the effect does not improve, employees, lack of attachment, and the hr department have trouble managing.

In this article Lac Viet SureHCS will analyze in detail the form of payroll popularity today, at the same time giving hints optimal choice for businesses to control costs, improve efficiency in human resource management.

1. What is the form of salary payment?

In personnel administration form of salary is a collection of ways that businesses use to pay income for workers based on the value of the labor they create. This is not merely numbers to pay at the end of the month, which is a strategically important part in human resource management. Form pay to help businesses mounting personnel costs with efficient work, thereby creating work motivation retain talent.

To understand better, need to distinguish the two concepts are often confused:

- Forms pay: Is the way businesses choose to pay the income to the employee (for example pay over time, according to the product, according to the model 3P...).

- Method of calculating salary: Is a specific formula to calculate the amount of money that employees receive in a pay period (for example: basic salary + allowance + bonus).

A form of good pay not only ensure compliance with labor laws, but also fit with the strategy of human resource development, helping businesses balance costs, increase performance and create fairness internal.

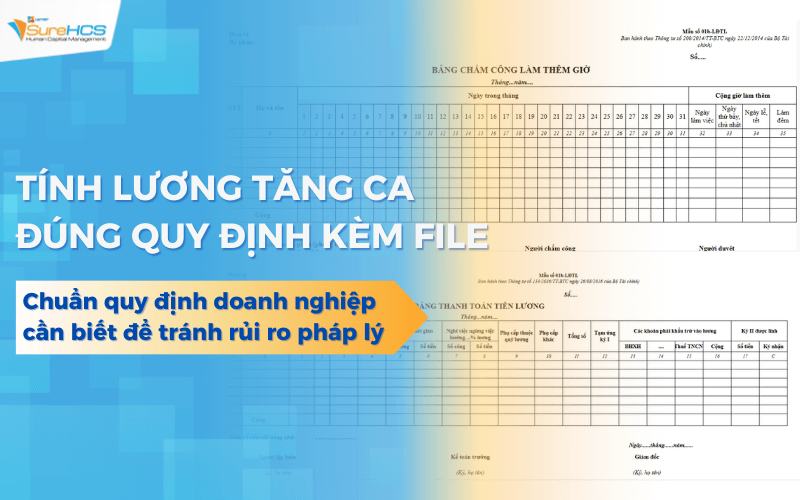

- How to calculate salary increase ca standards need to know to avoid legal risks

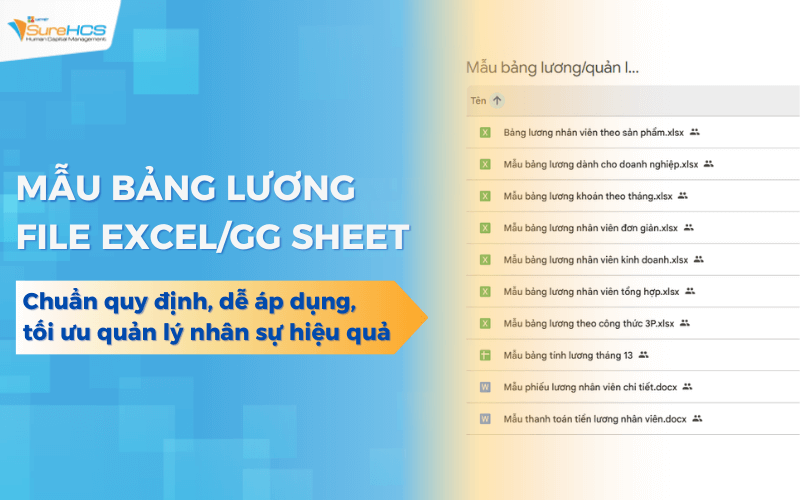

- 10 Sample employee payroll latest standard rules, easy to apply, optimal management personnel

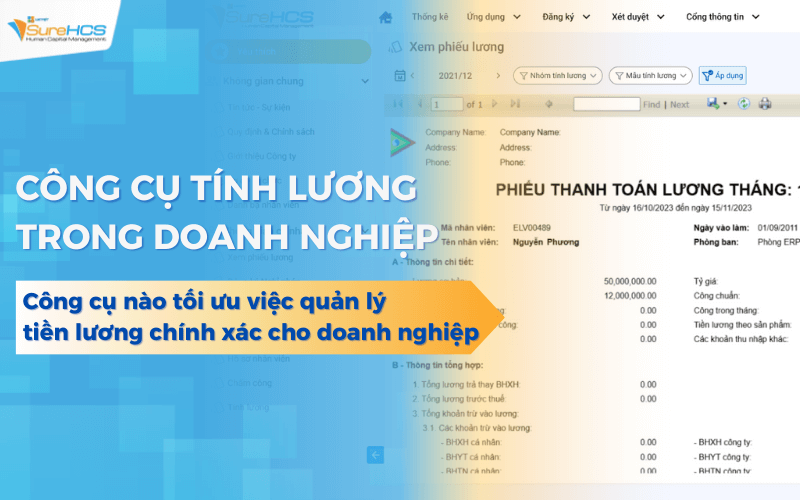

- Tools wage calculator how optimal management salaries accurate for Enterprise?

- 10 Ways payroll standard recipe, practical examples, and legal note

2. Principles of wage payment that businesses need to adhere to

The building operated the form of pay should be based on the basic principles to ensure effective human resource management.

2.1 Paid according to the quantity and quality of labor

One of the most fundamental principle is that a business must pay based on the value of labor to the fact that employee contributions. This means not only according to the number of hours worked but also have to consider the quality of work results.

For example, the same 8 hours each day, but employees A complete more orders, higher quality employee B, then the income level of A must be more proportionate. This helps business to encourage higher performance and reduce the cost of salary for the position less effective.

2.2 fair internal and competitive with the market

A policy of pay effective the need to ensure fairness between the equivalent position in the same organization, while maintaining competitive salaries compared to the labor market outside.

The comparison of the internal salary with market data to help businesses do not pay excessive low that employees come out, also don't pay too high that cost the team up is not necessary.

According to the report wage and labor market 2025 of Talentnet-Mercer, tend to pay wages in Vietnam today are very cautious, with wage increases, on average, to a record low within a decade because business focus optimal cost than before. However, the company still willing to pay more for qualified personnel convert and retain its strategic location and shows the importance of policy formulation and pay versatile, but there are grounds for market data.

2.3 Compliance with labor laws

Finally, the form of pay must comply with the labor law countries. In Vietnam, Labor Law regulations regarding minimum wage, working time, overtime, allowances, social insurance, etc.

These rules set out the legal framework protects basic rights of workers and avoid legal risks for business.

3. Common forms of compensation currently used in businesses

In personnel administration, choosing the form of payroll suitable not only decided to wage costs of the business, but also directly affects work motivation, performance, engagement of employees. Below is the form of paid most popular today

3.1. Pay by the month

Pay by the month is the form businesses pay workers a salary fixed in each pay period (usually 1 month), based on the number of days and agreed in the labor contract.

This form is in accordance with the job positions are:

- The mission is clear, stable, according to day/month as office staff, accounting and administrative.

- The work does not bring specific products as customer service support.

| Advantages | Cons |

|

|

Illustrative example: An administrative staff working 8 hours/day, 22 days/month, fixed income monthly to help them proactively plan personal spending and business to estimate personnel costs.

3.2 Paid by the hour, by the day

Paid by the hour or by the day, is form of income paid based on the number of hours or number of days actually worked during the month. This form is usually applied to workers, seasonal workers, part-time employees.

Matching

- Seasonal workers (peak hours, peak season).

- Retail business services, there are large fluctuations in demand for resources.

- Flexible positions as reception, serve, drive.

Note about attendance, overtime, overtime: When applying this form, businesses need to have a system accurate timekeeping to properly calculate the number of hours and comply with regulations on overtime, according to the Labor Law. This is the important part to ensure both the rights of workers just avoid errors in personnel costs.

3.3 Paid according to the product

Paid according to the product's form workers receive income based on the number of products they create, or complete. Income proportional to production volume and product quality.

Conditions apply effective

- Can measure clearly the results of work (production, orders, service completed).

- Systematic quality assessment synchronized to ensure product standards.

| Advantages | Risks |

|

|

Practical example: In a garment factory, the income of workers is calculated according to the number of complete product quality. Workers complete as many products standard, income as high. Business also only have to pay wages commensurate value they make out.

3.4 Paid exchange

Salary exchange is a form of pay income according to a job, project or certain revenues. Other than paid according to time or product single, salary exchange associated with the overall objective of the work or the contract.

The difference between the salary exchange and wage according to the product

- Salary according to the product calculated individually according to individual unit.

- Salary exchange calculated according to the total results complete a job or project specific.

Matching

- Business activities, projects, professional services.

- The construction project, media, events.

Legal note and build targets exchange clear

- Business should develop clear objectives, evaluation criteria, terms completed.

- Need to regulatory compliance, insurance, labor rights under the law.

3.4 Paid according to the model 3P

Salary 3P is a paid model, modern, are many large enterprises applied to ensure fair efficient. 3P include:

- P1 – Position (job location): value of position in the organization.

- P2 – Person (individual capacity): capacity, skills workers bring.

- P3 – Performance (results of work performed): efficient results and the actual workers achieve.

The outstanding advantage of this form of paid 3P

- Increase fairness and transparency: the Salary is determined based on clear criteria measure to help workers understand why they received a salary there.

- Aligns pay with performance capacity: workers have superior capacity to effectively contribute will be paid a salary commensurate, from which a business retain the best talent.

- Consistent business growth, expansion of scale: When the business grows, the location, capacity, there are distinct differences, the model 3P help design business policies, wage flexibility, more fair.

Any business should apply salary 3P?

- Medium and large business need permission system, performance evaluation clear.

- Business need to retain high-quality personnel in the context of competitive human resources increasingly harshly.

4. Compare the form of paid – the Business should choose what form?

In fact, many businesses are struggling not because of “do not know the form of paid,” that because I didn't know what form that best fits models operate by themselves. Select the wrong form of pay can lead to three major results: personnel costs increased, but performance does not improve, employees, lack of motivation and the hr department take a lot of time and handling.

4.1 comparison of synthetic forms of pay

| Form of payroll | The level of motivation for employees | The ability to control the cost of business | Complexity when managing | Worth bringing back to business |

| Pay over time (per month, per hour) | Average. Workers assured of income, but little motivation to increase performance if not associated with rewards or evaluate the results. | To estimate the cost of the monthly salary, but difficult to assess the real effect of expenses. | Low. Easy to deploy, operate, consistent with human apparatus compact. | Fit small business, job stability helps to manage, simple to ensure compliance with the law. |

| Paid according to the product | High. Income is tied directly to the output, workers tend to work more to increase income. | Good. Businesses pay wages according to the results generated, but need quality control to avoid hidden costs. | Average. Need to track product quality and standard products. | Help increase labor productivity, in accordance with business production or job measurable results. |

| Paid exchange | High. Hr focus on the goal, the end result instead of the working time. | Good. The cost associated with the target job, easy to control if only the exchange obviously. | Medium to high. Need to clearly define the objectives, scope and completion conditions. | In accordance with project work, business, business help optimize costs, accelerate the progress. |

| Paid according to the model 3P | Very high if properly implemented. Income reflect the location, capacity and work results, motivational sustainable for the good. | High. Business to avoid paying salary according to seniority, but low efficiency. | High. Need assessment system location, capacity, performance, basically. | Fit medium business and large support for retaining key personnel, long-term development. |

4.2 instructions to select a form of paid according to the scale business

Don't have a paid model “standard” for every business. Scale organization is important factors to consider.

For small business

Small businesses often have limited resources, the management has not complex. So:

- Should give priority to pay over time bonus combo simple.

- Can apply salary exchange or salary according to the product for a number of positions such as sales, production craft.

- The main goal is easy to manage, easy to control costs, ensure compliance with the law.

For medium business

Business just started dealing with math performance and retain personnel:

- Should incorporate the many forms of paid groups for different positions.

- The business location, production can apply salary according to the product or salary exchange.

- The location management expertise can step by step approach paid model 3P in the simple.

For big business

Big business has the organizational structure complex, multi-level and functional group:

- Should apply pay system with a clear structure, typical model is 3P.

- The form of payroll need fastened with hr strategies, long-term roadmap for advancement, performance reviews.

4.3 instructions to select a form of paid salary by industry

Besides scale, industry also affect the choice of the form of payroll.

Manufacturing industry

- In accordance with the salary according to the product or salary exchange.

- Easy to measure the output, quality, performance.

- Help business control costs, improve labor productivity.

Trade – service

- Combined salary over time and salary exchange/sales.

- Sales staff, customer service often need motivation directly from the business results.

- This form helps increase revenue without fixed costs rise too high.

Technology, projects and consulting

- In accordance with salary exchange according to the project or salary 3P.

- Hard work, the measured output should review according to the contribution value, the output result.

- Pay the salary associated with the capacity, efficiency, help retain high-quality personnel in the environment of fierce competition.

In summary, the choice of the form of pay should not be based on trend or sentiment, which should be based on the scale, field, management capabilities and development goals of the business. When the form of paid accordingly, business is not only good cost control, but also create motivation work sustainable for workers.

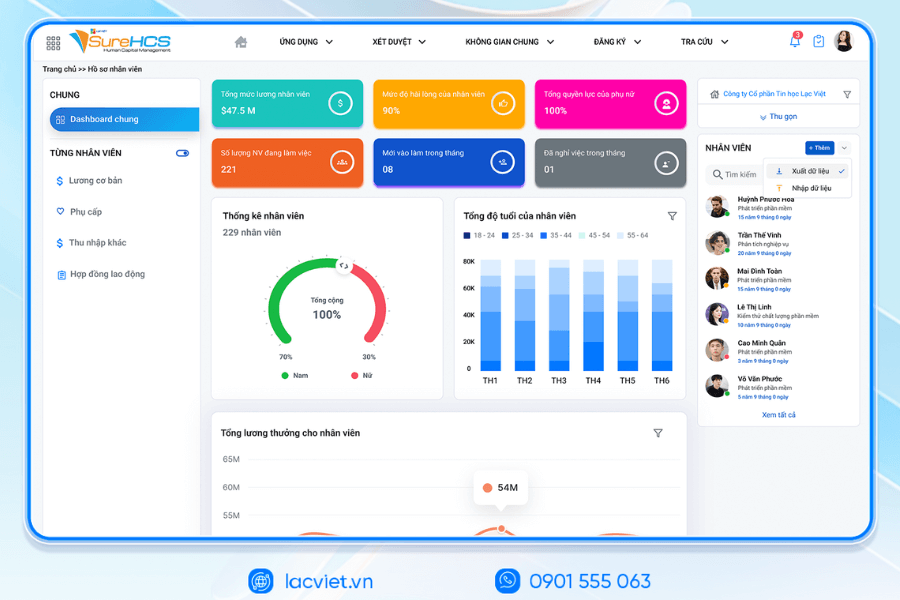

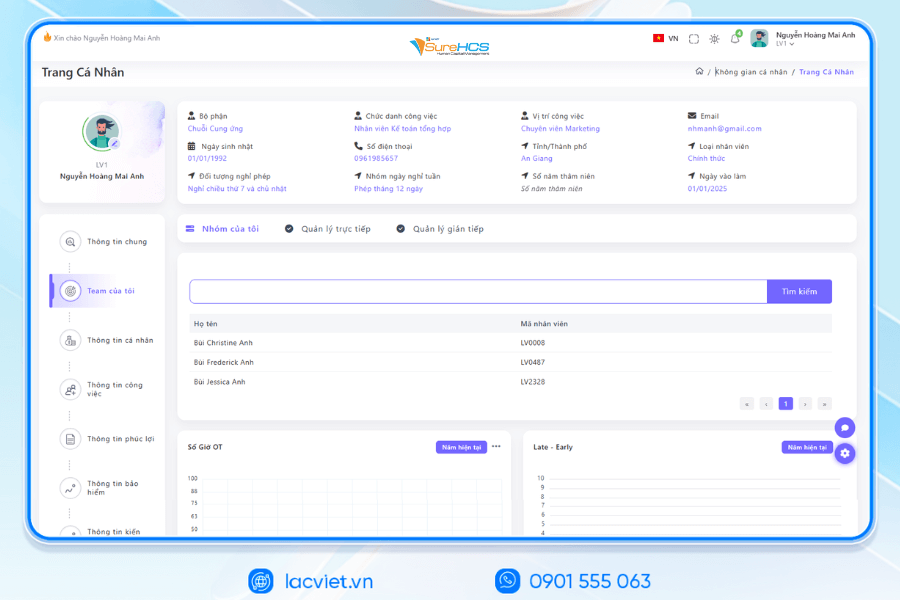

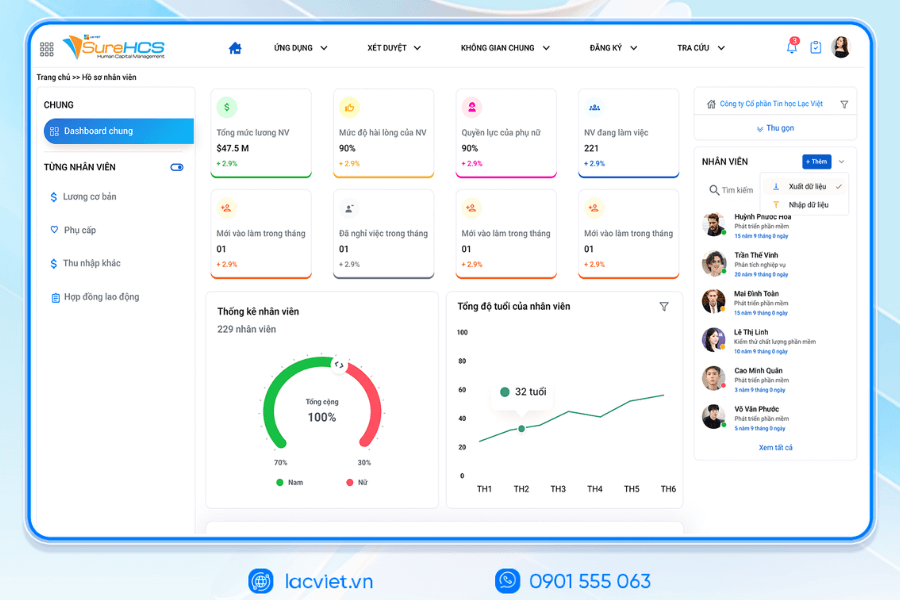

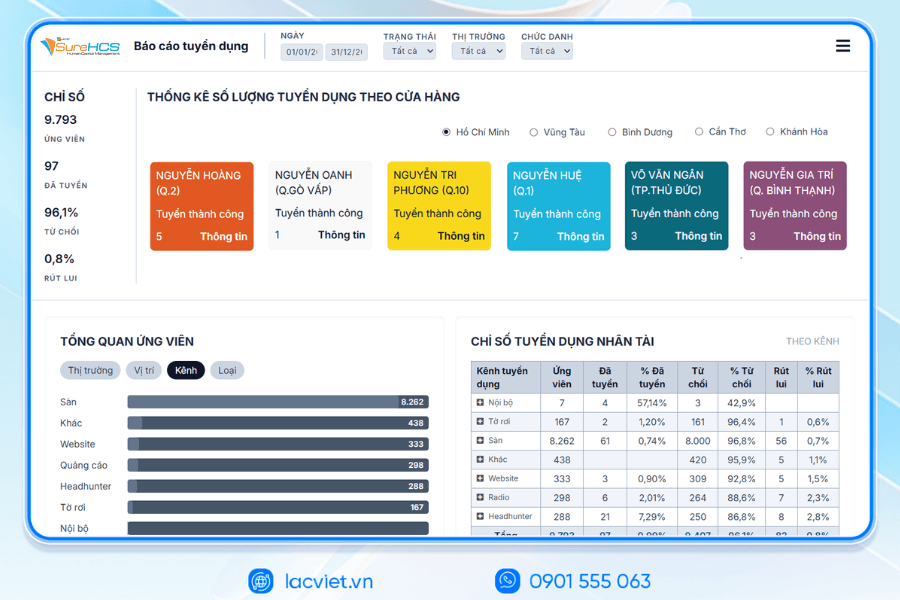

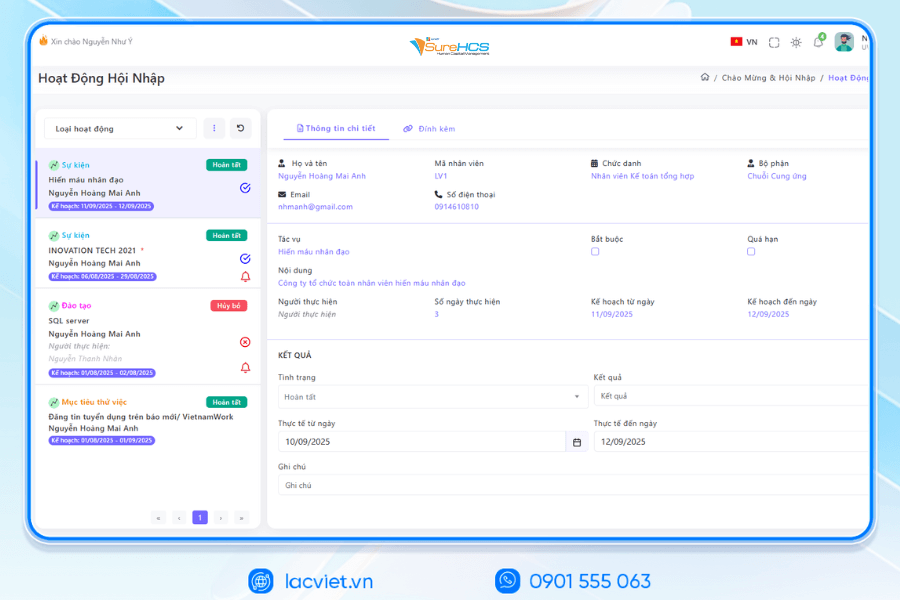

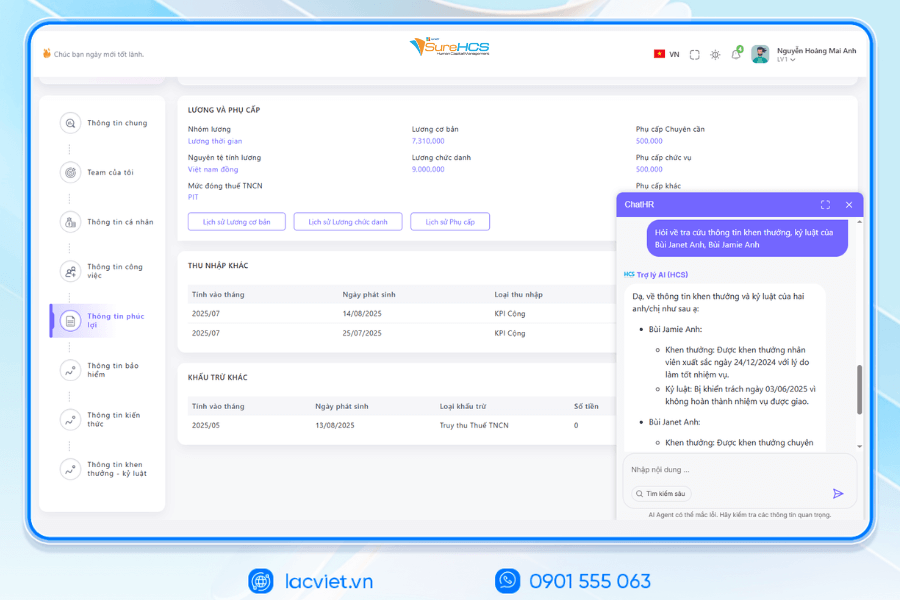

5. LV SureHCS C&B payroll software offers in-depth customization to suit various payroll payment methods within businesses

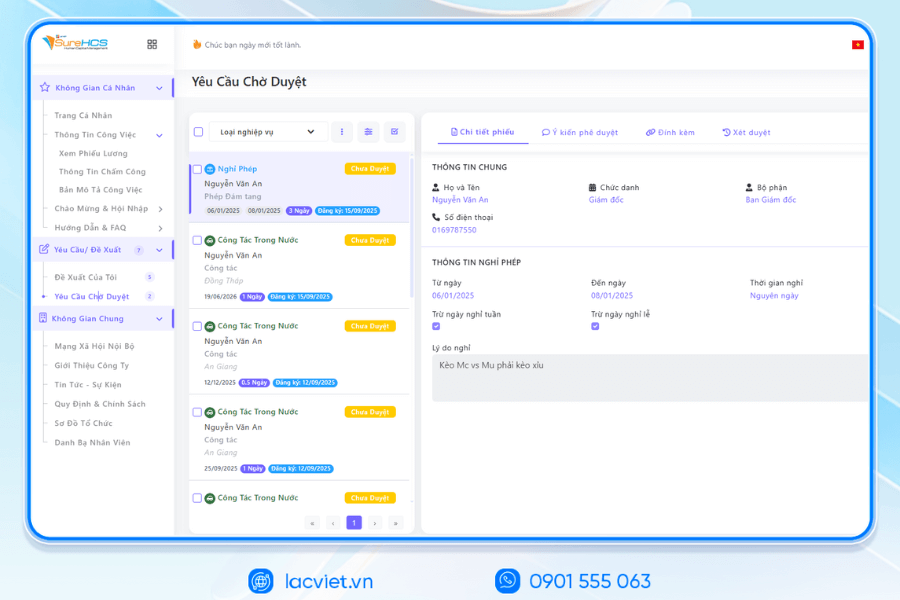

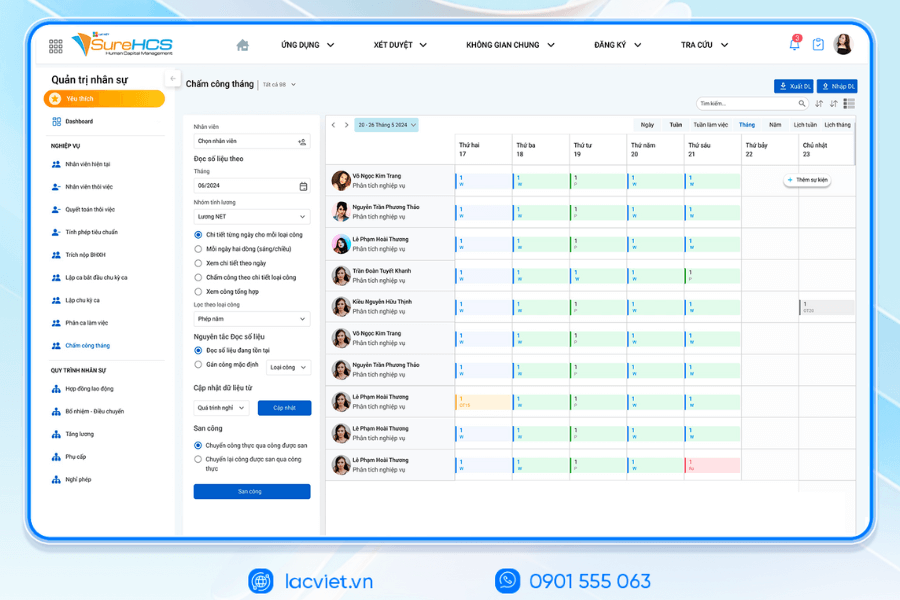

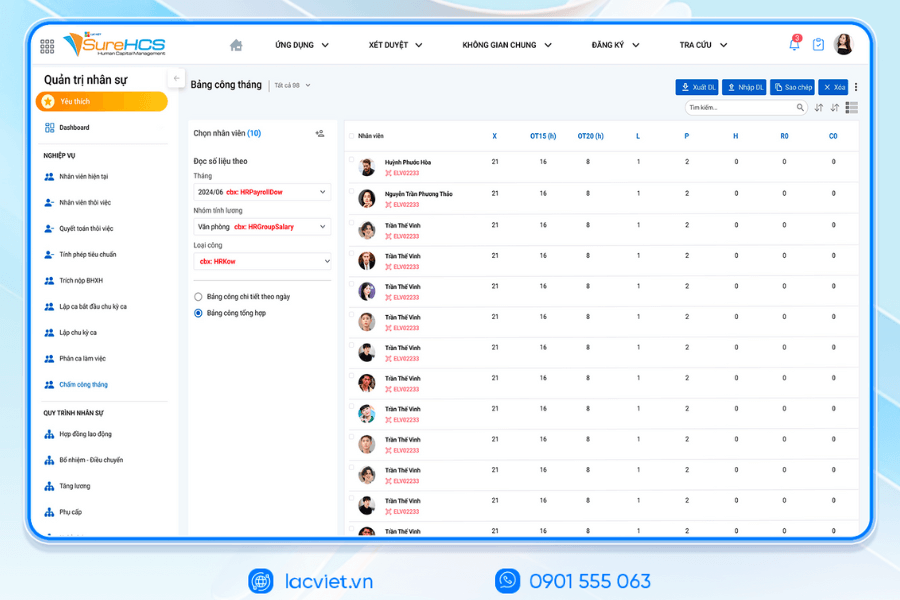

Management and payroll is one of the most complex work in the hr department, especially when businesses apply many forms different pay, such as salary, according to time, piecework, salary exchange or salary according to the model 3P. If handled manually using Excel file managers faced with flaws, payment delays, difficult to control costs.

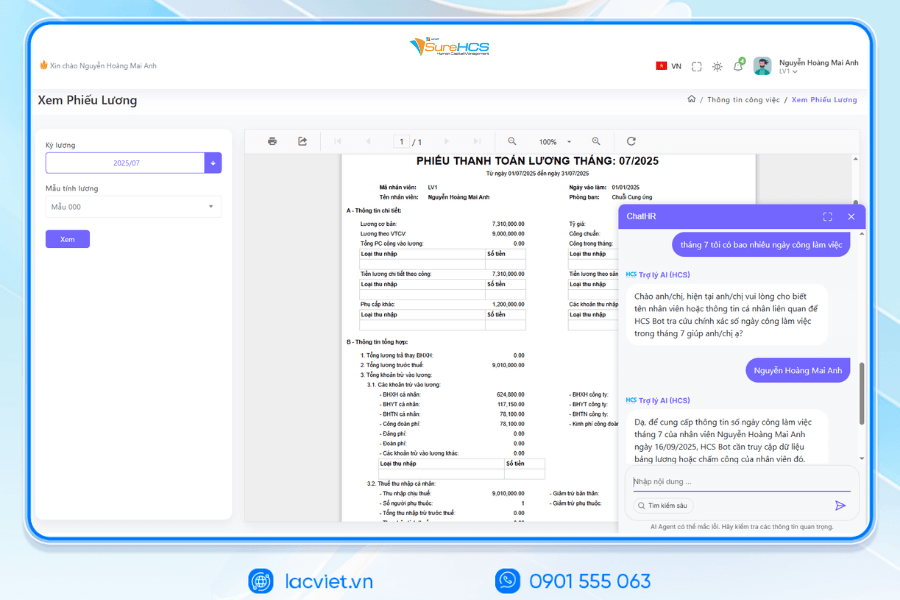

Software LV SureHCS C&B developed by Lac Viet is the solution, custom software in-depth to solve the full problem. This is not only a tool payroll, but also is the foundation of the entire hr process – attendance – payroll – benefits, in accordance with many enterprise scale, diversity policy pay in Vietnam. The software meets all requirements, legal business support, auto-updates the changes to personal income tax, SOCIAL insurance, and regulations labor, reduce audit risk, internal disputes in the process of paying income.

Software features LV SureHCS according to each form of payroll

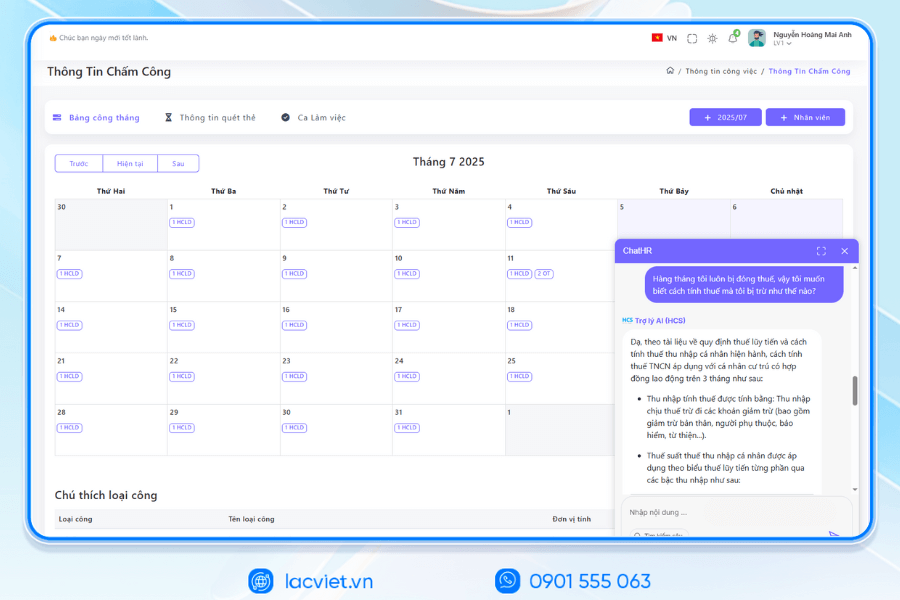

- Support wages over time, by month, by the hour: LV SureHCS direct connection with attendance system multi-form – fingerprint, face recognition, GPS, WiFi, or stop the online help automatically records the fact of the employees by the hour, shift, or by date. This data is synchronized directly to payroll automatically calculates daily, overtime, overtime, leave under the provisions. This helps reduce errors crafts ensuring compliance with labor laws.

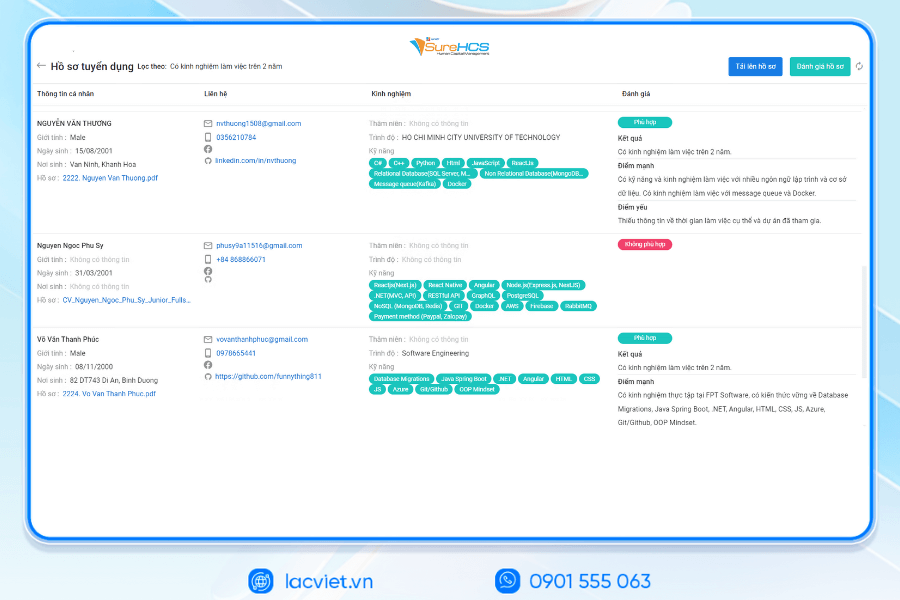

- Calculate salary according to the product – transparent, standardized for production: For business production or business based on the output, LV SureHCS have module payroll in-depth product. The system automatically collects the output according to the ca, chains or groups and handle the food as complex as progressive, KPIS, reward – and-punishment, combined attendance data in a consistent way.

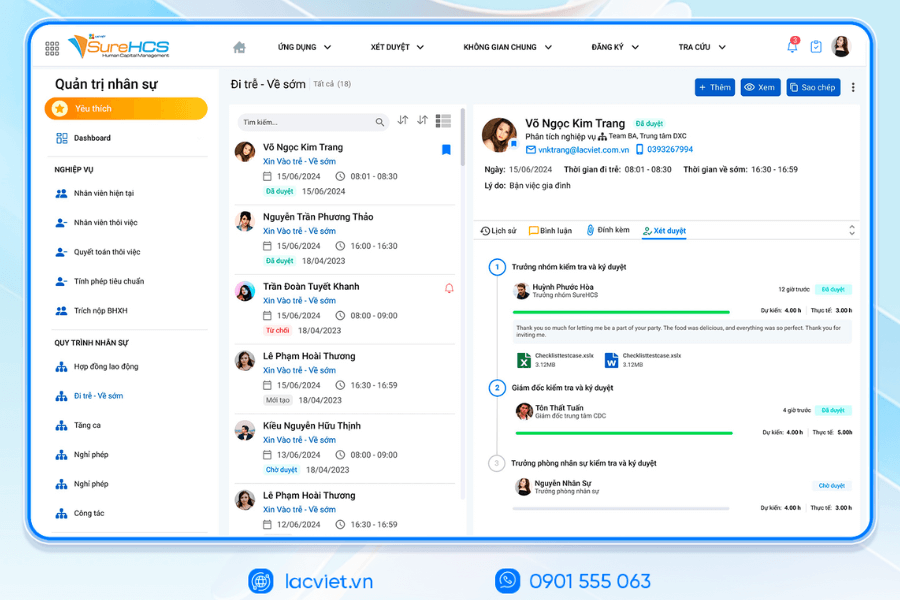

- Support salary exchange flexibility in project management work: LV SureHCS allows configuration wage policy exchange under the project, services or specific tasks. The hr department can set the level, condition, complete, payment term, apparently in connection with module timekeeping, KPI and automatic payments.

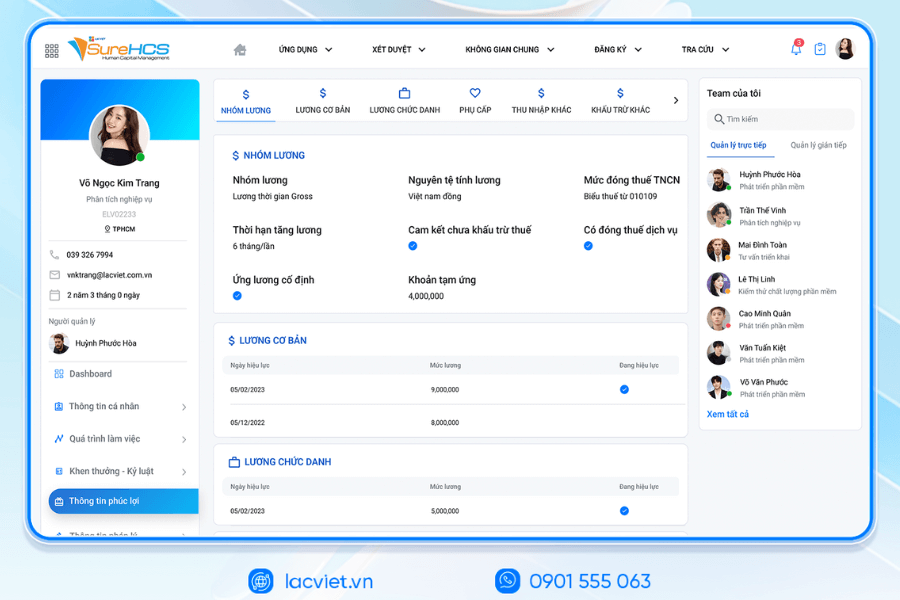

- Calculate salary according to the model 3P – standardized remuneration policy: Paid model 3P (Position – Person – Performance) data requests, performance reviews, capacity, location of work to be closely integrated. LV SureHCS provides tools automate the entire process, from configuring payroll by location, data link KPI/OKR, to calculate individual capacity and results of implementation work.

For businesses that are applied many forms different pay system, a payroll software integration, custom depth as LV SureHCS C&B is essential tool to optimize processes, ensure transparency, cost control efficiency. This solution fits all businesses small, medium and large corporations with demand management complex.

LAC VIET SUREHCS – A CUSTOMIZED, IN-DEPTH HUMAN RESOURCE MANAGEMENT AND COMPENSATION & BENEFITS PLATFORM FOR BUSINESSES

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

Feature highlights:

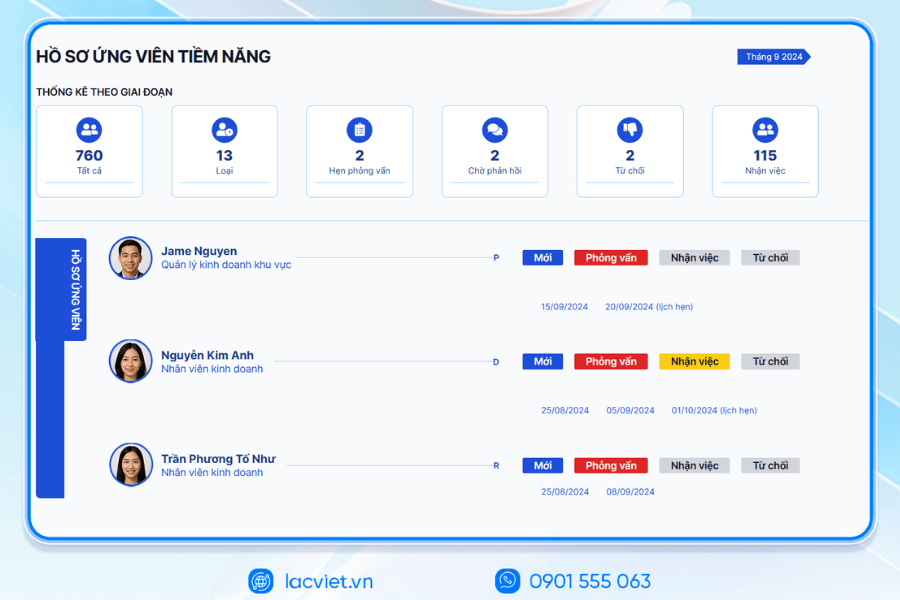

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

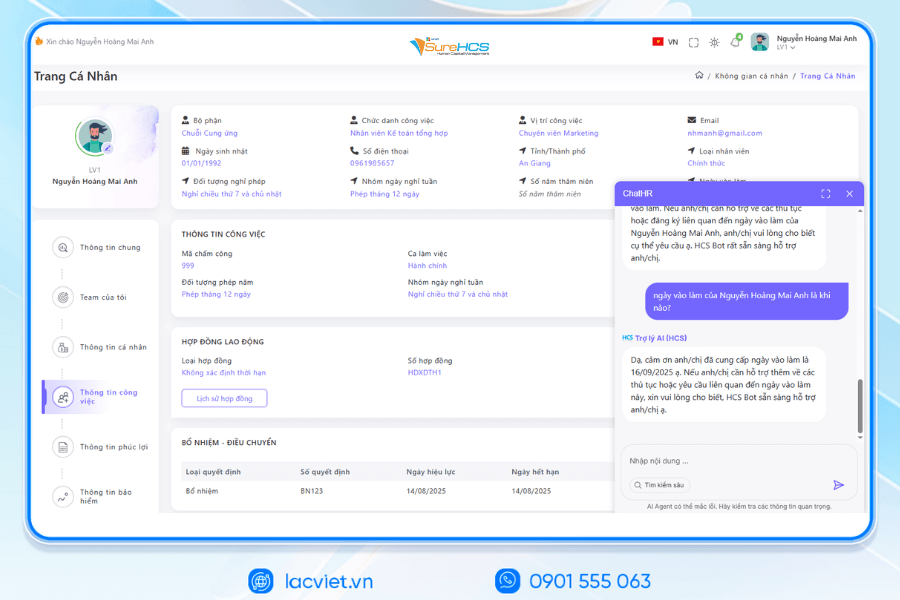

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

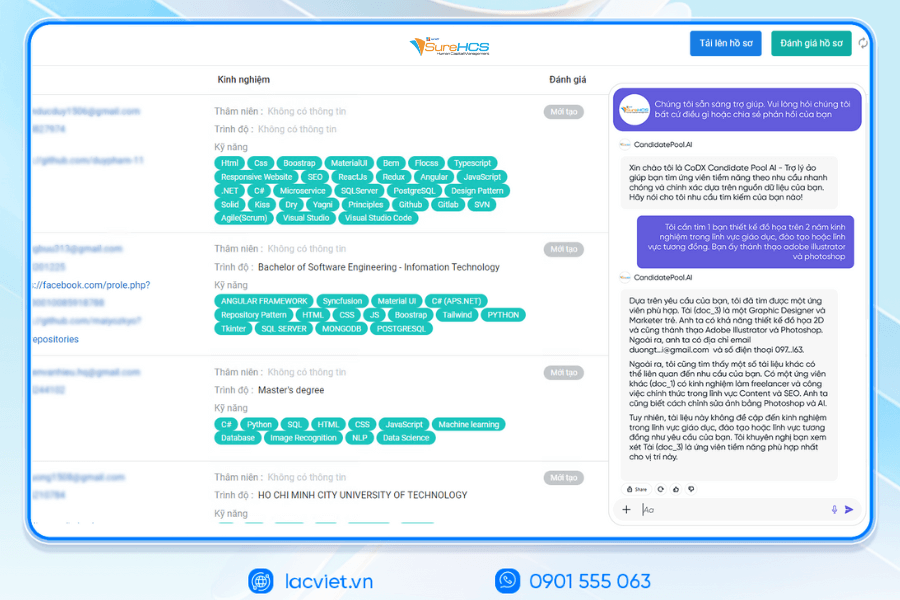

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile Successful Plastic, Long Thanh, Phu Hung Life, the airports of Vietnam (ACV), the enterprise division of SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to over 10,000 personnel

- Corporations, businesses, multi-subsidiary, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depths according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need to automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Please contact us to receive solutions consulting LV SureHCS in accordance with the scale model to pay the wages of your business today to start the digitization process hr – timesheet – payroll effectively sustainable.