Wage night shift is calculated by the hourly pay of ca day plus at least 30% according to the provisions of The Labor code. Wage night shift 12 hours, including wage night shift + overtime night (at least 150%-200% + extra 20% off) purchase time to do more. The night shift full 8 hours wages = hourly wage × 8 + allowance night shift (30%).

Working the night shift is a form of labor peculiarities, which require employers to pay higher wages compared to day shift in accordance with the law. However, in fact, many businesses and workers still perplexed in determining wage night shift 8 hours and 12 hours, especially when combined with overtime. Learn how payroll night shift not only help businesses comply with the law, but also ensure the legitimate rights for workers.

The same Lac Viet SureHCS learn in detail how in this article.

1. Properly understand about the night shift and wage night shift in business

In fact, human resource management, a lot of businesses have trouble salary calculator for employees working at night, especially with the shift pattern as long as the night shift 12 hours. Causes mainly come from not properly understand the concept of night shift and the structure of wage night shift in accordance with the law, leading to errors in salary potential risks disputes, labor inspectors.

Understanding the basic concept here is the platform to enterprise payroll night shift 12 hours and 8 hours correctly, transparent consistency.

1.1 Night Shift is what according to the provisions of labor laws?

According to The Labour code 2019, duration of night work is defined as from 22 pm to 6 am the following day. Any period of work of the workers fall into this time frame are considered night work, irrespective follow the 8-hour shift or shifts of 12 hours.

This means:

- If a work shift start from 21h, ending at 5 the next morning, then part time from 22h to 5 pm is night work.

- If employees work the night shift lasts 12 hours, businesses need to separate clearly the hours of night work and hours in working day in the same ca to payroll regulations.

The reason the law has specific provisions for the night shift is by working at night is often more influential to health, biological rhythms, and personal life of the employee. So The state requires businesses to pay more wages for the duration of night work as a form of offset reasonable.

This rule is clearly stated in Article 98 – The Labour code 2019. Business can refer to the original text in the main source, as The government Portal or the law library:

1.2 Salary ca what is the night? Include the account?

Wage night shift is not a salary account completely separate, which is the sum of many terms, wages, various is calculated based on the time actually worked by the employee in the night.

In essence, wage night shift usually consists of three groups main account below.

- Firstly, salaries normal working hours.

This is the money wage is calculated according to the unit price of wage or salary hours agreed in the labor contract. Business needs determine the exact salary of normal working hours to make the base of calculation of the sum more later.

For example, if employees are hourly rate is 40,000/hour, then this is the platform to calculate the entire wage night shift.

- Monday, account pay more due to night work.

As a rule, workers who work at night are paid at least 30% of the salary calculated according to the unit price of wage or salary hours of a normal working day.

This account aims to compensate for the workers work left to beat normal. This is the point where many businesses are often missing or not correct when applying payroll night shift 12 hours.

- Tuesday case, just work the night shift was just working overtime.

In fact, night shift 12 hours very easy to arise overtime, by the time the standard work according to the labor law generally does not exceed 8 hours/day.

When workers: Just did the night just doing more hours than working time normal

Then, in addition to wages, overtime under the rules, businesses must pay an additional 20% of the salary calculated on the unit price of wage or salary hours of work done in the daytime.

The gross account as on that how to calculate wage night shift 12 hours more complicated than the night shift 8 hours, which is also the reason many organizations and businesses are looking for information about how to calculate wage night shift 12 hours and 8 hours to avoid errors when deploying reality.

- What are the common forms of salary payment, and which one is the most cost-effective?

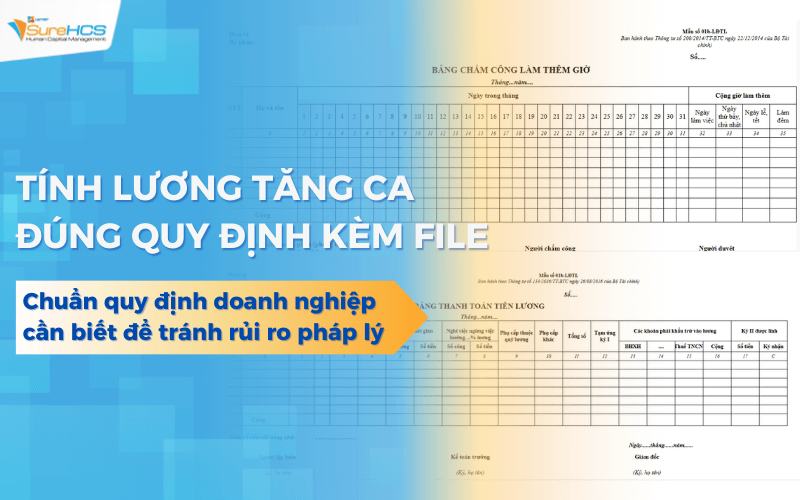

- How to calculate salary increase ca standards need to know to avoid legal risks

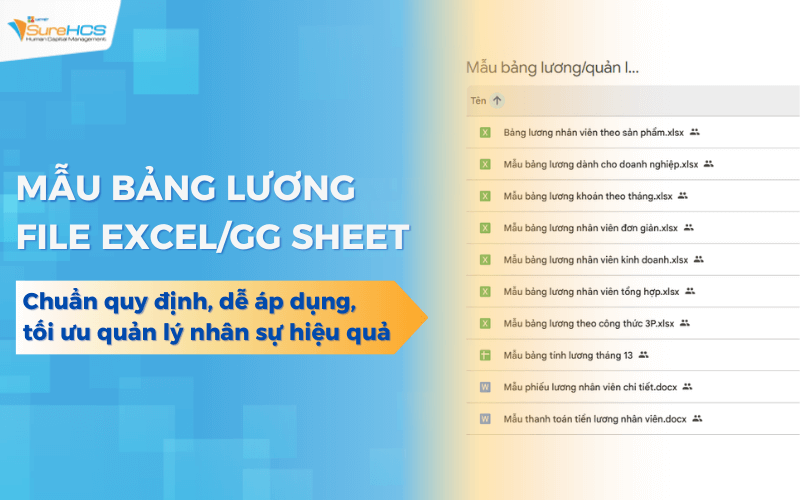

- 10 Sample employee payroll latest standard rules, easy to apply, optimal management personnel

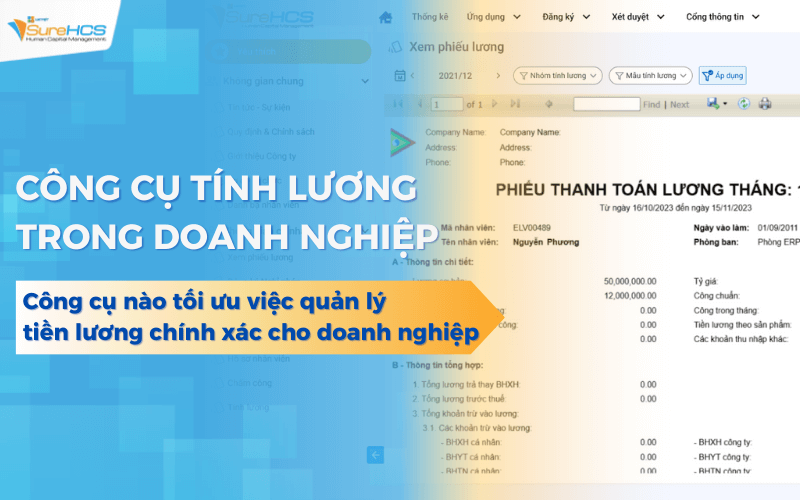

- Tools wage calculator how optimal management salaries accurate for Enterprise?

2. How to calculate wage night shift 12 hours in accordance

In the business of manufacturing, logistics, medical services, operated continuously, night shift 12 hours as the model worked quite popular. However, this is also the type of shift work easy-sai salary, by the same ca can simultaneously arises hours, night work and overtime hours of the night.

To properly calculate the wage night shift 12 hours, businesses need to adhere closely to the principles below, instead of lumping the entire 12 hours on a fixed salary as how to make handmade ago.

2.1 principles payroll night shift 12 hours business need to know

The first principle is most important is night shift 12 hours is not synonymous with 12 hours work the same in terms of wages.

According to The Labour code 2019, duration of the normal working of the labor usually does not exceed 8 hours/day. Therefore, in a night shift lasts 12 hours, businesses need to clearly define:

- The working hours in the norm (usually 8 hours)

- The overtime hours (usually 4 hours remaining)

Principles Monday is a clear distinction between “night work” and “overtime night”.

- Night work: is the work interval falls into the time frame from 22h to 6am the following morning.

- Overtime the night: is time worked in excess of time, normal business hours, at the same time falls into the time frame night.

These two concepts may sound the same, but the way calculation is completely different, here the main point is that many organizations and businesses are looking for information about how to calculate wage night shift 12 hours and 8 hours are often confused.

Principle Tuesday is not to be pooled whole 12 hours to apply a single number.

The gross hours night and overtime night will lead to:

- Dropping a lack of rights for workers

- Or pay the excess cost of salary that business uncontrolled

- Increase the risk of dispute, arrears when is labor inspection

So want to properly calculate the wage night shift 12 hours, business required to separate the hours, calculated separately itemized.

2.2 formula how to calculate wage night shift 12 hours

In fact, wage night shift 12 hours is constituted from three groups of recipe, businesses need to understand each group to apply correctly.

Firstly, the formula for calculating the salary basic working hours.

Salary basic working hours are determined by:

- Grab wages under a contract of employment

- Divided by the number of hours worked standard in months or during the day according to internal regulations

This is the salary background, used to make the bases the account plus more.

Monday, formula for calculating the night work.

According to Article 98 of The Labour code 2019, workers worked at night to be paid at least 30% of the salary calculated according to the unit price of wage or salary hours of a normal working day.

In other words, with each hour of work fall into the time frame from 22h to 6h, business need:

- Full pay hours basic

- Plus at least 30% hourly

Tuesday, formula calculate the overtime at night (if available).

When workers took an extra hour, just as the night, in addition to the accounts mentioned above, businesses also have to pay additional 20% of the salary calculated according to the unit price of wage or salary hours of work done in the daytime.

Account 20% this is the very or omission in practice, especially when businesses are still managing shifts, payroll using Excel file or dot work.

The whole of the principles and formulas are specified in Article 98 of The Labour code 2019, businesses can collate at the main source, as The government Portal or the law library.

2.3 example illustrates how to calculate wage night shift 12 hours easy to understand

To business to apply, can consider the example of the following fact.

Suppose a production staff:

- Work the night shift from 18h to 6am the following day (total 12 hours)

- Hourly rate under the contract is 40,000 vnd/hour

- Time standard work day is 8 hours

In ca do this:

- From 18h to 22h: 4 hours working day

- From 22h to 6h: 8 hours night work

- In that 4 hours late exceed 8 hours/day is considered overtime night

Salary will be disaggregated into:

- Hourly basic for the entire period of work

- Account to pay extra due to night work for 8 hours in the night

- Account paid more by doing more hours a night for 4 hours exceeds the

Dissection this business:

- Accurate and complete in accordance

- Easy to explain to employees when you have questions

- Control get wage costs according to each type of work shift

In fact, according to the report of the Organization international Labor office (ILO), the calculation of salaries, lack of transparency, particularly with the shift work night and ca elongation, is one of the common causes lead to labor disputes in the business of manufacturing, service, operating 24/7. Business can refer to the related analysis in ilo.org to better understand this risk.

3. How to calculate wage night shift 8 hours in accordance

Compared to the night shift 12 hours, night shift 8 hours is the form of the popular and “easy” than in many businesses. However, in fact, many businesses still make a mistake or lack of wage night shift 8 hours, mainly due to not clearly distinguish between night work and overtime, or apply machine a fixed salary for all ca.

3.1 the night Shift 8 hours is to understand how?

Night shift 8 hours is shift work has a total working time of the day is 8 hours, in which the entire or a part-time fall into the time frame night, be the law determined from 22 hours to 6 hours the next morning.

For example:

- Ca work from 22h to 6am next day

- Ca work from 21h to 5am the next morning (in which 7 is the night)

With night shift 8 hours in working conditions usual:

- Workers do not arise overtime

- Business just to calculate pay more due to night work, not plus overtime night shift 12 hours

This is the difference important that the organizations and enterprises are seeking information about how to calculate wage night shift 12 hours and 8 hours need special attention.

3.2 the principle of calculating the wage night shift 8-hour business need to know

The first rule is working the night shift 8 hours is still considered to be working full time standard of the day, as long as the total working time does not exceed 8 hours.

Principles Monday is all hours worked fall into the time frame from 22h to 6h are counted as working hours at night and must be paid more wages as prescribed.

Principles of Tuesday's wage night shift does not replace the basic salary, which is the account paid in addition to wages, hours of work normal.

This means:

- Businesses still have to pay full salary under a contract of employment

- At the same time additional pay allowances due to night work

3.3 formula how to calculate wage night shift 8 hours

According to Article 98 of The Labour code 2019, workers worked at night to be paid at least 30% of the salary calculated according to the unit price of wage or salary hours of a normal working day.

How to calculate wage night shift 8 hours can understand in a simple way as follows:

- Basic hourly wage × number of hours worked

- Plus at least 30% of the hourly wage for each hour of night work

If the entire 8 hours, only to fall into the time frame night (for example from 22h to 6h), then all 8 hours are applicable rate plus this.

Conversely, if the ca is working only part time is night, the business just charge plus 30% for the number of hours actually worked the night, do not apply to the entire ca.

This rule is clearly stated in Article 98 of The Labour code 2019, businesses can collate at the main source as chinhphu.vn or thuvienphapluat.vn to ensure correct application.

3.4 example illustrates how to calculate wage night shift 8 hours

Suppose an employee working in the night shift 8 hours:

- Working time: from 22h to 6am next day

- Hourly rate under the contract: 40.000 vnd/hour

In this case:

- Basic salary: 40.000 × 8 hours

- Account paid more due to working night: 30% × 40.000 × 8 hours

Due to work shift does not exceed 8 hours/day, should:

- Does not arise overtime

- Business't have to apply additional level of 20% for overtime night

This just rules, just simple, easy to explain to employers and convenient when comparing payroll monthly.

4. Compare how to calculate wage night shift 12 hours and 8 hours

In the process of implementation consultants for business, one of the questions that are put out the most is: should organize the night shift 8 hours or 12 hours to just comply with the law, just optimal staffing costs?

Want to answer the question this, businesses need to understand the similarities and differences in salary between the two types of ca, instead of just compare the working time.

The comparison below to help organizations and businesses that are seeking information about how to calculate wage night shift 12-hour and 8-hour thorough look over before making a decision.

4.1 similarity between how to calculate wage night shift 12 hours and 8 hours

Same point the first is evenly apply the principle to pay more wages when working at night.

According to Article 98 of The Labour code 2019, all working hours fall into the time frame from 22h to 6am the following day are considered night work and must be paid at least 30% of wages, regardless of whether it is 8-hour shift or shifts of 12 hours.

That is, elements “night” is legal grounds important, not the length of the work shift.

Same point Monday's are based on actual hourly wage of workers.

Business needs determine exactly:

- Wages under a contract of employment

- Unit price salaries normal working hours

From that platform to the account, plus more for hours of night work. This helps to ensure transparency, easy to collate and easy to explain to employees when incurred questions about payroll.

In essence, whether the night shift 8 hours or 12 hours, if the business is properly calculate the hourly and separate the right hours of the night, they are all adhere to the same legal framework.

4.2 difference business are often confused

Biggest difference lies in whether arising overtime or not.

With night shift 8 hours in working conditions usual:

- Total working time does not exceed 8 hours/day

- Does not arise overtime

- Businesses only need to pay 30% extra for working hours at night

This makes calculation of wage night shift 8 hours of relatively simple, low-risk flaws if the process clocking clear.

On the contrary, with the night shift 12 hours:

- Part time exceeded 8 hours/day is considered overtime

- If the more this fall at night, a business must apply multiple levels plus different

- In addition to basic hourly wage and 30% for night work, also additional 20% of wages due to just working overtime just to do it at night

This is the point where businesses often confused or omissions, in particular when:

- Pooled whole 12 hours on a fixed salary

- Do not separate clearly the hours of night work and overtime hours of the night

- Manage shifts, using a spreadsheet crafts, difficult to control the current on – going accuracy

As a consequence, deviation of salaries, easily lead to internal complaint or legal risks when is the labour inspectorate.

4.3 Business should choose the how to optimize cost?

No work shift pattern which is “best” for every business. The choice of night shift 8 hours or 12 hours need to put in the context of actual operation, target hr management.

Businesses should prioritize the night shift 8 hours when:

- Model production or service allows for split shifts flexible

- Want to reduce complexity in payroll

- Towards stability in terms of health, productivity, long-term of the labor

On the contrary, the night shift 12 hours is usually applied when:

- Business operation, continuous 24/7 and difficult to arrange more scroll work

- Industry characteristics such as production lines, logistics, medical

- Business had attendance system payroll enough detail to separate the hours, apply the correct coefficients

About angle expenses, ca 12 hours isn't always cheaper or more expensive than 8-hour shift. If true enough as a rule, wage costs, the night shift 12 hours usually higher because of many terms, plus more. However, business can be compensated for by:

- Reduce the number of labor shifts

- Reduced cost delivery ca

- Optimal operation if well organized

It is important that businesses need right from the beginning, instead of select work shift pattern based on emotional or old habits. When clearly understand the difference in wage night shift 12 hours and 8 hours, the business will be more active in controlling costs, compliance with laws and construction labor relations sustainability.

5. Solutions to help businesses calculate wage night shift 12 hours and 8 hours exactly

To avoid the mistakes mentioned above, businesses not only need the “know how”, but also need to build a system for managing shifts and wages good, in accordance with the actual operation.

5.1 Standardized regulation shifts, and regulations payroll

Solution first most important is to standardize regulation shifts, right from the start.

Businesses need to specify:

- The type of work shift (day shift, night shift 8 hours, night shift 12 hours)

- The start time and end each song

- Principles for determining hours of night work, overtime

These contents should be clearly shown in:

- Contract labor

- Internal labor regulations

- Regulation pay salaries and bonuses

When clear rules, business not only easy to apply in practice, but also the legal basis firmly when the process with the employee or agency management.

5.2 application software, timekeeping, and payroll automatically

With the business have shifts, complex, especially the night shift 12 hours, the management of the craft almost no longer fit.

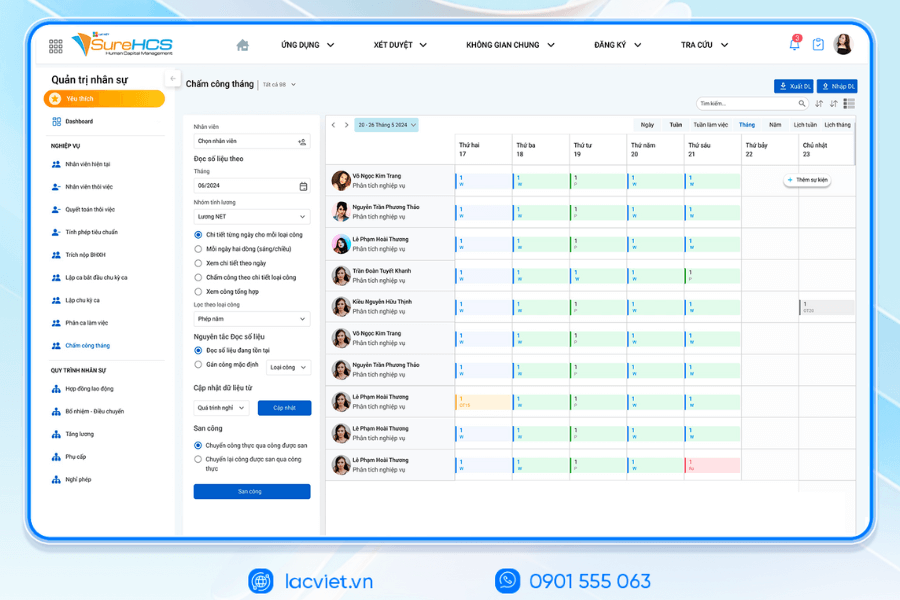

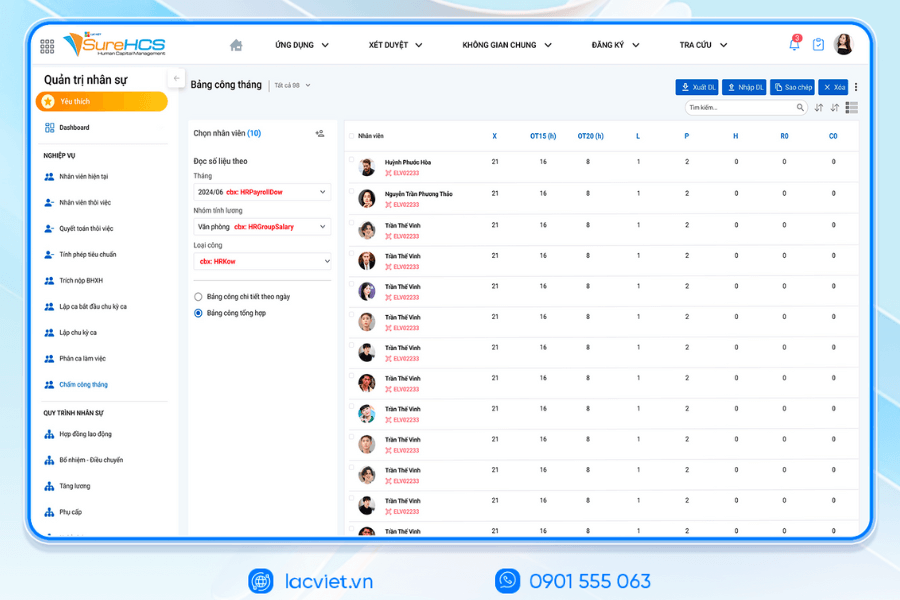

Application software, timekeeping, and payroll help:

- Automatically separates hour work day, night, overtime

- Automatically apply the correct coefficients for each type of hours

- Reduction depends on the manipulation of HR and accounting

According to the study of human resource management, business application system attendance – payroll automation can significantly reduce the data error, time, payroll processing, while improving transparency in pay.

When properly applied solution, the business will receive these values are very specific:

- Reduce the risk labour disputes related to wages the night shift

- Transparency personnel costs, especially with models working shift 12 hours

- Save time for the hr department and accounting

- Enhance the experience and engagement of workers, especially working group night capital under a lot of pressure about health

More importantly, businesses can actively choose, compare between night shift 8 hours and 12 hours based on accurate data, instead of relying on feelings or habits former manager.

- 10 Ways payroll standard recipe, practical examples, and legal note

- 10 payroll software hr most striking 2026 popular

- Payroll software according to KPI optimal performance management, and pay fair wages for business

- Payroll software 3P LV SureHCS C&B automation salary calculation accuracy, ease of deployment

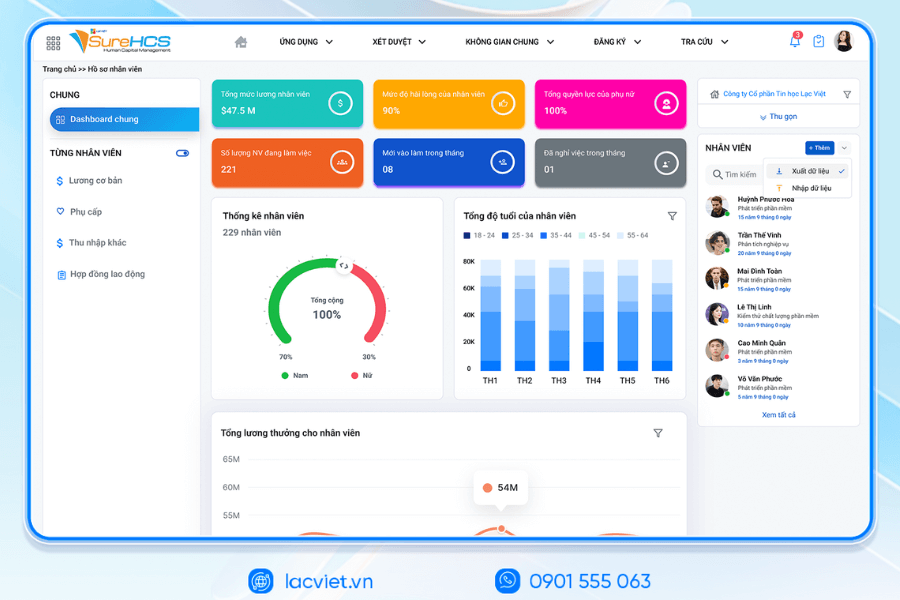

6. LV SureHCS C&B, payroll custom depth shifts for business

In the context of modern businesses increasingly operate according to the multi-model, a lot of the crew, the night shift lasts, the accurate timekeeping, and payroll in accordance with each shift, each working hours become a problem important for the hr department and parts C&B. Management by manual methods or simple spreadsheet is not only time consuming, but also prone to cause errors, especially when expanding business scale or more points of production branch.

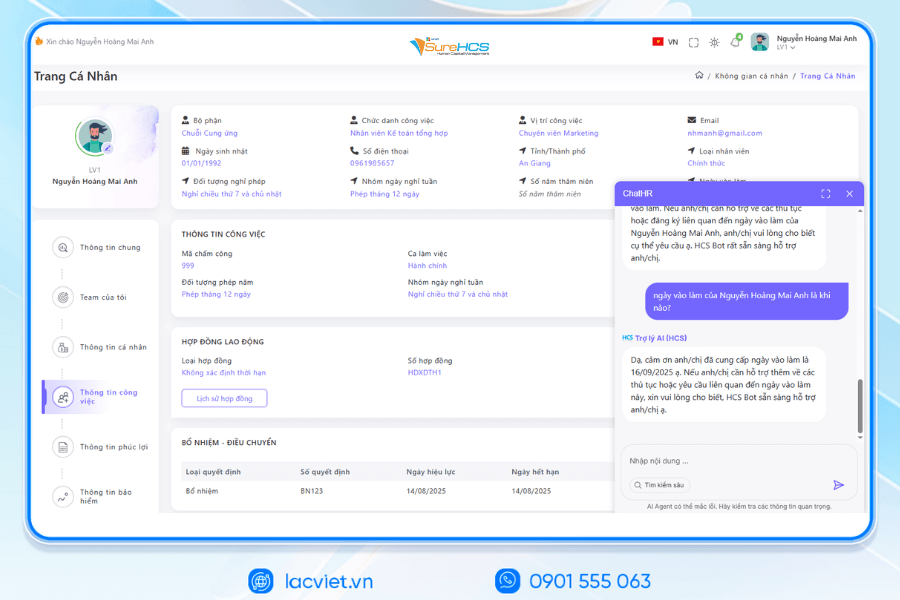

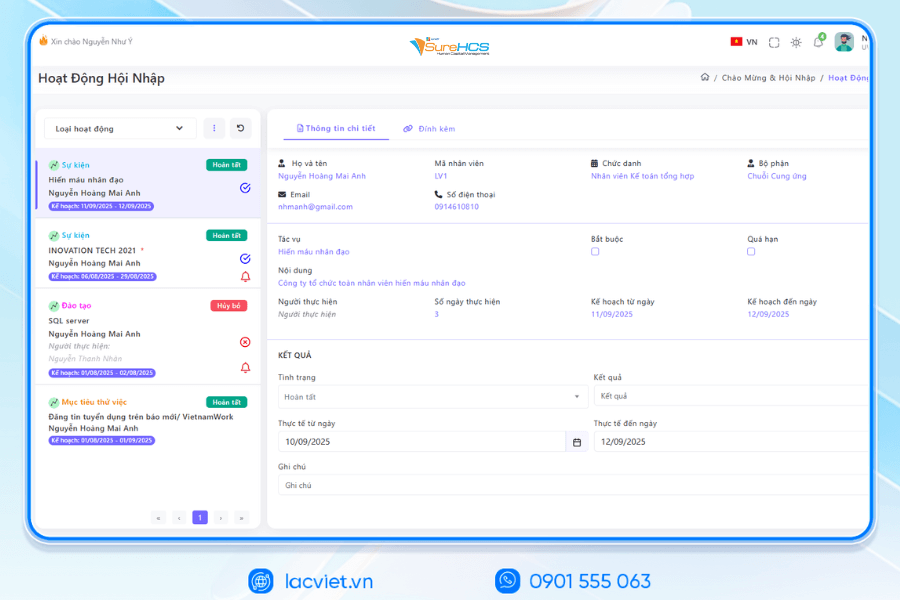

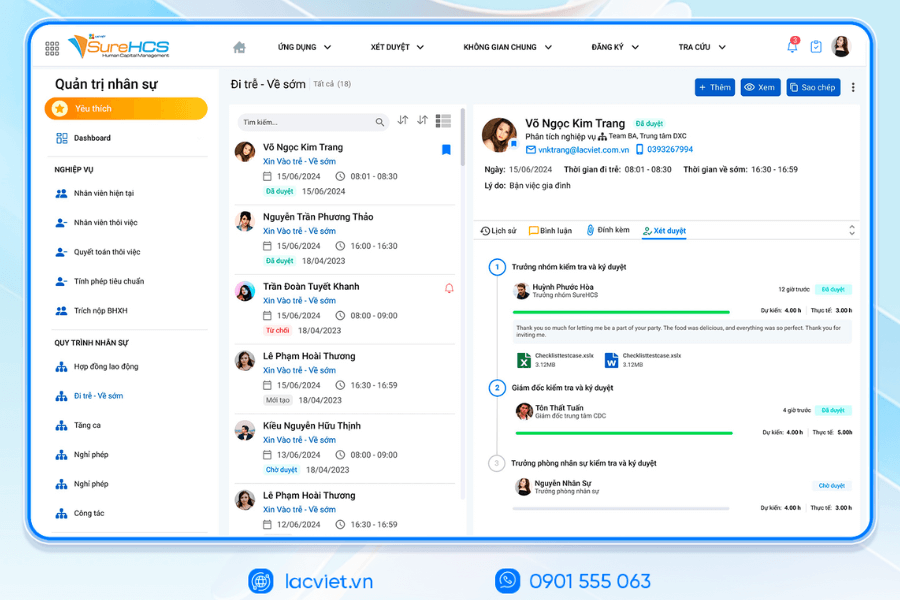

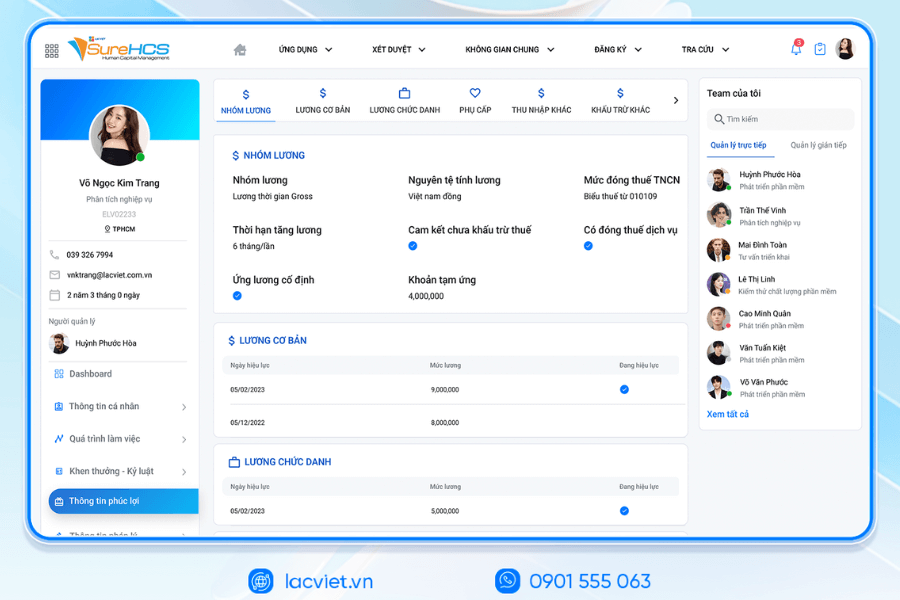

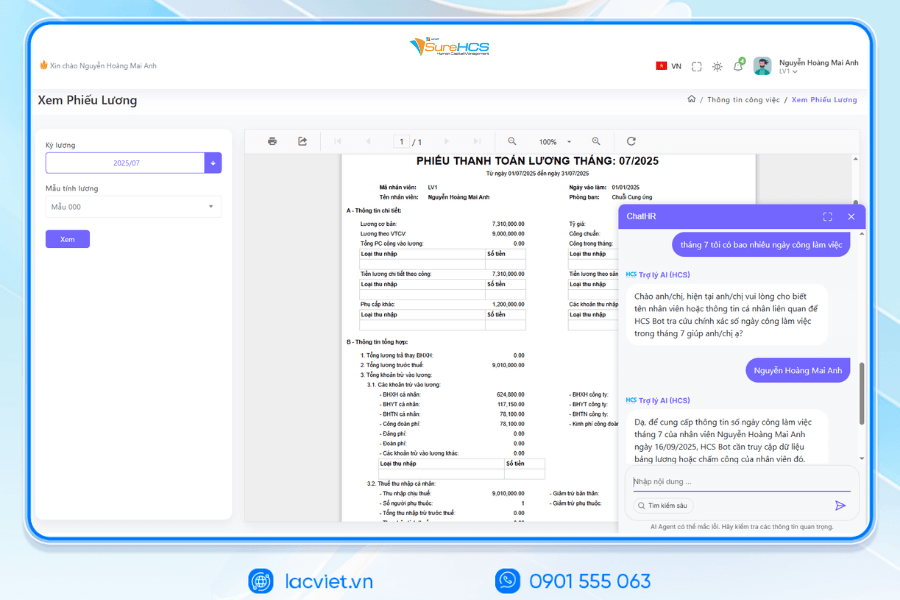

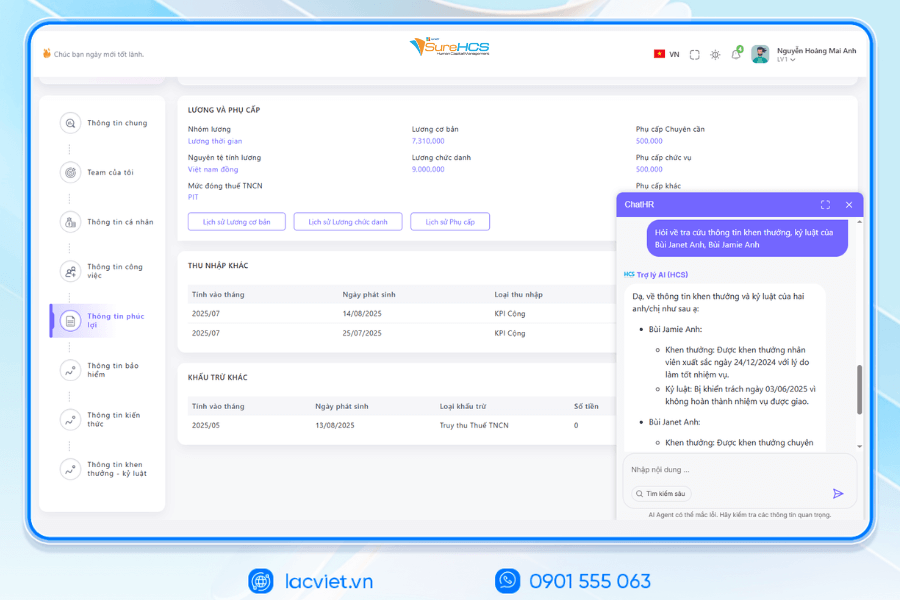

HRM softwares LV SureHCS C&B designed to solve the root of these challenges by automating the entire process attendance – payroll – benefits, especially with the work shift as complex as the night shift 12 hours and the night shift 8 hours.

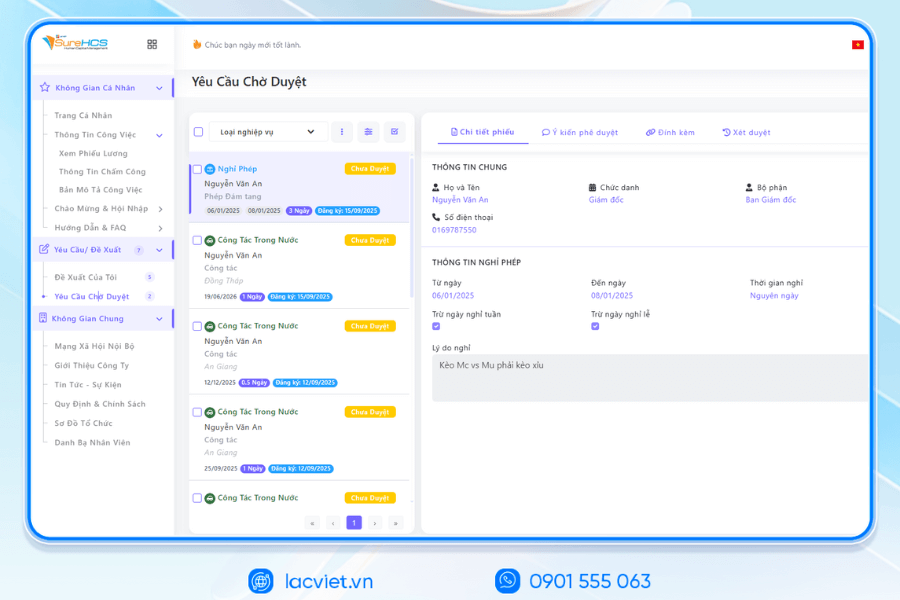

LV SureHCS C&B allows to configure payroll in many different models, including paid by the hour, shift, according to the product, or based on work performance (3P). With this feature, businesses can define the formula for calculating the salary for night shift, ca increased ca, ca to do further strictly according to internal policies and legal provisions that do not need to depend on IT or complicated programming.

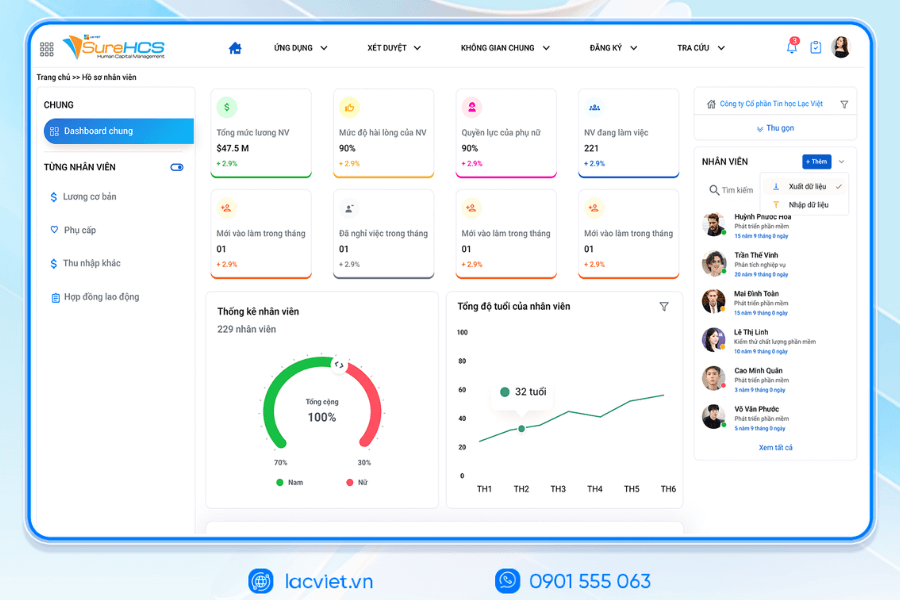

The actual value that LV SureHCS C&B bring to a business:

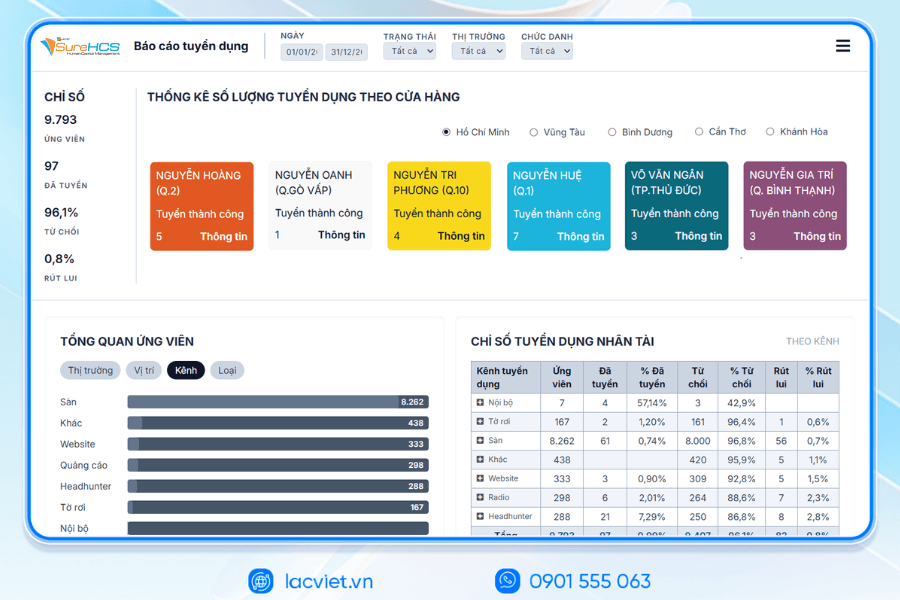

- Automatically separates hours and shift work: identity system recorded hours according to shift specific (day shift, night shift 8 hours, night shift 12 hours...), from which properly apply the coefficients to pay more according to the regulations.

- Integrated attendance data – overtime – leave – salary calculator seamless: data hours after being recorded will automatically sync to the module payroll, reduce errors due to data entry and shorten the processing time payroll monthly.

- Flexible configuration in accordance with the characteristics each enterprise: the set of rules about shift coefficient, allowance, how to calculate the hours of the night or the classification overtime can custom fit labor policies of the business that still ensure the correct law.

- Detailed reporting, transparent: provides real-time reports about hours of work, wage costs, according to the ca, increased synthesis of ca..., help leadership easy strategic decisions about resources and costs.

LAC VIET SUREHCS – A CUSTOMIZED, IN-DEPTH HUMAN RESOURCE MANAGEMENT AND COMPENSATION & BENEFITS PLATFORM FOR BUSINESSES

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

Feature highlights:

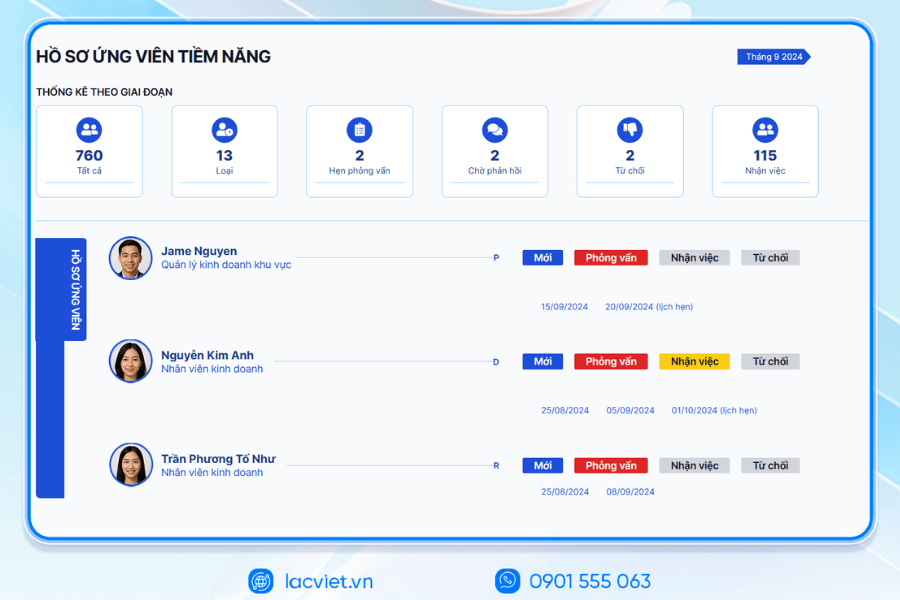

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

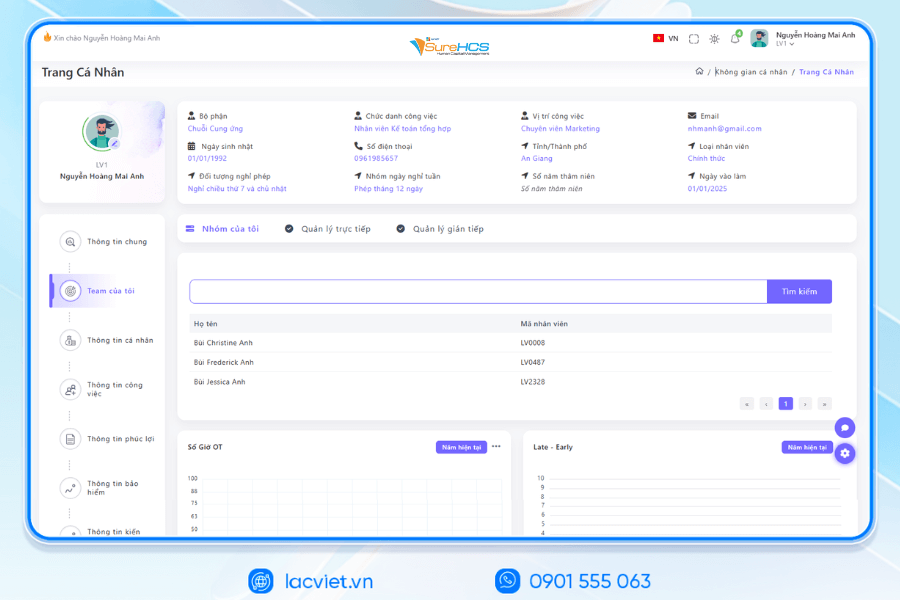

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

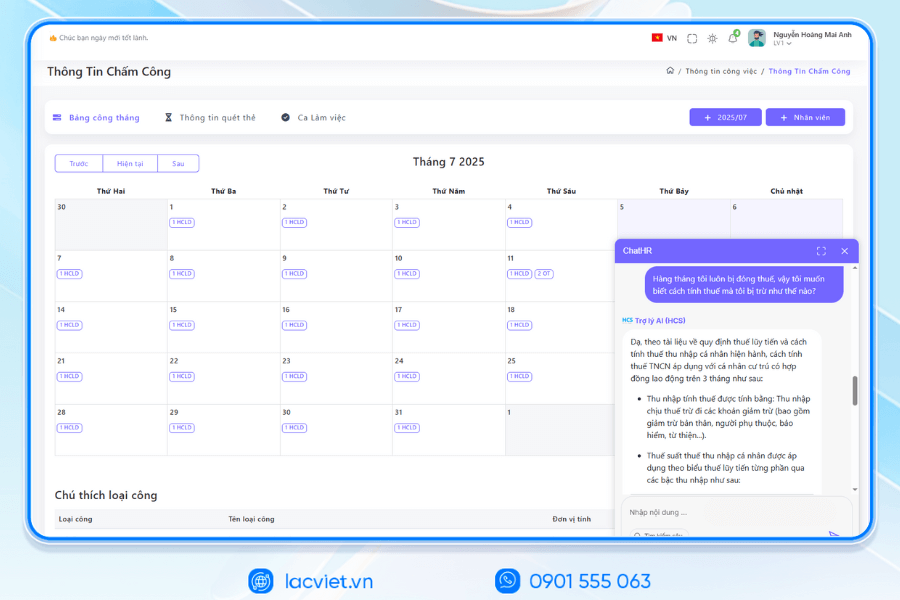

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

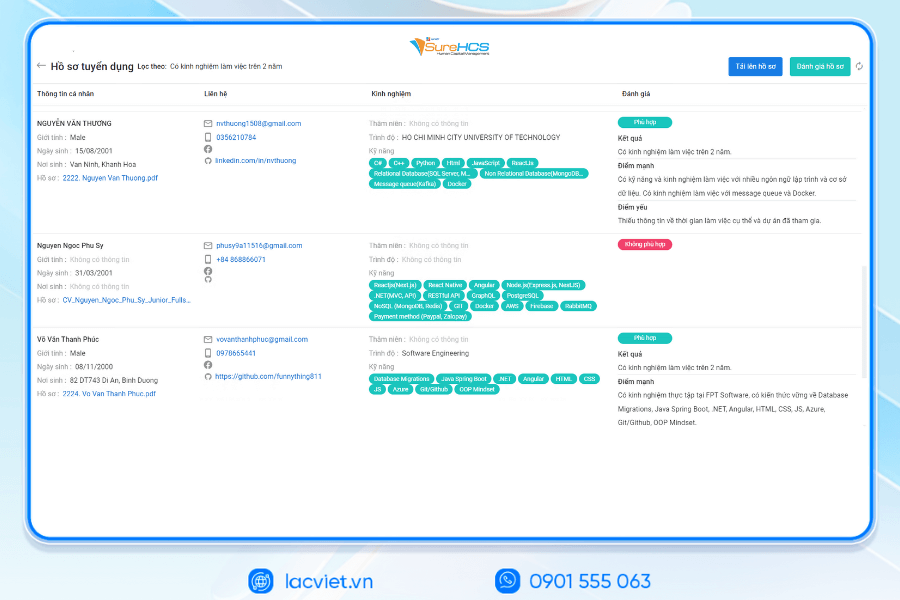

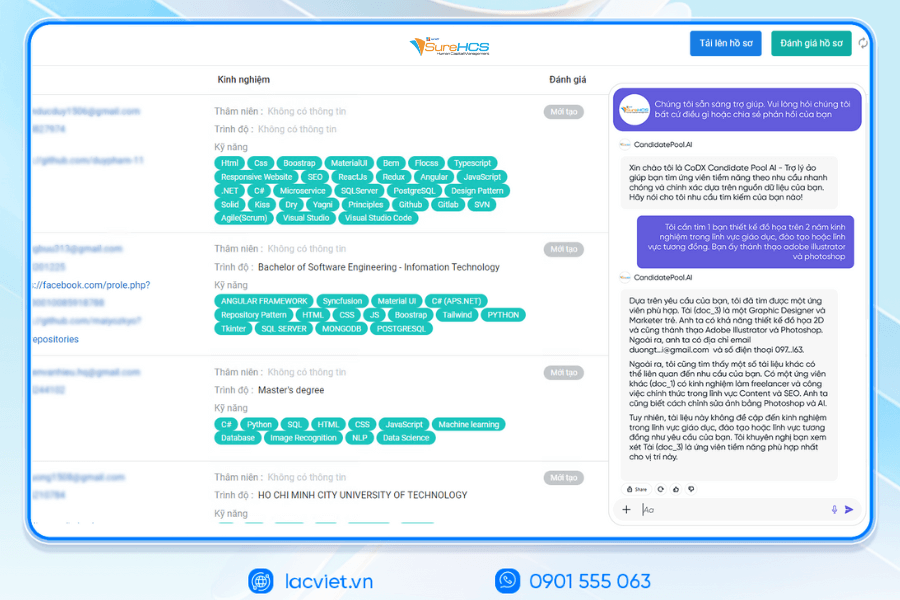

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile Successful Plastic, Long Thanh, Phu Hung Life, the airports of Vietnam (ACV), the enterprise division of SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to over 10,000 personnel

- Corporations, businesses, multi-subsidiary, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depths according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need to automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The software application LV SureHCS C&B doesn't just help HR departments reduce the load administrative work, but also improve the accuracy, transparency and effective hr management, thereby creating value sustainability strategies for the business. Especially with the business manufacturing, logistics, retail, or service a large scale, has the shift pattern salary complex, this software becomes indispensable tool to ensure optimal operating costs.