How to calculate monthly salary popularity is based on the time actually worked, with allowances, bonus and other mandatory deductions. Food get = (Salary agreement / Number of days the standard) × Number of days of actual work + Bonus – Penalty – insurance – PIT. The account insurance, including SOCIAL insurance, health INSURANCE as prescribed. The number of days the norm, from 22-26 days/month, depending on the business.

Payroll is the process of determining the income of employees based on time worked, the results of work with the remuneration policy of the enterprise, at the same time comply with labor laws.

This article Lac Viet SureHCS will help the business understand the methods of calculating wages popular today, formula for calculating the specific example illustrated, easy to understand and the important note to pay exactly for optimal staffing costs.

1. How to calculate the salary is what? Why business need to understand the right and true?

1.1 salary Calculator what is in hr management business?

In hr management, how to calculate the salary is understanding the method, a formula that businesses use to determine the amount of workers who receive a salary based on working time, mass, or work results, together with the remuneration policy was issued.

In simple words, how to calculate the wages employees are answers to three core questions:

- Employees are paid based on what factor? (time, product, performance, or combination)

- Recipe salary calculator tool can happen?

- The account would be the account which is deducted?

For example, with an office worker, paid by the month, the formula for calculating the regular rate of pay is built based on salary agreement number of the actual date, the number of overtime, allowances related. Meanwhile, with the business of production, calculation of salary can be attached directly to the output or the level of labor.

So, how to calculate the salary is not just a calculation, which is an important part of system administration personnel, closely associated with attendance, performance reviews, personal income tax and mandatory insurance.

1.2 why the organizations and enterprises need to understand properly about how to calculate salary?

As practice shows, many organizations and businesses are looking for information about how to calculate the salary usually starts when one of the following issues:

- Employee inquiries or complaints about wages

- Errors in payroll calculation process, arrears or refund

- Concerns legal risks related to labor, tax, insurance

- Enterprise scale increases, and salary calculation craft no longer fit

Understanding improperly or inconsistently applied and salary calculation can lead to many negative outcomes:

- Lose the confidence of workers, affecting the level mount

- Increased risk of labor disputes

- Difficult to control personnel costs, particularly in the expansion phase

1.3 Applied properly payroll bring what value for business?

When construction business, properly applied, payroll, value, bring not only lies in the “pay the right money for employees”, which was clearly manifested in the following aspects:

- Firstly, ensure transparency, fair internal. A formula for calculating the salary obvious, was media transparency helps employees understand why they get current salary. This is especially important for businesses that have multiple parts, many forms work differently.

- Monday, reducing legal risks related to labor and wages. According to The Labour code 2019, employers are obliged to pay in full, on time and in the right deal. The application of the wrong calculation of salary can lead to arrears, penalties, administrative or long dispute. Source reference: https://vbpl.vn (Portal legal documents in Vietnam)

- Tuesday, help businesses better control personnel costs. When the salary calculation is standardized, easy business analysis the proportion of wage costs in total operating costs, thereby making the decision to adjust the fit.

- Fourth, create a platform for automation, timekeeping, and payroll. A payroll is clearly a prerequisite for business application software payroll. If the recipe is not uniform, attendance data, non-standard, the automation will not bring real effect.

- 10 Sample employee payroll latest standard rules, easy to apply, optimal management personnel

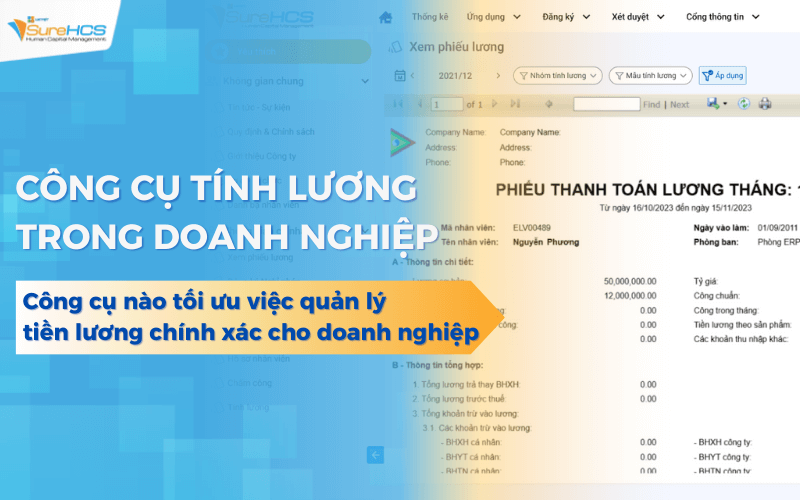

- Tools wage calculator how optimal management salaries accurate for Enterprise?

- 10 payroll software hr most striking 2026 popular

- Payroll software according to KPI optimal performance management, and pay fair wages for business

2. The legal grounds business need to know when applying payroll

With respect to the organizations and enterprises are finding out information about how the payroll factor is the legal foundation required. A formula for calculating the salary, although considered reasonable design of the admin but if not, comply with the law, businesses can still faced with the risk of dispute, arrears or administrative penalties.

Properly understood correctly apply the legal grounds help businesses build how to calculate employee salary transparency, sustainable, safe in the long term.

2.1 legal Provisions related to how to calculate salary in Vietnam

The current Labor law is legal grounds highest adjustment issues related to wages. Follow The Labour code 2019salary is the amount that employers pay for workers to perform work under the agreement, including salaries by job or title, allowances and other additional payments.

From this rule, businesses need to note some important principles when building formula for calculating the salary:

- Firstly, the principle of payment. Wages must be paid in full, on time and not be lower than the minimum wage due to state regulations. Business not cut salaries or changing the way payroll if no agreement with the employee.

- Monday, term and form of payment of wages. The law allows businesses to pay by the month, half year, week, or according to the product, depending on the particular job. This opens up the flexibility in the way payroll, but requires business must be clearly stated in the contract of employment or wage payment regulations.

- Tuesday, regulations on the minimum wage. Wage agreement in the contract of employment and real wages are not lower than minimum wage. This is a “safe threshold” legal that every business must adhere to, even when applied in the form of paid according to the product, or by performance.

Understanding these principles, businesses can proactively design calculation of salary in accordance with the business model that still ensure compliance with the law, avoid the risk of arrears or penalty.

2.2 The earnings, deductions need right in the way payroll

In fact deployed, many flaws does not come from complex formula which comes from the misidentification of earnings and deducted in the calculation of employee wages.

About earnings, wages typically includes:

- Basic salary or wages under the titles

- Allowances (responsibility, position, toxic, edible, ca...)

- Enjoy the additional payments according to enterprise policy

The important point is that not all these terms have the same way of processing when calculating tax and insurance. If the business is not classified clear from the beginning, the formula for calculating the salary will be false.

About the deduction, the business need, right enough:

- Social insurance, health insurance, unemployment insurance in accordance

- Personal income tax of employees

According to the data of Social insurance in Vietnamthe errors related to close – insurance quote is one of the common causes leading to arrears sanctioned businesses, especially small and medium enterprises.

A very important note in the way payroll is to avoid confusion between:

- Taxable income and income not taxable

- Account calculation of insurance premiums and account no insurance

For example, a number of allowances brings the benefits may not be taxable or not insurance premiums if you meet the conditions as prescribed. If the business does not understand, the wrong application will increase the cost of unnecessary personnel or cause disadvantage for workers.

3. The distance calculator salary common in business today

In actual operation, there is not a calculation of salary only suit for any business. Depending on the business model, the peculiarities of work, human resource strategies, businesses will choose the method of calculating different salaries. Understanding the nature each salary calculator help businesses properly applied, limiting the dispute and optimal personnel costs.

3.1 How to calculate salary according to the time

How to calculate salary according to the time is the most common form today, especially with business office services, hr administration. Earnings of workers are determined based on the time actually worked, not directly dependent on the output.

Salary per month

Salary according to months, usually applied to employees working stable, full-time.

Formula for calculating the salary downloads:

Food get = Salary agreement / Number of working days standard × Number of days actually worked

± allowances, bonus

– deductions (insurance, taxes)

For example: An employee has a salary agreement 12.000.000/month, number of days of work the standard is 26 days, real gone in 24 days.

Real wage = 12.000.000 / 26 × 24 ≈ 11.076.923 copper (not including allowances and deductions).

Salary by date

This form usually applies to seasonal workers or the position does not make enough months.

Recipe: the daily Wage = Salary / Number of working days standard

Hourly wage

In accordance with labor, part-time, work in shifts.

Recipe: hourly Wage = Wage day / Number of hours worked in the day

How to calculate salary according to the time easy to manage, easy to explain to workers, in accordance with the timekeeping system automatically. However, if not tied to performance reviews, businesses can see the status of “enough now, but not effective enough”.

3.2 How to calculate salary according to the product

How to calculate salary according to the product form is paid based on the number or quality of the product that the labor completed. This method is popular in business, manufacturing, industry, and garment assembly.

Income of workers in proportion to the output produced. Do as much income as high for meet the quality standards.

Formula calculate salary according to the output:

Salary products = Number of standard products × Unit price of the product

For example: A worker completes 500 products/month unit price 20,000/product.

Salary = 500 × 20.000 = 10,000,000.

When should I apply?

- Businesses can measure the exact output

- The repeat, get the lowdown clear

How this salary calculator help businesses fastened wage costs, with labor productivity, thereby better control the price of production.

3.3 How to calculate wage earnings or performance

This is how to calculate employee wages popular in the business-to-business sales brokers.

Salary plus commission

Workers have a fixed salary guaranteed minimum income, combined with a commission based on sales or contract carry on.

Illustrated recipe: Salary = Salary plus (revenue × commission Rate)

How to calculate wage this created strong motivation for employees, and help businesses share the risks and the business results in a logical way.

3.4 calculation of salary exchange

Salary exchange is a form of pay based on the volume of work or the end result was the agreement, does not depend on the time specific work. Salary exchange helps enterprises proactively costs, in accordance with the work not need to manage tight on time, but require clear results.

Business and labor ago:

- Workload

- Salary exchange

- Term completed

When business should apply?

- The project, short-term

- Can measure the unknown outputs

Risks and how to control: If not specified criterion, testing, business prone to disputes about the quality of work. So salary exchange need to go any contract or agreement details.

3.5 How to calculate salary according to the KPI work efficiency

Salary according to KPI is a form of pay attached directly with the level of goal completion the work of the staff in a review. KPI can be revenue, production, the rate of completion of the work or the norms different effect.

In essence, how to calculate the salary is usually built according to the model:

- Fixed salary (guaranteed basic income)

- Salary fluctuates based on the level reached KPI

Recipe payroll KPI downloads:

Food get = fixed Salary + (Salary KPI × Percentage of completion KPI)

For example, An employee whose salary is fixed 8,000,000, salary KPI maximum of 4,000,000.

If the level is complete KPI is 80%, the wage KPI enjoy is 3.200.000 vnd.

How to calculate salary according to the KPI helps business fastened wage costs, with efficient work, limiting the status of “enough now, but not enough results”. According to research by Deloitte, the business link pay with performance clearly have the mounting level employees is higher than the paid model pure duration.

3.6 How to calculate salary according to the model 3P (Position – Person – Performance)

Salary 3P is paid model modern is many businesses apply when you want to enhance fairness and retain staff long-term.

Three factors in the model 3P include:

- P1 – Position: Salary according to the job position

- P2 – Person: Pay according to individual capacity

- P3 – Performance: Salary according to the results of work

Salary 3P help business:

- Paid fair wages by location and capacity

- Motivational development for staff

- Easy to standardize wages as business, scale

Formula for calculating the salary 3P illustration:

Salary = Salary position + allowances capacity + Bonus work efficiency

For example: An employee has:

- Position salary: 10,000,000

- Allowance of capacity: 2,000,000

- Bonus effect: 3,000,000

Total salary = 15,000,000

3.7 calculation of 13th month salary

13th month salary is not mandated by law, which is often viewed as bonuses last year, depends on the policy and business results of the business.

The distance calculator 13th month salary downloads:

- Paid in full 1 month's salary if the employee do the full 12 months

- Pay in proportion to the time worked during the year

- Pay according to the results of rating or performance

Illustrated recipe: 13th month Salary = Salary average year × (Number of months at work / 12)

13th month salary is a tool to retain effective personnel, particularly in the period last year. According to a survey by Mercer on remuneration policy, bonus last year have significant impact to the decision to sticking of workers.

3.8 How payroll overtime overtime

Wage overtime is paid more for workers when working outside the working time normal, according to the provisions of the labor law.

According to The Labour code 2019, wages, overtime is calculated as a percentage compared to the unit price of wage or salary according to the work being done.

Formula for calculating the salary increase ca basic:

Salary increase ca = hourly Wage × coefficients do more × the Number of hours of overtime

In which:

- Do more days often: at least 150%

- Make extra day off every week: at least 200%

- Do more on holidays: at least 300% (not including salaries holidays)

3.9 calculation of wages, working holidays, new year

When employees work on holidays and new year according to the regulations, businesses must pay higher wages on a normal working day.

Under current regulations: workers work day and holidays are paid at least 300% of salary, not including salaries holidays (if paid by the day).

Illustrated recipe:

Salary holidays = the daily Wage × 300% + Salary date (if available)

The application of properly salary calculator holidays to help businesses avoid the risk of violation of labor laws, especially in the service industry, production of continuous operation.

3.10 calculation of salary do holidays (Saturday, 7-Sunday)

With the labor day vacation every week fixed, if work on that holiday, businesses have to pay overtime pay vacation days.

The amount of the minimum wage according to the law: at Least 200% hourly wage or salary day

Recipe: Salary do on vacation = hourly Wage × 200% × the Number of hours worked

How to calculate monthly salary clear for holiday help business:

- Active staffing

- Control costs incurred in addition to the plan

- Limit the conflict of rights

4. Mistakes businesses often encounter when applying payroll

In the process of consulting, system deployment, timekeeping, and payroll for many types of businesses, one can see that the errors do not come from the business “don't know how to calculate wage”, which come mainly from the application of inconsistent or no longer fit with the actual commissioning. This is the popular error that the organizations and enterprises are seeking information about how to calculate the salary should be especially noted.

4.1 payroll inconsistencies between the parts

A common mistake is that each department applies a payroll staff other, each other, despite the belonging to a system common salary.

For example:

- Parts of A salary calculator by date of the standard 26 days/month

- Parts B back conversion in 22 days

- How to calculate overtime pay, or leave between the parts is not homogeneous

The result is:

- Staff is hard to understand, easy to compare, leading to questions or complaints

- Hr takes more time to explain and adjustable handle

- Business difficult to control payroll costs overall

About the admin, formula for calculating the salary should be standardized at the business, then the new adjusted flexibly according to specific groups of labor. If not, there is a “general framework”, the salary calculator will gradually become patchwork and lack of transparency.

4.2 Non-timely updates of changes to the law on wages

Labor law, payroll, insurance and taxes in Vietnam are adjusted periodically. However, many businesses still retain payroll for many years without reviewing the appropriate level.

A number of risks downloads:

- Apply the minimum wage has expired

- False wages, overtime under the new rules

- Insurance deduction, or tax is not properly grounded existing legal

According to the report, the labor inspectorate of the Ministry of Labor – invalids and Social affairs, the violation related to salaries and insurance are still among common error in business, particularly in the area of small and medium enterprises.

If the business is no timely update, how to calculate the salary right about the internal can still become wrong legally, entail risk arrears, penalties.

4.3 depend too much on spreadsheet crafts

Excel spreadsheet is still the tool is many businesses used to calculate wages. However, when the scale of personnel increased, the excessive dependence on the handle will reveal many restrictions.

Risk flaws high: Just a wrong formula, the wrong one attendance data, the entire payroll can be affected. The revise very time consuming, easy to miss.

Time consuming, difficult to control, data: Data, attendance, shifts, overtime is often scattered in many different file. This makes the check access pay history, or to control when a dispute becomes complex.

5. The optimal solution how to calculate salary for business modern

To fix the mistake on, businesses need to look at how to calculate pay as part of the management system overall, instead of just the last step of the payroll process.

5.1 Standardized processes timesheets – payroll

Core solutions is first standardized processes, before thinking tool or software.

Cụ thể:

- Building a payroll system for the entire business

- Specifies how to convert days, hours, overtime

- Connection data, attendance, shifts, vacation into the same processing flow

When the process is standardized, the personnel department will:

- Reduce processing time craft

- Easily explained formula for calculating the salary for employees

- Create a solid foundation for the automation later

Value the fact that businesses control the risks right from the root, instead of handling errors in the last step.

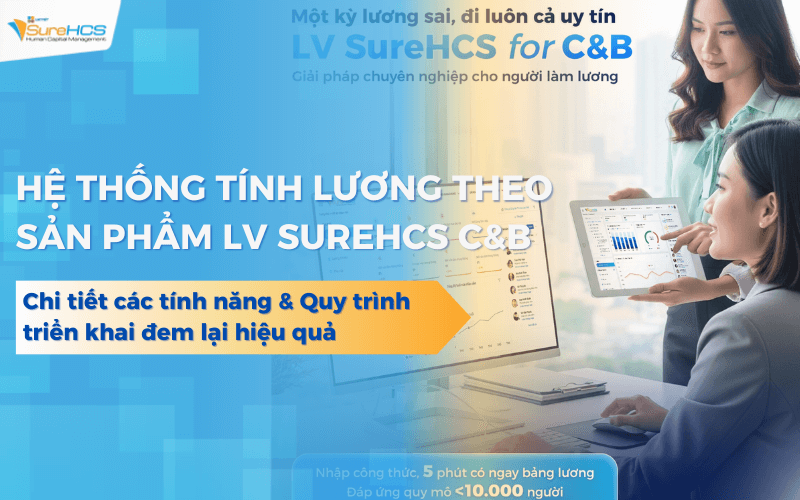

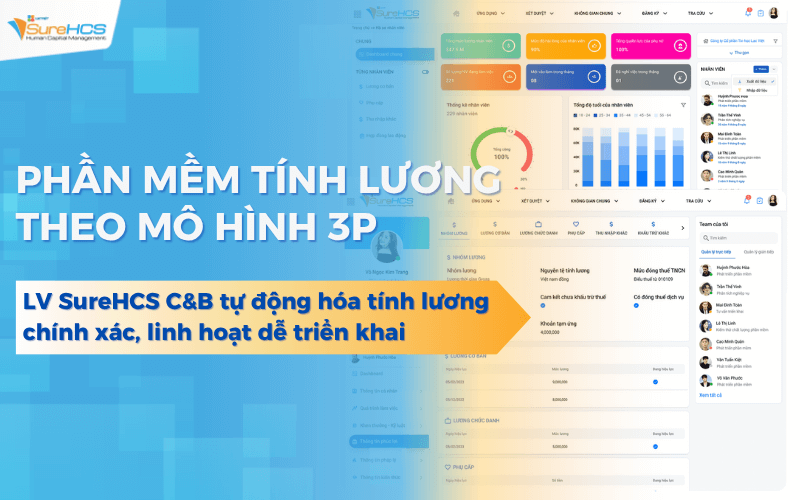

5.2 application software payroll LV SureHCS C&B to increase the accuracy

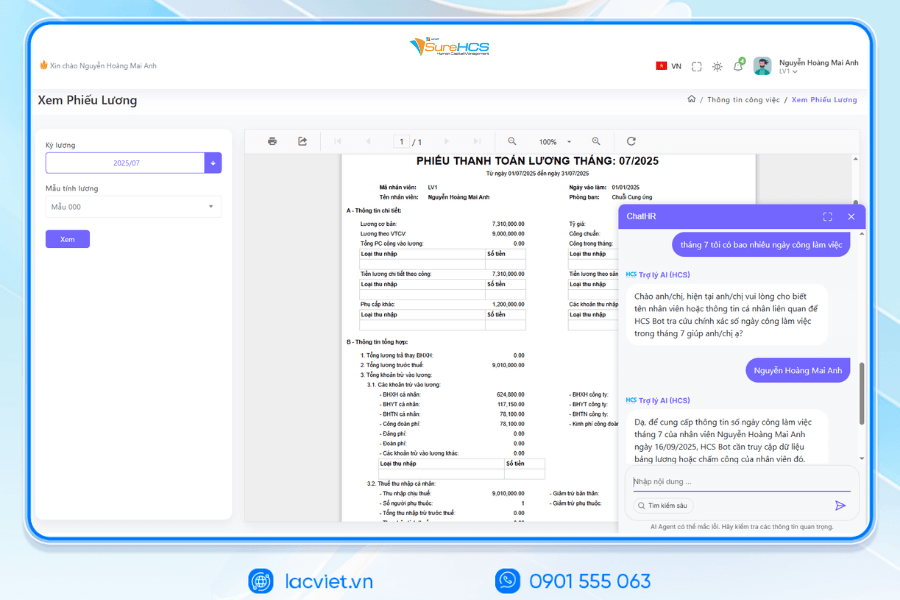

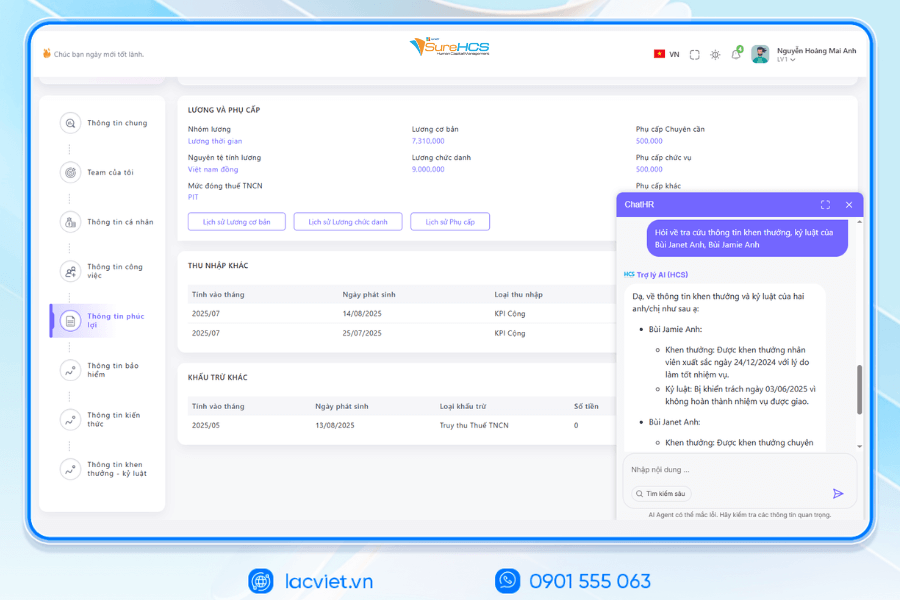

After the process was clear, the application software is steps away essential to optimal operation.

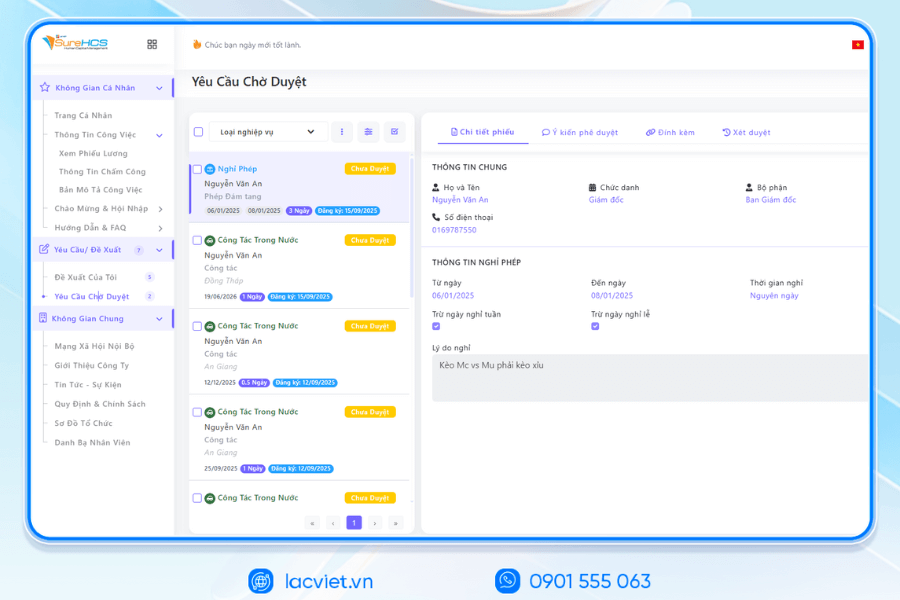

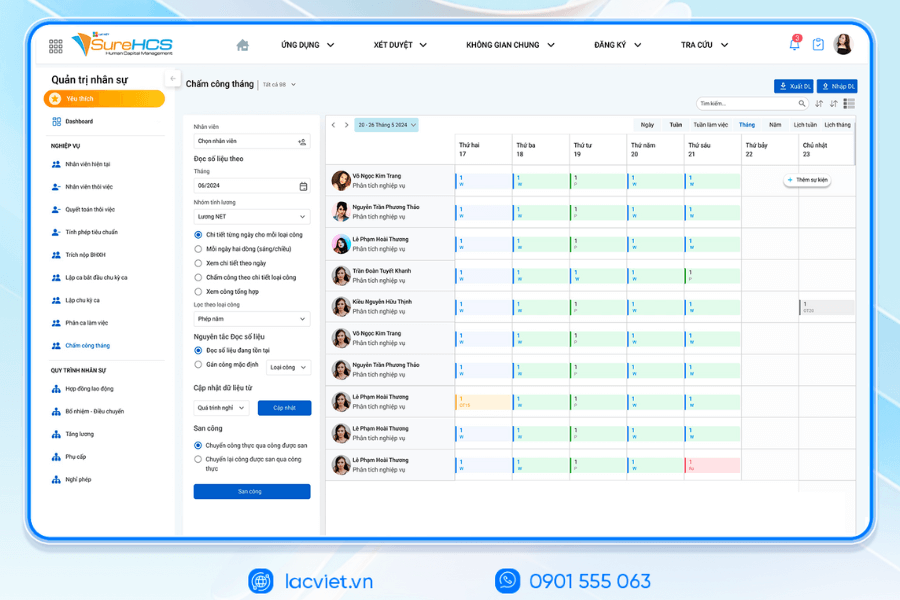

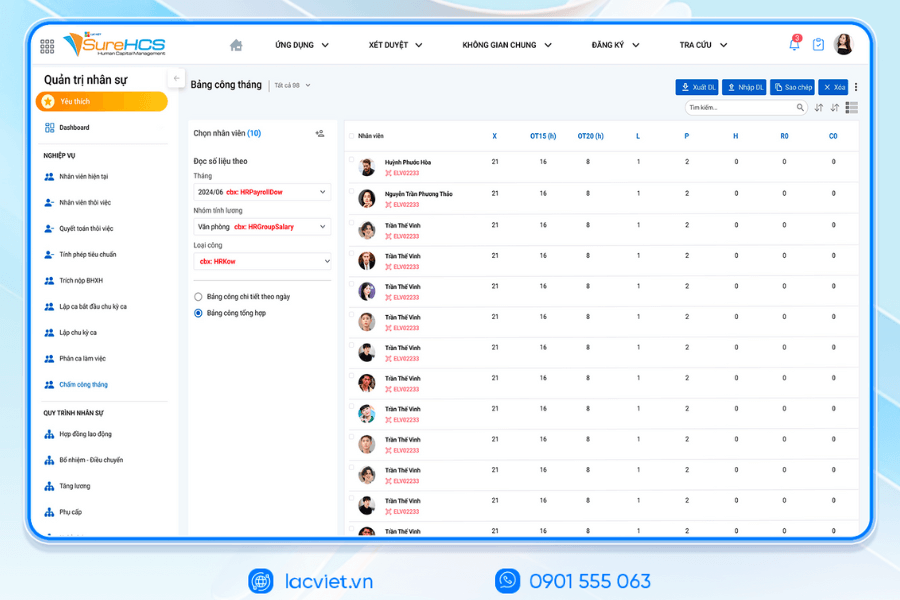

- Auto chemical formula for calculating the salary: The software allows you to set the formula for calculating the salary according to each group of workers. When attendance data changes, the system automatically updates the result, to reduce dependence on manual action.

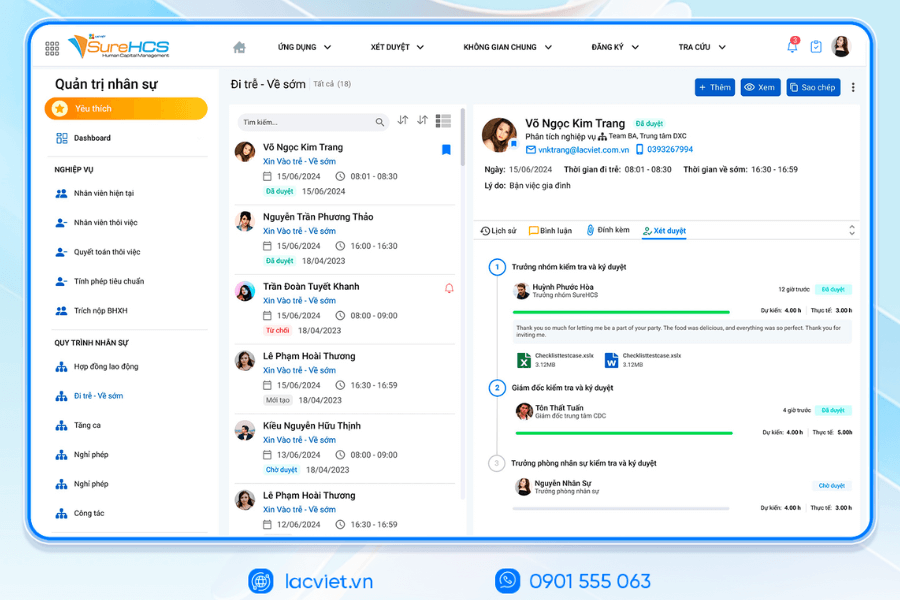

- To limit errors and disputes: the Data is stored centrally, there is history edit clear. When arising questions, personnel can access and control quickly.

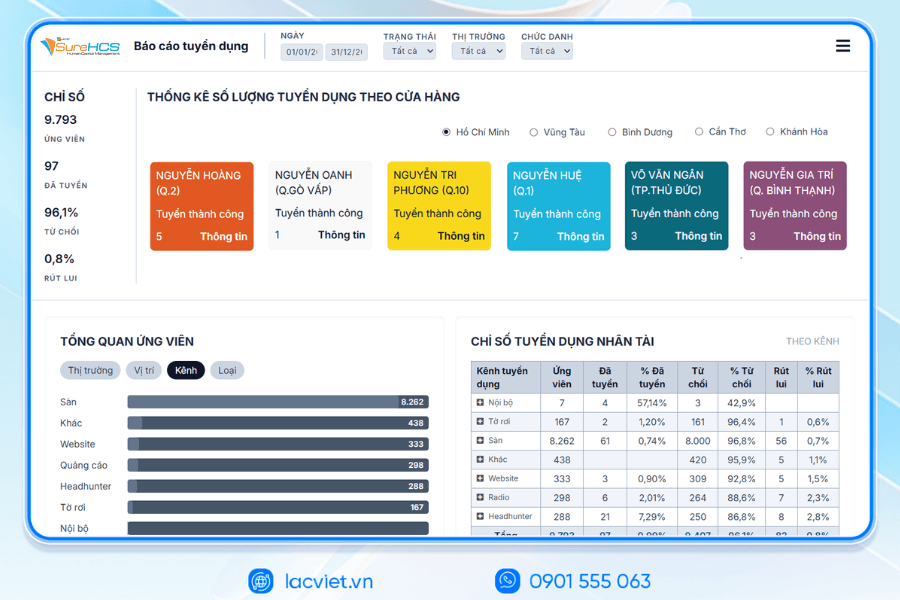

- Easy to control, data analysis: Businesses can track payroll costs by department, project or phase, from which support decision-making personnel more accurate.

In the context of the organizations and enterprises are seeking information about how to calculate wages, one can see that the biggest challenge lies not in the lack recipe, which is located in the ability to deploy precision, consistency and compliance with the law in fact operate. When the number of personnel increased by payroll staff increasingly diverse (salary, duration, KPIS, 3P, overtime, holidays, months, 13...), the processing by spreadsheet is very easy to arise flaws and consuming more resources.

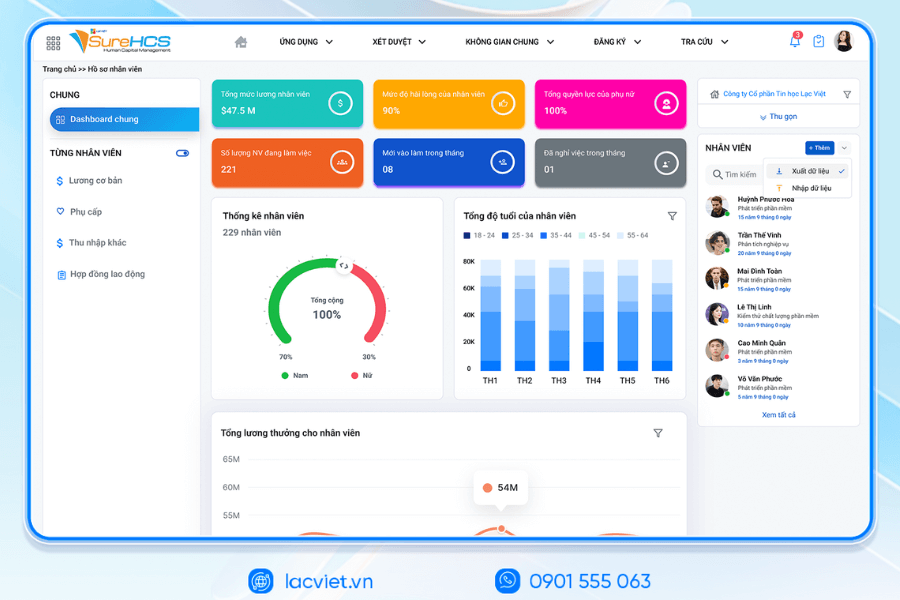

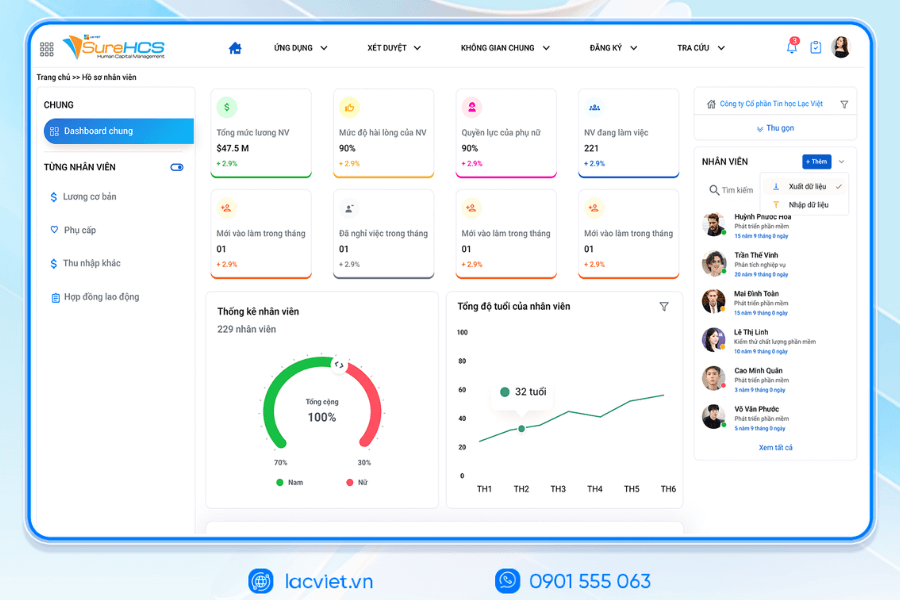

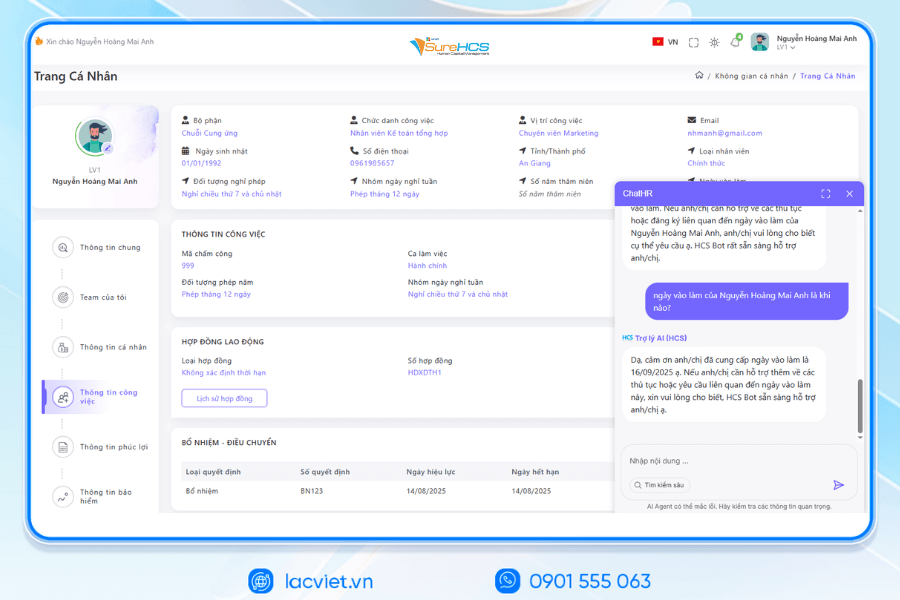

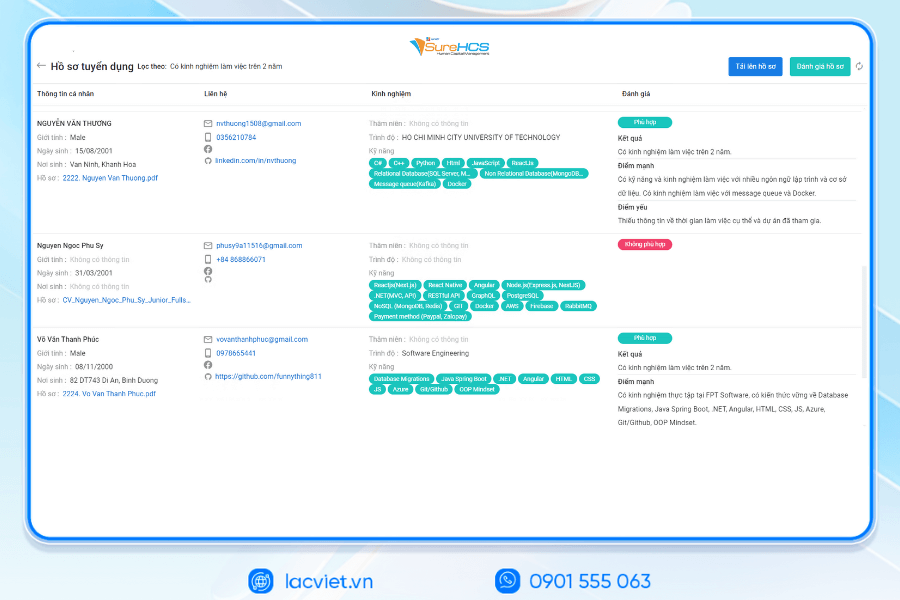

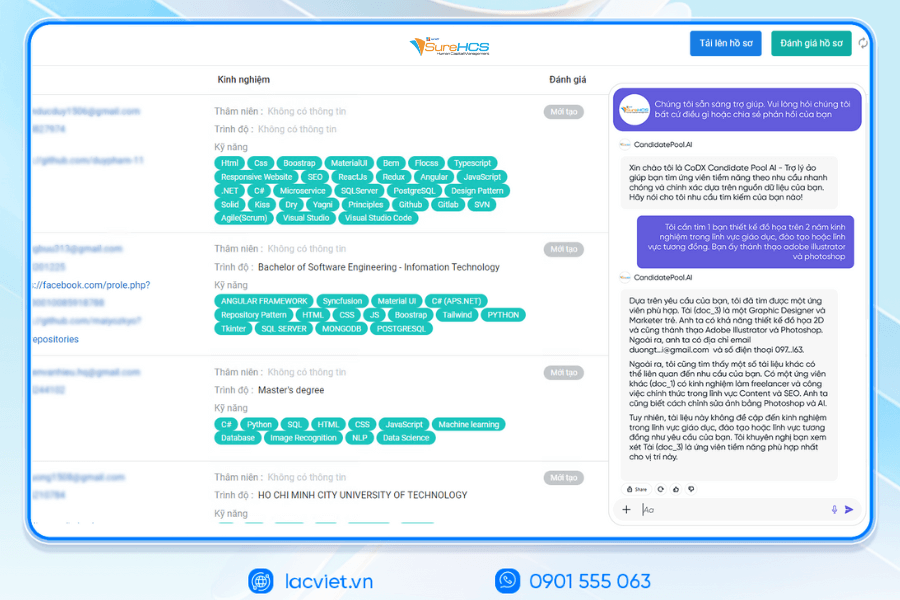

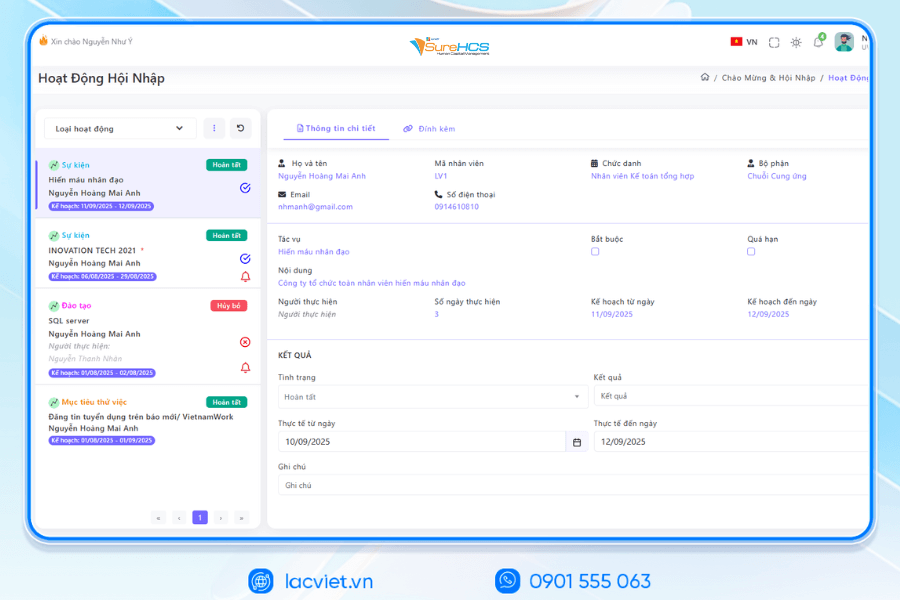

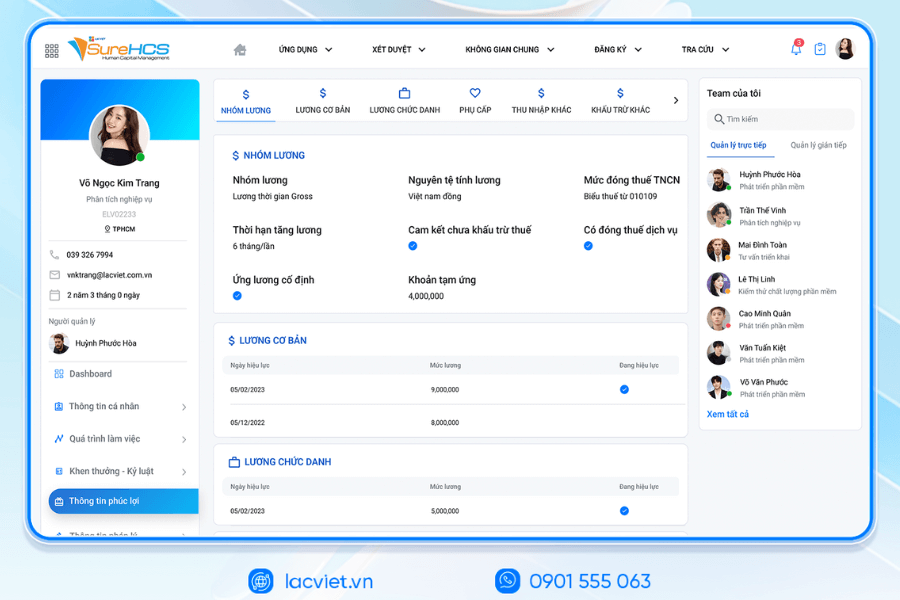

Software LV SureHCS C&B was developed to support business standardize automate the entire process attendance – payroll – benefits on a unified platform. The system allows businesses to configure flexible formula calculate salary according to the true internal policies to ensure compliance with the current regulations on wages, insurance and tax.

Instead of having to handle discrete't pay table, each file timekeeping, hr can manage centralized data, reduce risk of errors, easy interpretation of results calculate the wage for workers. This is the core value that LV SureHCS C&B bring for business in the process of modernization of public human resource management.

LAC VIET SUREHCS – PLATFORM, HUMAN RESOURCE MANAGEMENT, C&B CUSTOM-INTENSIVE FOR BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

Feature highlights:

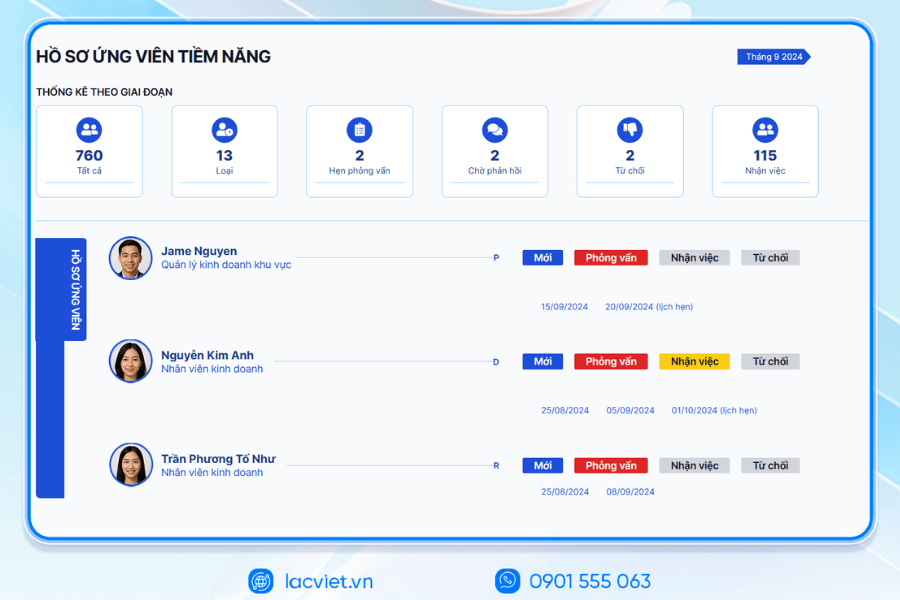

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

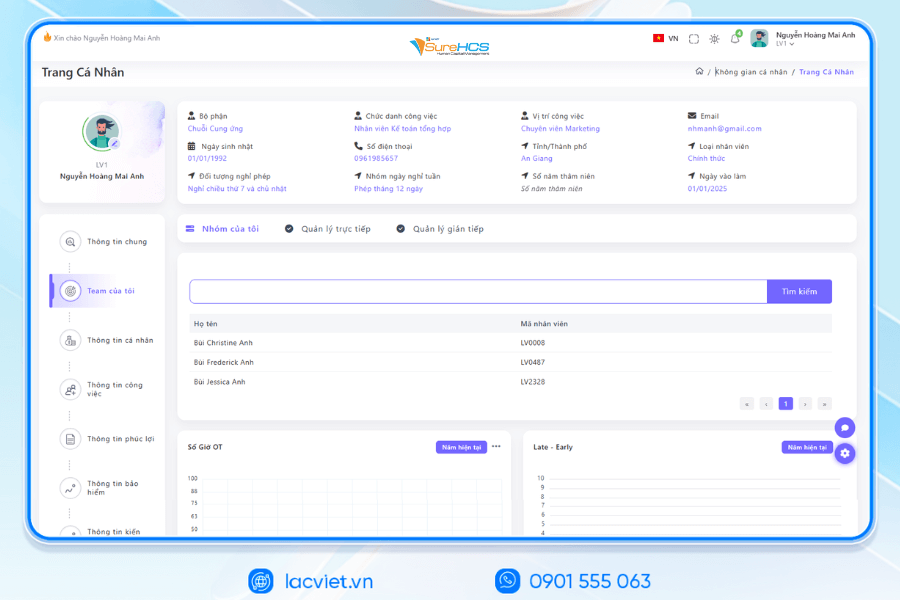

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

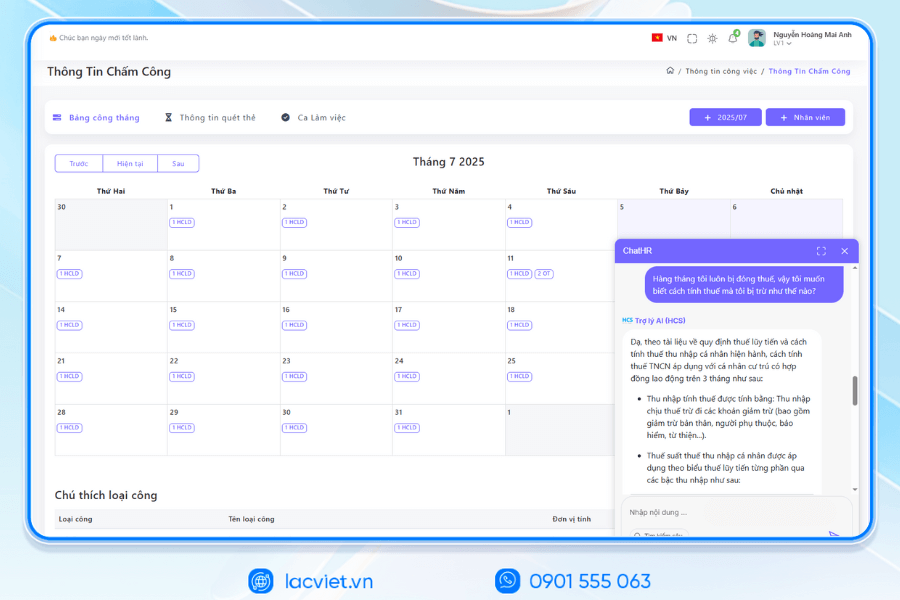

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile Successful Plastic, Long Thanh, Phu Hung Life, the airports of Vietnam (ACV), the enterprise division of SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to over 10,000 personnel

- Corporations, businesses, multi-subsidiary, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depths according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need to automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

If your business is looking for a solution to help manage attendance – payroll accurate, flexible, easy to expand according to the scale, LV SureHCS C&B is the option worth considering.

Businesses can get advice, in-depth experience demo solutions or upload documents to guide the construction formula for calculating the salary standard for each step the optimal wage system-oriented modern sustainable.