Since the day 01/02/2021, when workers do more hours, working at night, working overtime at night, how to calculate overtime pay will be calculated according to the formula specified in the Decree 145/2020/ND-CP on 14/12/2020.

How to calculate overtime pay

Paragraph 1 of Article 98 of The Labour code 2019 additional regulations on wages overtime on new year's day than specified in Article 97 of The labor code 2012. In addition, the new Law based on wages actually paid for the work to calculate overtime.

Specific rules about wages, overtime be guided as follows:

(1) For EMPLOYEES paid according to time, be paid overtime when working outside normal working hours of businesses regulated under Article 105 of The Labour code 2019 and is calculated according to the following formula:

|

Wages overtime |

= |

Actual hourly wage of the job is doing on a normal working day |

X |

At least 150% or 200% or 300% |

X |

Number of overtime hours |

In which:

|

Actual hourly wage of the job is doing on a normal working day |

= |

Wages actually paid by the job is done of the month or week or day that EMPLOYEES working overtime (T1) |

: |

The total number of actual hours worked respectively in the month or week or day, EMPLOYEES working overtime (T2) |

Note:

+ (T1) does not include wages, overtime, extra pay when working at night, the salaries of public holidays, new year, holidays are paid according to the provisions of The Labor code; bonus in accordance with Article 104 of The Labor code, the bonus initiative; money to eat between shifts, the account support gasoline, telephone, travel, money, housing, childcare, raising kids; support when a loved one dies, EMPLOYEES who have relatives marriage, birthdays of EMPLOYEES, occupational diseases and other account assistance, other benefits not related to work done or titles in their CONTRACTS.

+ (T2) not in excess of the normal working day in the month and the number of hours worked normal in 01 days 01 week according to the rule of law which business to choose and regardless of the number of overtime hours.

– A level at least equal to 150% compared to the actual wage paid by the job is done on a normal working day; apply for overtime hours on weekdays;

– A level at least equal to 200% of with actual hourly wage of the job is doing on a normal working day; apply for overtime hours on weekends;

– And the level at least equal to 300% of with actual hourly wage of the job is doing on a normal working day; apply for overtime hours on a public holiday, new year, holidays are salaried, not to mention the salaries of public holidays, new year, holidays trying wage for EMPLOYEES paid days.

(2) For EMPLOYEES paid according to the product

EMPLOYEES are paid according to the product, be paid overtime when working outside more normal working hours to do more quantity, product weight in addition to quantity, mass product according to the labor agreement with the business and is calculated according to the following formula:

|

Wages overtime |

= |

Unit price paycheck product of the normal working day |

X |

At least 150% or 200% or 300% |

X |

Number of additional products |

In which:

– A level at least equal to 150% compared to the unit price of wage-product of the normal working day; apply for extra products on the day casual;

– A level at least equal to 200% compared to the unit price of wage-product of the normal working day; apply to products do more on weekends;

– And the Level at least equal to 300% compared to the unit price of wage-product of the normal working day; apply for extra products into the holidays, new year, day of paid holidays.

Formula for calculating wages, working at night

Similar to wages, overtime, the new Law also based on wages actually paid by the job (the current regulation is the salary of work) to determine wages, working at night.

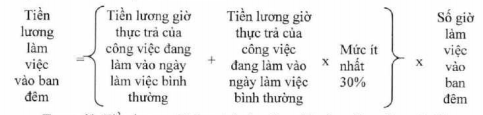

(1) For EMPLOYEES paid over time, wages, working at night is calculated as follows:

In which: actual hourly wage of the job is doing on a normal working day is defined as when determining the wages for overtime stated above.

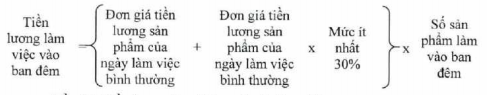

(2) For EMPLOYEES paid according to the product, wages, working at night is calculated as follows:

Formula how to calculate overtime at night

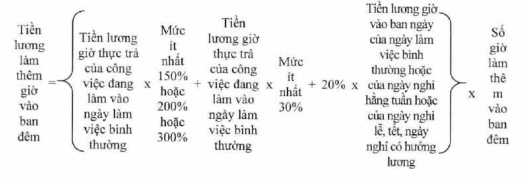

(1) with Respect to EMPLOYEE salary by the time wages overtime at night is calculated as follows:

In which:

– Actual hourly wage of the job is doing on a normal working day is defined as when determining the wages for overtime stated above.

– Hourly wage on the day of a normal working day or rest day every week or day, holiday, new year, holidays are paid is determined as follows:

+ Hourly on the day of a normal working day; be charged at least equal to 100% of with actual hourly wage of the job is doing on a normal working day for cases where EMPLOYEES do not work more hours during the day of that date (before overtime at night); at least equal to 150% compared with actual hourly wage of the job is doing on a normal working day for the case of EMPLOYEES who have to do more hours during the day of that date (before overtime at night);

+ Hourly wage on the day of the weekly rest; be charged at least equal to 200% of with actual hourly wage of the job is doing on a normal working day;

+ Salary hours in the daytime of day, holiday, new year, day of paid holidays; be charged at least equal to 300% compared to the actual wage paid by the job is done on a normal working day.

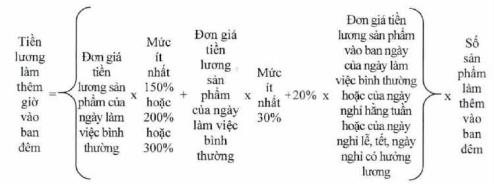

(2) For EMPLOYEES paid according to the product, wages, overtime at night is calculated as follows:

In it, the unit price of wages products on the day of a normal working day or of a day off every week or of the day, holiday, new year, holidays are paid is determined as follows:

+ Unit price of wage products on the day of a normal working day; be counted at least 100% compared to the unit price of wage-product of the normal working day for cases where EMPLOYEES do not work more hours during the day of that date (before overtime at night); at least equal to 150% compared to the unit price of wage-product of the normal working day for the case of EMPLOYEES who have to do more hours during the day of that date (before overtime at night);

+ Unit price of wage products on the day of the weekly rest; be charged at least equal to 200% compared to the unit price of wage-product of the normal working day;

+ Unit price paycheck product in the daytime of day, holiday, new year, day of paid holidays; be counted at least 300% compared to the unit price of wage-product of the normal working day.

According to the source TVPL