The tool payroll downloads include a spreadsheet (Excel/Spreadsheet) fit small business payroll software for accountants – HR help automate the salary, insurance/ tax tool and salary calculator online Gross – Net for individual quick lookup income actually received. Choosing the right tools to help reduce errors, save time, ensure compliance with labor laws.

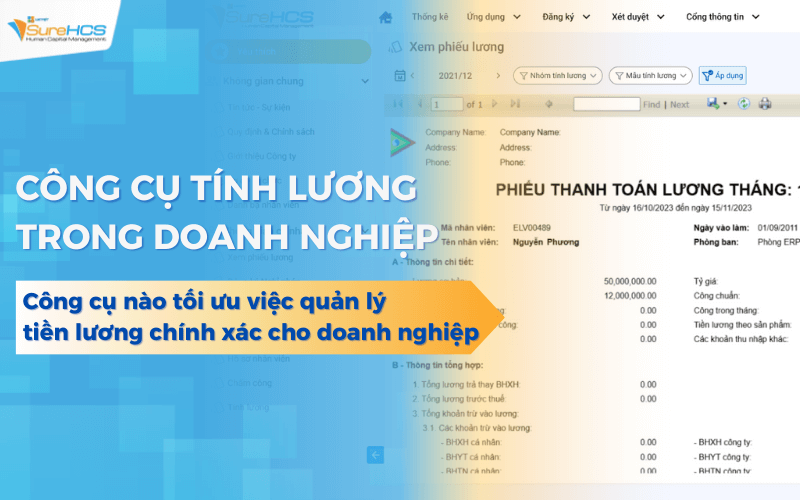

Tool payroll is the solution supports business process automation salary calculator, tax deductible – insurance, management, employee income correctly, transparent. In the context of business, increasing pressure on the cost of personnel, compliance with the law and experience of employees, the application tool payroll not even a choice, which is inevitable demand.

Article Lac Viet SureHCS will help the business understand the tools salary calculator what is, how it works, selection criteria appropriate to each organizational model.

1. Tool payroll what is?

Tool payroll is a software system designed to automate the calculation of wages for employees in the enterprise based on the data about the duration of work, allowances, tax credits and deductions in accordance with the law. Instead of having to use Excel spreadsheet tools this handle complex elements automatically, so that it brings the most accurate results consistency of each pay period.

With the organizations and enterprises are read information on tool payroll, this is not merely payroll software but also is the solution helps to reduce errors, increase labor efficiency, ensure compliance with labor law and tax. It's like the replacement of the payroll by an apparatus, automatic operation that you don't have to re-enter each number each month.

Distinguish tool payroll with the use of Excel crafts

- Excel is a spreadsheet flexible but easy to errors when manipulating the hand, there is no mechanism to check the tax laws change.

- Tool payroll automatically updates new rules (tax, SOCIAL insurance,...), error message when there is abnormal data, recorded history manipulation helps to access easily.

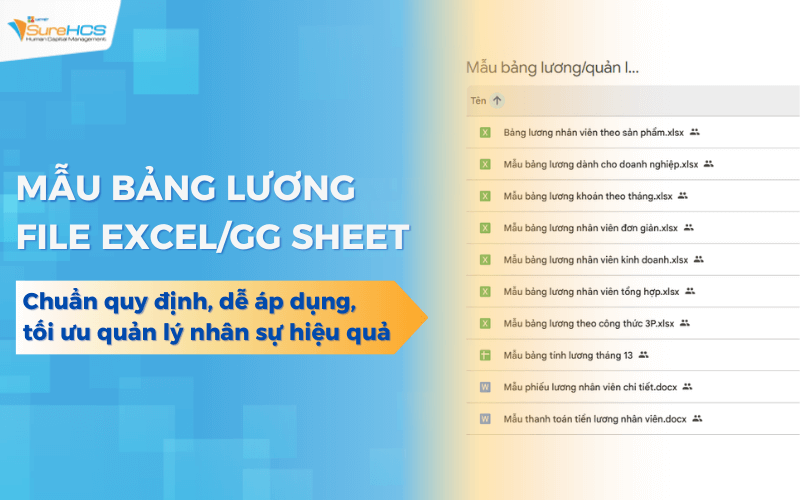

- 10 Sample employee payroll latest standard rules, easy to apply, optimal management personnel

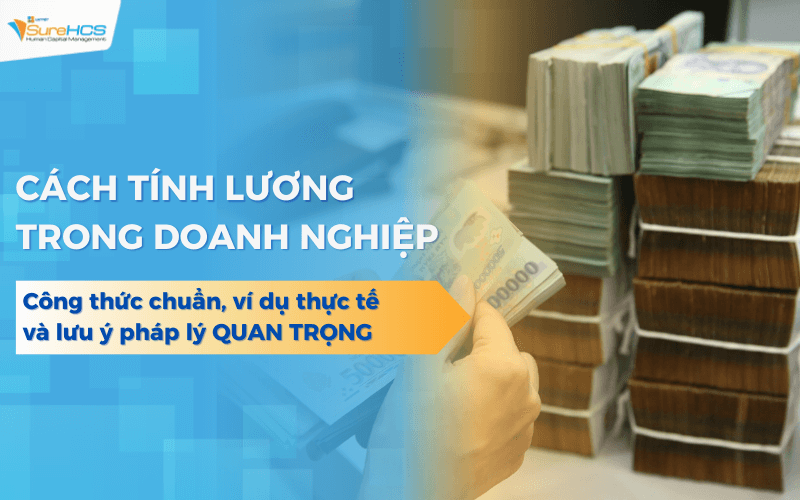

- 10 Ways payroll standard recipe, practical examples, and legal note

- 10 payroll software hr most striking 2026 popular

- Payroll software according to KPI optimal performance management, and pay fair wages for business

2. The tool payroll common use in the business today

2.1. Tool payroll spreadsheet format (Spreadsheet)

Tool payroll spreadsheet format is the most popular Excel or Google Sheets are forms of the wage is very much business use in the early stages. This is the method of calculating wages can support formula, in that the design, payroll, data entry, attendance allowances, deductions and construction calculation formulas.

Results salary depends entirely on:

- The accuracy of data entered

- The right of the formula has been set

- Skills, experience of the establishment payroll

Values that spreadsheet bring to a business:

- The cost is almost equal to 0, ease of deployment, right

- Flexibility in the edit formula on demand

- Business suit is very small, less hr salary structure simple

Limitations to consider

- Easy to errors when the number of employees increase or wage policies complex

- Difficult to control history edit, trace data

- Much depends on individual wages

- Do not auto-update regulations, taxes, insurance

In fact, many businesses only recognize the risks of the wrong payroll, internal complaint or need for control with the tax authorities, and insurance. So spreadsheets are often only suitable short term, is not a sustainable solution as business development.

2.2 tool payroll system software professional

This is the group tool payroll professional, designed for business integration, process timesheets – payroll – tax – insurance in a unified system.

Payroll software for HR and accounting activities based on the principles:

- Automatically retrieve data, attendance, shifts, overtime

- Apply the wages were set available

- Automatic deduction of personal income tax, SOCIAL insurance, health INSURANCE

- Cumshot, payroll, salary slips, the related report

Personnel do not need to “sit plus line by line” which only need to check, revise and approve before paying.

Real value for business:

- Sharply reduced processing time wage per period

- To limit errors due to manipulation craft

- Ensure compliance with legal provisions on wages, taxes, insurance

- Data transparency, ease of exposition when you check

According to many reports on international payroll automation, businesses use payroll software can significantly reduce the errors in estimating save tens of percent of the processing time per pay period compared with the manual method.

Suitable object

- Medium and large business

- Business has many shifts, overtime, wage policies complex

- Organizations that want to standardize processes, cost control personnel

With respect to the organizations and enterprises are read information on tool payroll, this is often the solutions bring long-term value stability instead of just solving math problems before the eyes.

2.3 salary Calculator online quickly calculate Gross – Net for individuals

Other than the above two types, tools salary calculator online Gross – Net is not a tool payroll management for businesses that primarily serve the needs fast lookups of individual workers.

Engine Gross – Net online allows users to:

- Enter the Gross salary (salary before tax) to estimate Net pay (receive)

- Or import Net salary to calculate the contrary Gross salary

Distance calculator based on the general regulations on personal income tax and mandatory insurance in Vietnam.

Limits of engine Gross – Net online

- Reference only and do not reflect the full privacy policy of each business

- Not applicable to the case have allowances, bonuses, deductions peculiarities

- Do not replace the tool payroll professional in business

So, this tool is suitable for individuals or used as a utility support, not solutions manager salaries official.

3. Tools professional payroll solve the problem of the business

3.1. Reduces errors in payroll, allowances, overtime

One of the biggest problems when business payroll is errors due to data entry, recipe not correct or change the rules without knowing it. Many studies showed that the method often error occurs, repeat automated tools and can reduce more than 90% of error in the calculations for the account, such as basic salary, allowances, overtime or a tax deduction.

Small error in wages can lead to employee dissatisfaction, complaints, take time to adjust back – this directly affects the experience, staff, causing costly for business.

3.2. Reduce the aggregate time and attendance data

With businesses using more shifts, or where there are hours more often, the synthesis of data from time and attendance system again is a big pain. Tool payroll automatically linked attendance data directly to payroll calculations without the need for HR to enter manually, thereby saving many hours of work per period wage.

For many organizations, the processing time wage can reduce more than 60-70% compared with the manual method, which helps HR team to focus on the mission strategy than as policy development, C&B.

3.3. Reduce the risk of violating regulations on taxes and insurance

The rules on personal income tax (PIT), social insurance contributions and health insurance often changes every year. If tracking applies crafts, business prone to errors that lead to late payment, lack of payment of tax, from which a fine or have to adjust multiple times.

Tool payroll modern automatic updates of the latest rules, ensuring the quotes submission correct, sufficient and timely according to the current legislation – this is especially important for the organizations and enterprises are read information on tool payroll to ensure exact compliance.

4. Tool payroll activity like?

With respect to the organizations and enterprises are read information on tool payroll, understand how the operation of a tool payroll is an important step to assess the value that this solution brings. Here is how the tool payroll, presented in a step by step process privacy – understandable, not too technical, always emphasize real value for the business.

Step 1: collect input data (attendance, contracts, allowances)

A tool payroll efficient operation need to start from the input data full accuracy. This is the foundation for the system to handle, create results salary accurate.

Input data include:

- Timesheet data real of staff from the attendance app attendance, or registration system now done through software.

- Information contract labor: wage base, the coefficient of salary, type of contract and the terms related to benefits.

- The level of allowances, subsidies under the policy of business: travel allowances, lunch, accommodation, etc.

- Data about holidays, vacations, overtime (overtime) is approved by the management directly.

Tool payroll modern automatic “pull” and synthesis of this data from the source storage focus instead of having to enter each line as when using Excel tradition. This helps reduce errors due to human, save time for the hr department every pay period.

Step 2: Processing rules payroll automatically

After the full set of input data, tools salary calculator will apply the rule payroll has been configured in the system to calculate the salary to pay for staff.

What tool handle includes:

- Calculate salary according to the basic formula: based on the wage contract and the number of hours actually worked.

- Apply coefficient increased ca (e.g. 150% for the day, often 200-300% for holidays or celebrations in the regulations) to automatically calculate overtime.

- The bonuses KPI or commissions, if any, based on input data from a system performance evaluation.

- Calculate the allowances prescribed internal business.

For example illustrated easy to understand: if an employee is working overtime on holidays, with the increased number of ca 300%, the tool will automatically apply this coefficient into the formula for calculating salary overtime without the need for personnel to enter each individual recipe. How to handle this helps ensure a consistent accuracy even with complicated cases such as overtime coincide with the night shift.

Values bring for business in this step is the complete removal of the “hand” to errors, increased processing speed ensures apply accurate according to policy.

Step 3: automatic deduction of personal income tax, SOCIAL insurance, health INSURANCE and other deductions in accordance

One of the most complicated parts of payroll is processed deductions required by law, deductions, close up, according to the regulations.

Tool payroll modern automatic processing:

- Personal income tax (PIT) according to current regulations based on taxable income after subtracting deductions.

- The account of compulsory insurance such as social insurance (SOCIAL insurance), health insurance (health INSURANCE), unemployment insurance (UI) in the proportions specified.

- The other account if there is such advance wages, penalty rules...

With automated tools, businesses no longer have to worry about the confusion the rate quoted according to the regulations (for example, SI is the percentage on salary closed BH) or omission of the mandatory deductions. This ensures compliance with the law and minimize the risk violations lead to an administrative fine or revise salary reports.

Real value for businesses is transparent, accurate, secure, legally, to help reduce pressure check, compare salary before paying.

Step 4: Export your payroll, payslips and reports

After complete processing rules, deductions, tools salary calculator will output the report tool can serve many objects used in different business:

- Payroll general for the company, detailing income and deductions of each employee in the states.

- Payslips, personal (Payslip) for each employee so they understand each account is paid and deducted.

- Expense reports related to payroll service, accounting, leadership to plan the budget.

- Report filed insurance – tax support for the declaration and payment due date for the tax authorities and social insurance.

The process of reporting are standardized, transparent, help businesses easily control, collation, explanations when necessary.

5. Tool payroll in accordance with the type of business do?

In fact, there is not a tool payroll “standard for every business”. Each type of business has various peculiarities about scale models, labor and wage policies. Value of tool payroll lies in the ability to solve the right problems that businesses are experiencing, rather than just have more features.

5.1 small and medium Enterprises (SME)

With small and medium business, large math is most often not located in the complex, which is the lack of resources in staffing, time to handle salary.

In many SMES, the payroll still depends on one or two hr administration – hr, using Excel craft. When this personnel leave or vacation, the whole process prone to disruption, not to mention the risk of errors due to the formula manually.

Tool payroll in accordance with SME need to meet:

- How to use simple, no need for IT knowledge intensive.

- Quickly set up the wages, allowances, deductions.

- Reasonable cost, suitable budget operation.

Actual values bring SME not only save cost, but more important is the reduction depends on the individual, ensure the payment of wages on time, the right number.

5.2 manufacturing Enterprises, many shifts,

Manufacturing enterprises are often faced with the problem far more complex than office blocks, especially:

- Many work shifts during the day

- Regular overtime

- Night shift, working holidays, vacation

If handled, the hr department must synthetic thousands of lines of attendance data every month, very easy to flaws in the application of the coefficient of increase in ca or confusion between the type of ca.

Tool payroll business suit production needs:

- Automatic data link clocking in shifts, according to the organization, according passes.

- Apply correct score increase shifts, night shifts according to the legal regulations and internal policies.

- The handle is large number of workers that still ensure speed, accuracy.

Core value here is to reduce disputes, wages, and increase transparency. When employees understand why I get paid the salary that the business will significantly reduce complaints, duration, explanation of the hr department.

5.3 big Business, a multi-branch

With large-scale enterprise, or have multiple branches, math lessons not only is the “right food” that is standardized, centralized administration.

Common problems:

- Each branch used different salaries

- Data dispersed, difficult synthesis report

- Leadership does not have the overall look of the wages fund the entire business

Tool payroll in this case should:

- Standardized recipe wage policies apply throughout the system

- Decentralized clear as branches, departments

- Synthesis report wages fund focused, serving decisions

Enterprise value received is good cost control, personnel, limit deviations between the unit and support leaders to make decisions based on data instead of hunches.

6. Selection criteria tool payroll suitable for business

With respect to the organizations and enterprises are read information on tool payroll, choosing the right solution equally important deployment. One tool does not fit can cause waste of costs and create more burden for the hr department.

6.1 accordance with the laws of Vietnam

The first criterion, is imperative that tools must meet the current regulations on wages, taxes, insurance in Vietnam.

Cụ thể:

- And properly deducted the tax on personal income

- Quotes submission right SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance, union funds

- Flexible updated as laws and policies change

Worth bringing back not only the right wage, which is to reduce legal risks and avoid the fines incurred due to errors in the declaration and settlement.

6.2 the Ability to customize according to the salary policy of the enterprise

Every business has a privacy policy different salaries. There, where applicable wage time, there where pay exchange, there where building systems salary 3P.

A tool payroll efficiency need:

- Allows to customize the wages according to the actual business

- The flexibility to add or reduce the earnings, deductions

- 't force businesses to change the policy only to “match software”

The value here is the full strategic incentives of the business, instead of turning tools of barrier operation.

6.3 Ease of use for the hr department, expertise does not need IT

In fact, the direct use tool payroll's hr C&B, that's not IT. So the interface and how to operate plays a very important role.

Fitting tools needed:

- Clear interface, easy operation

- There are instructions for use, supports deployment

- To reduce dependence on IT when need to adjust the formula or policy

Value yield is to increase the performance of work for HR, help them proactively handle the job instead of having to wait for technical support.

6.4 scalability, integration with other systems

Finally, enterprises should not only look at the current needs, which need the ability to grow in the future.

Tool payroll should be able to:

- Connect with attendance system

- Expand to hr management (HRM), performance reviews

- Integration with ERP or accounting software when business development

Long-term value is one-time investment, long-term use, avoid having to change the system as the enterprise scale increases.

7. Solution Lac Viet SureHCS C&B, payroll customized according to professional business

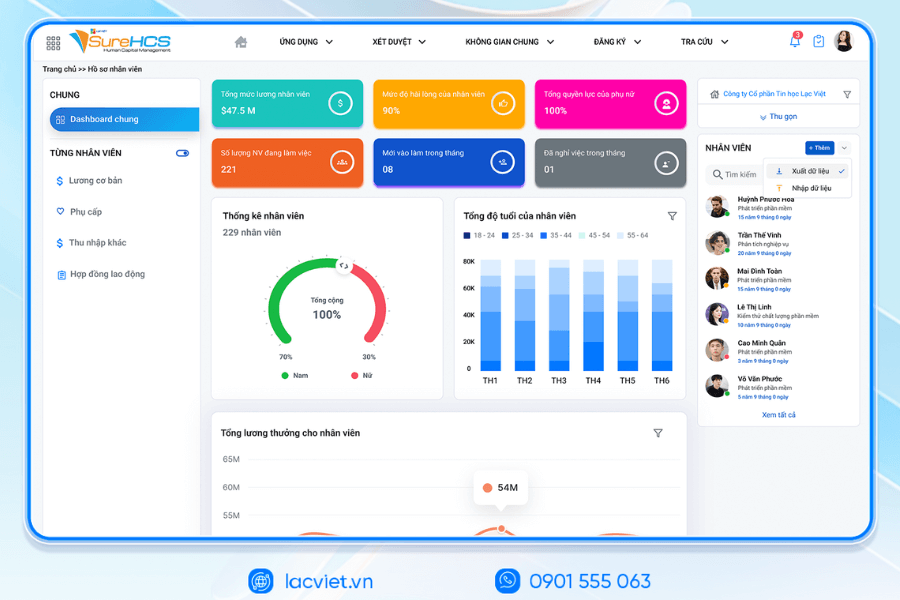

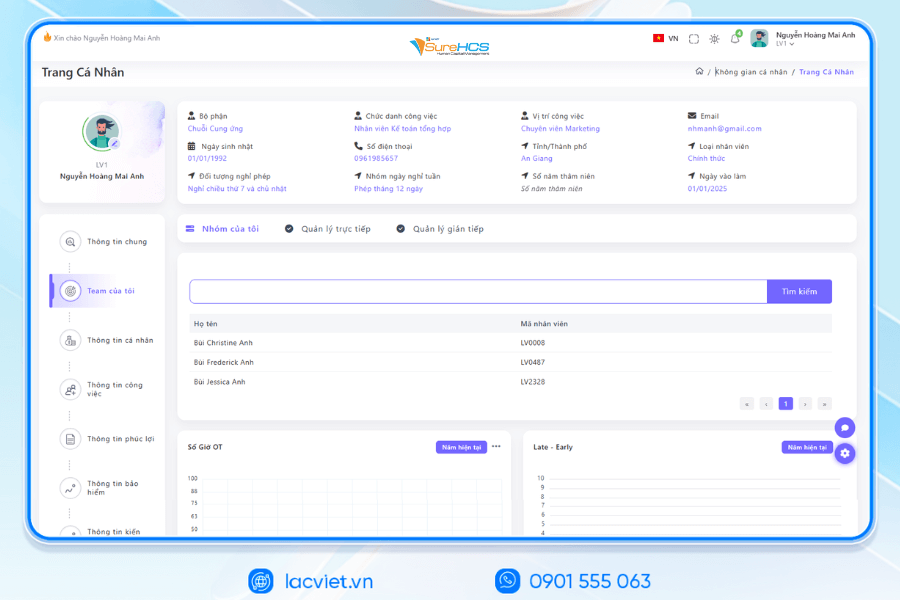

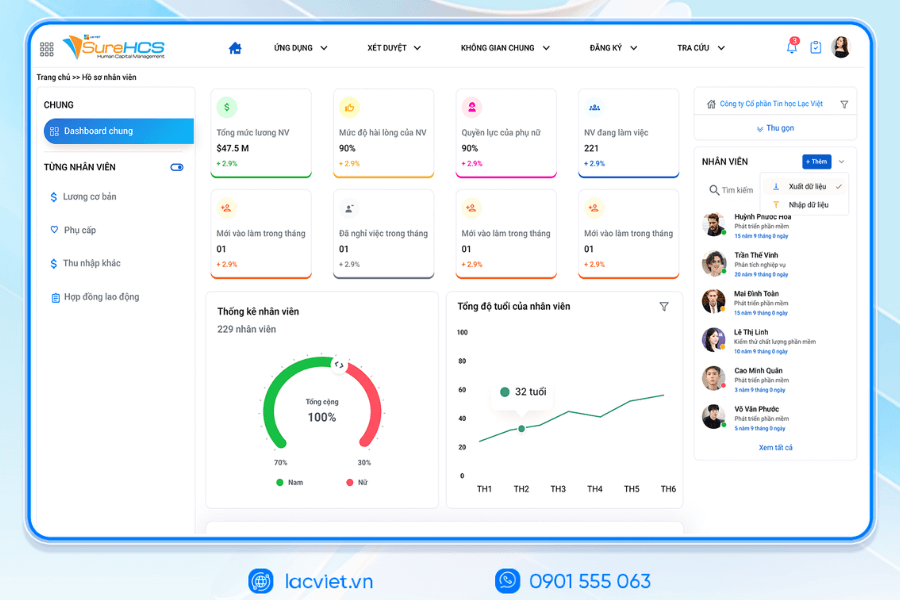

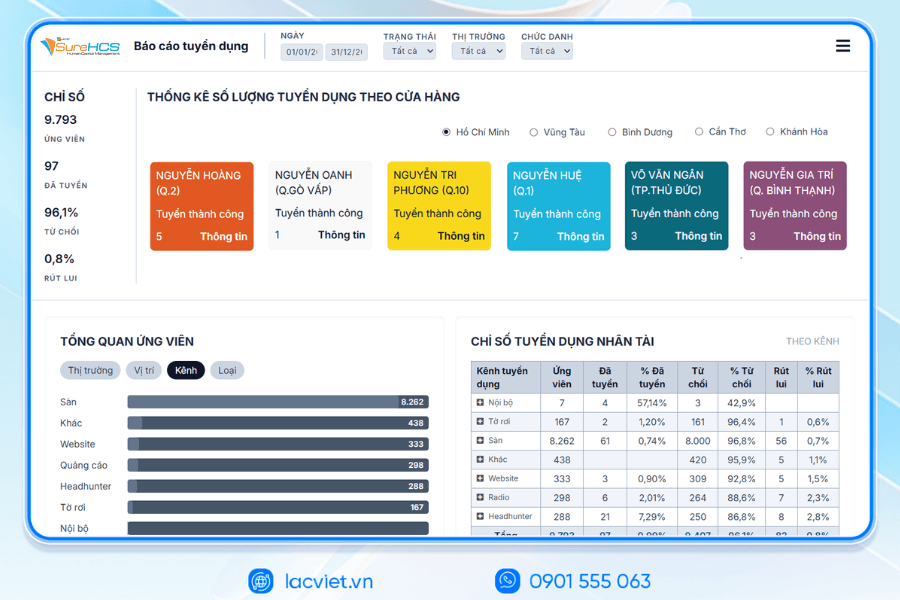

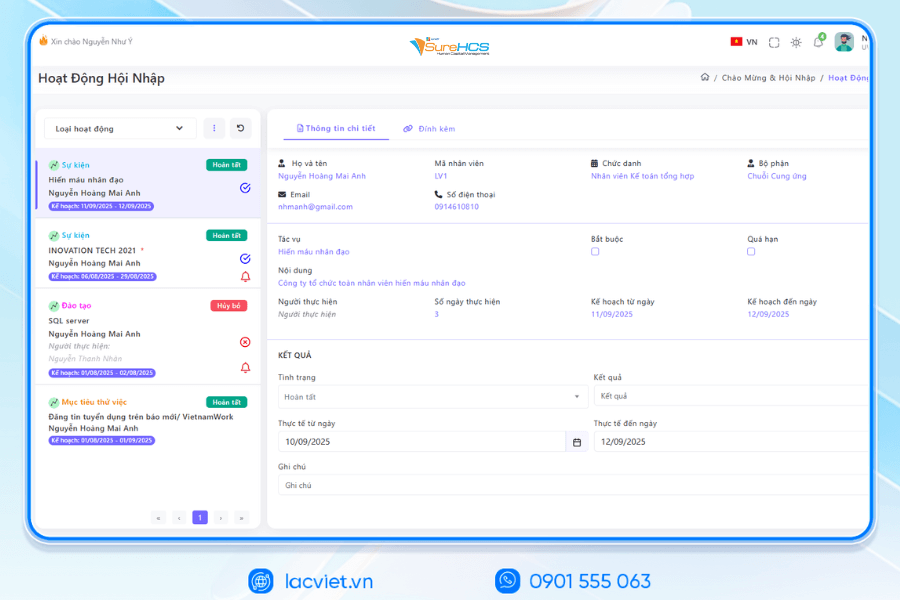

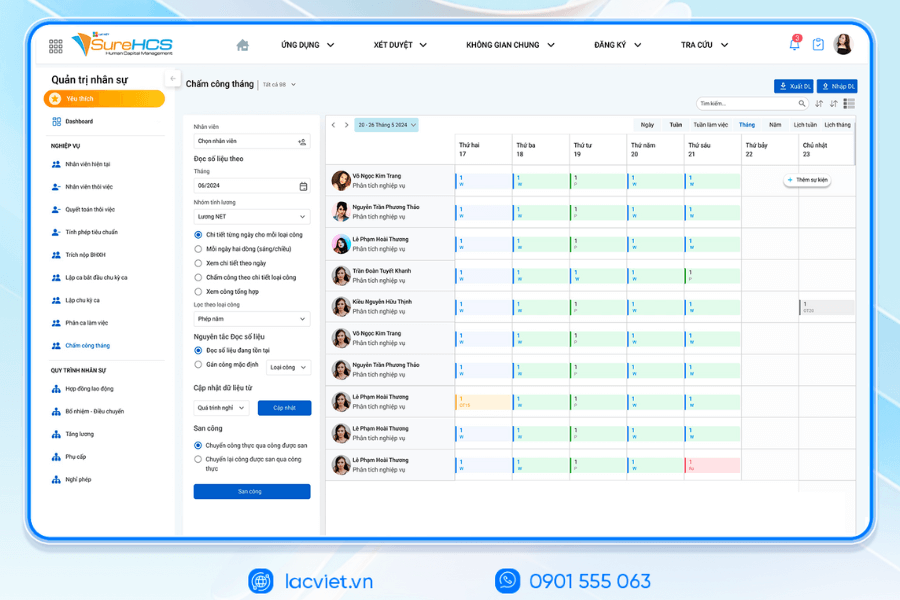

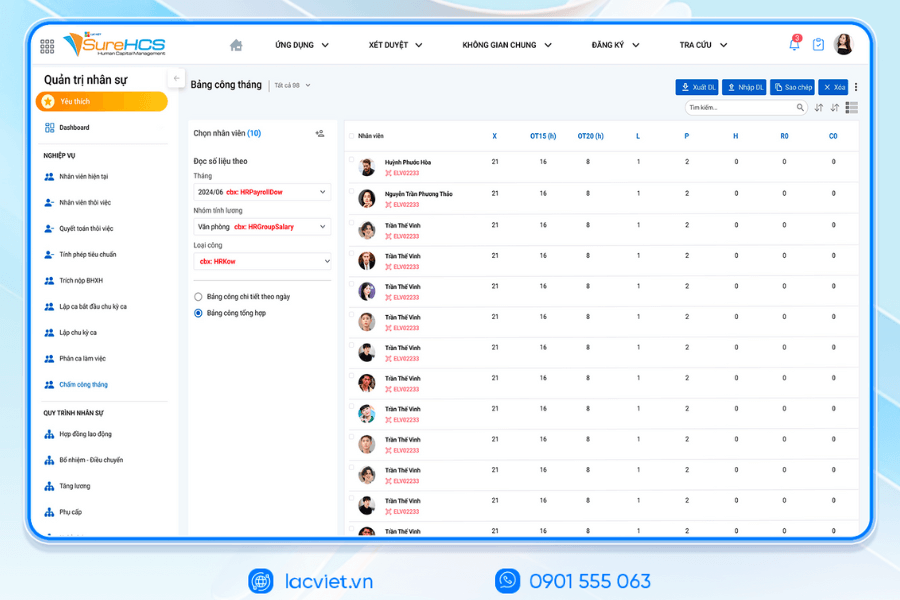

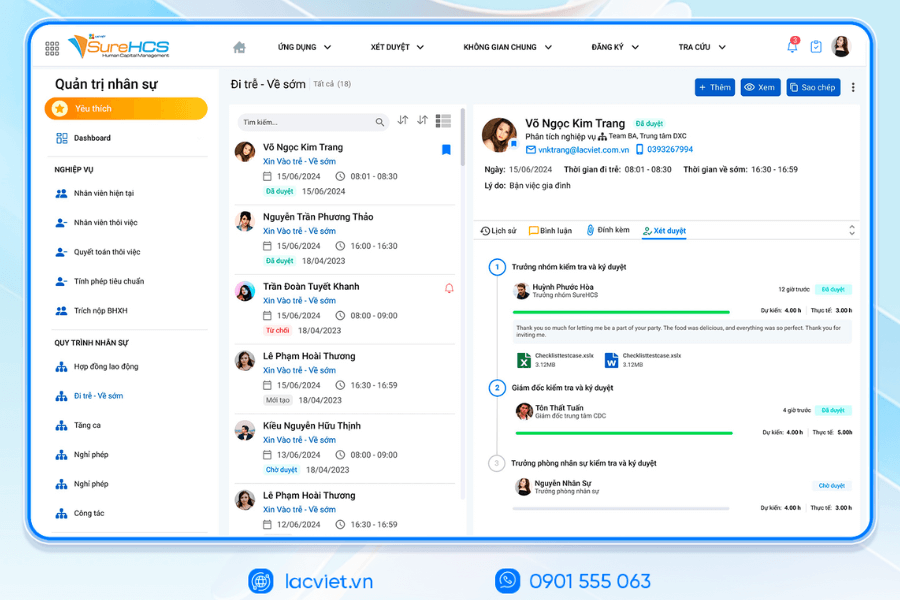

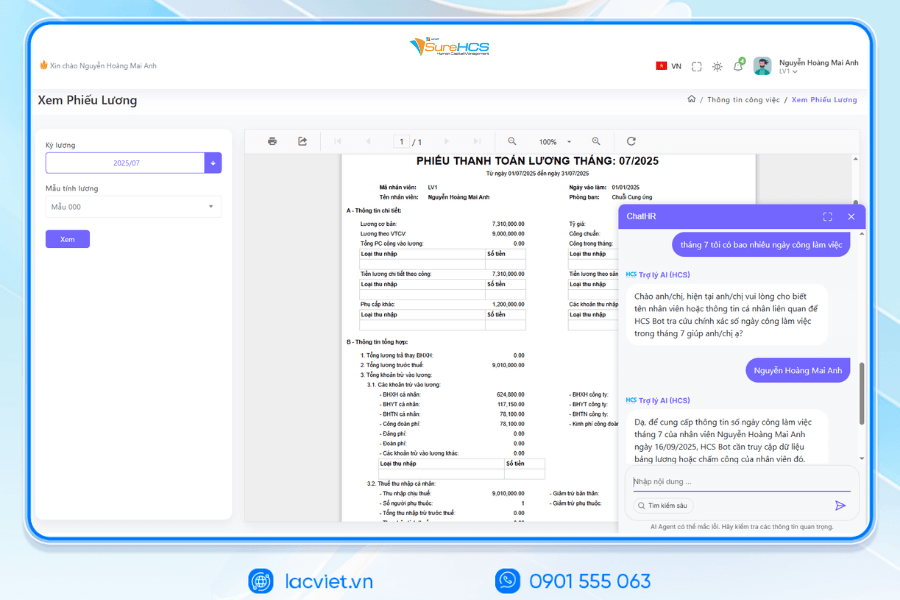

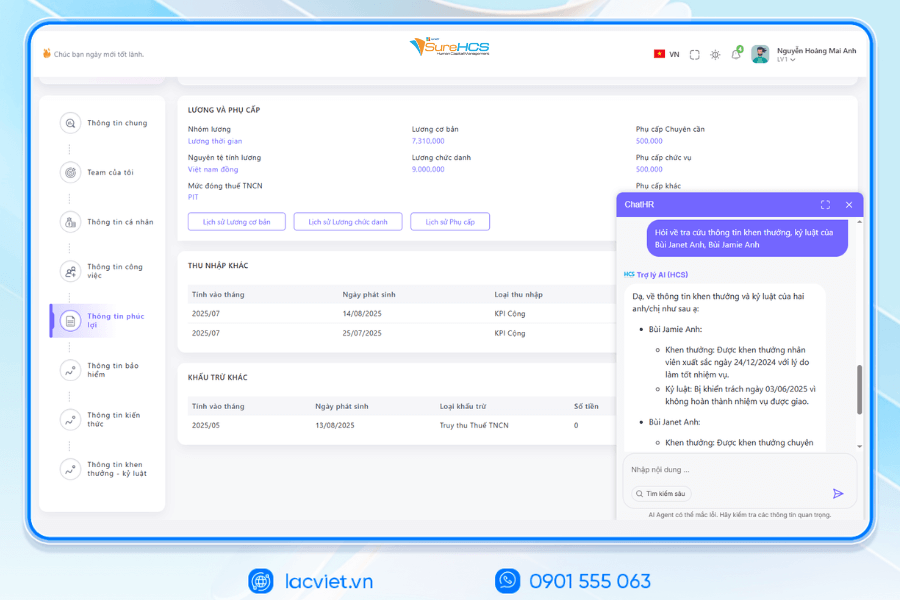

Software lacviet SureHCS C&B is the solution personnel administration – attendance – payroll is designed specialized for the organizations and enterprises are read information on tool payroll, wishing to automate the process of link data – salary – social insurance correctly transparency and compliance with the laws of Vietnam.

In actual operation, many businesses have trouble synthetic attendance data from many different parts, then have to handle the formula for calculating the salary complex, at the same time, the deduction as personal income tax (PIT), SOCIAL insurance, health insurance (health INSURANCE) and unemployment insurance (UI). Doing this if done manually easily lead to errors, prolonged processing time potential risks violation of law provisions.

Lac Viet SureHCS C&B fix those problems by linking closely attendance data to process payroll, calculate the social insurance according to current regulations. Data on working hours, overtime, night shift allowance, and the recipe salaries are collected automatically from attendance system, then the software automatically apply the calculation rules to give accurate payroll, minimize errors due to manual action.

In particular, SureHCS C&B also supports to export the detailed report service, accounting, management and department leaders, at the same time integrated with the payment system, process payroll, happens rapidly, more efficiently.

LAC VIET SUREHCS – PLATFORM, HUMAN RESOURCE MANAGEMENT, C&B CUSTOM-INTENSIVE FOR BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

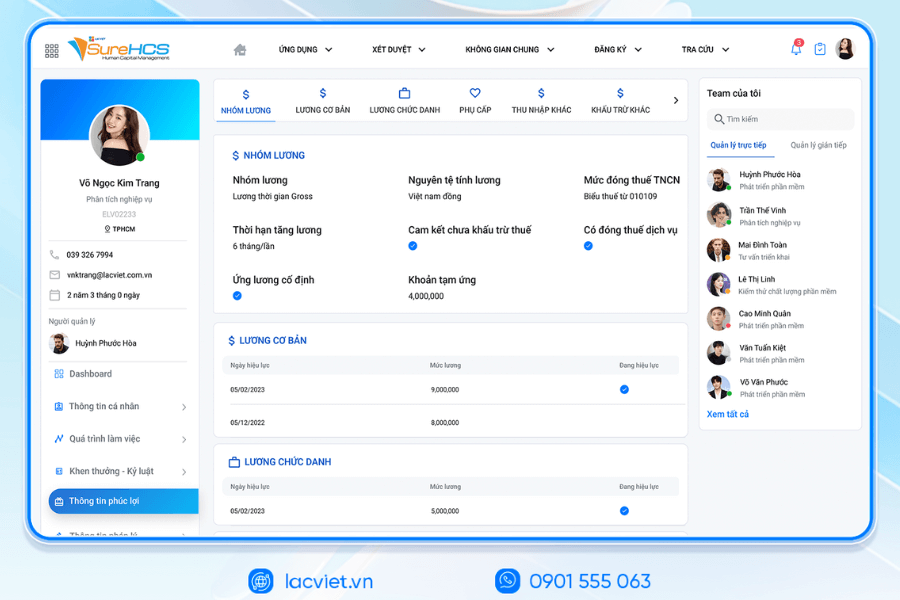

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

Feature highlights:

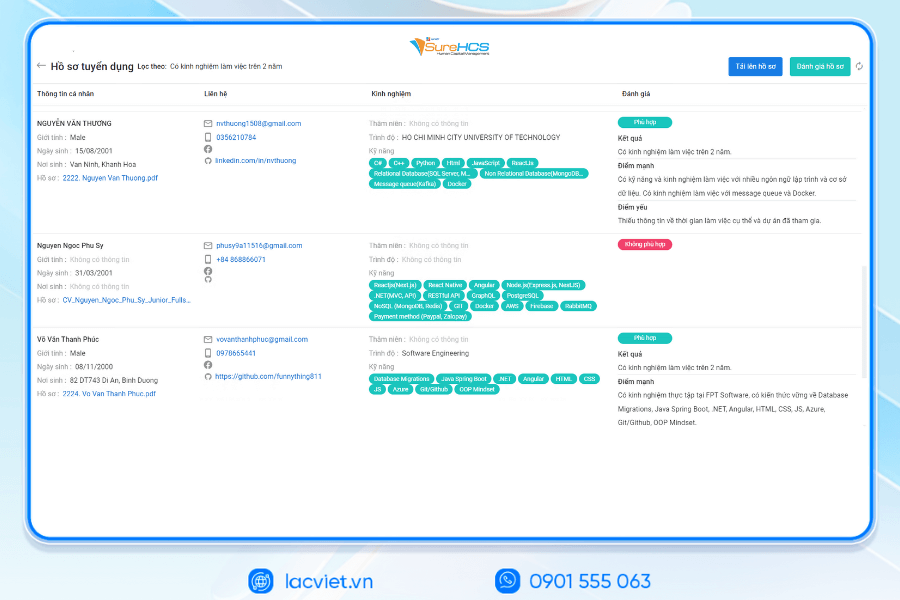

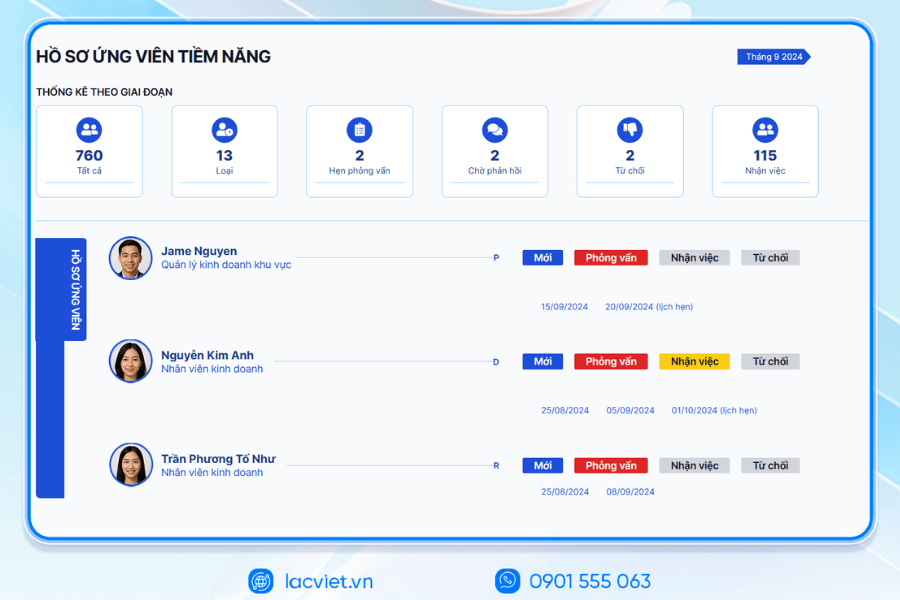

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

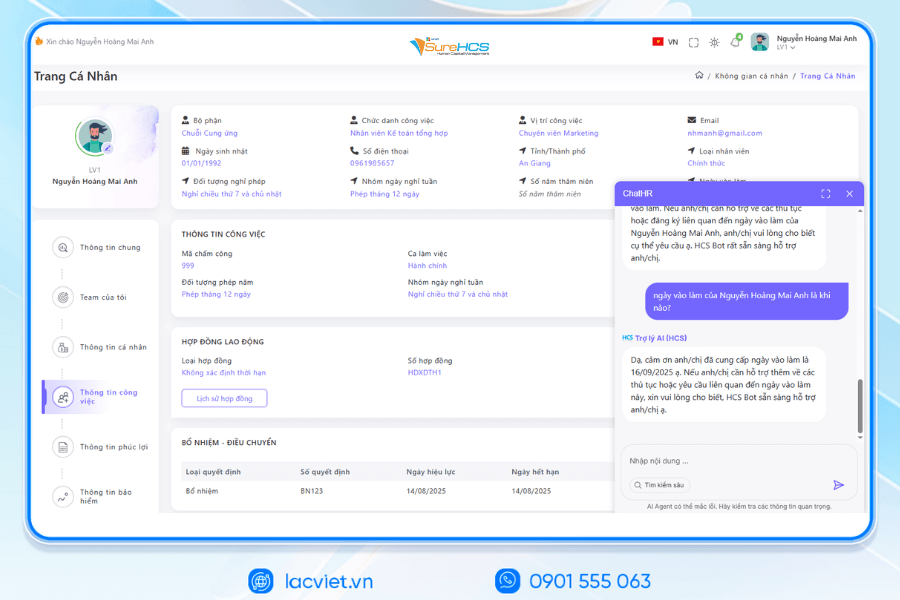

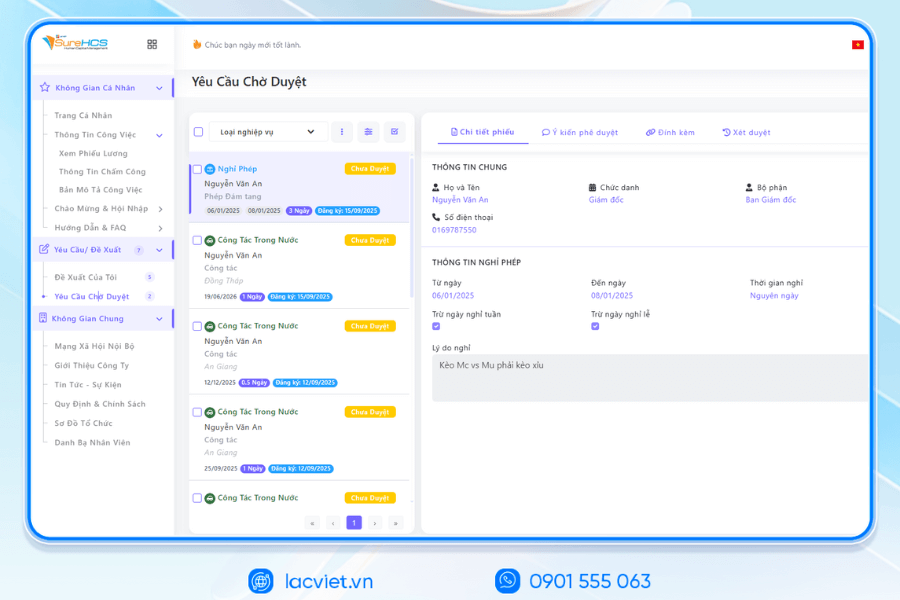

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

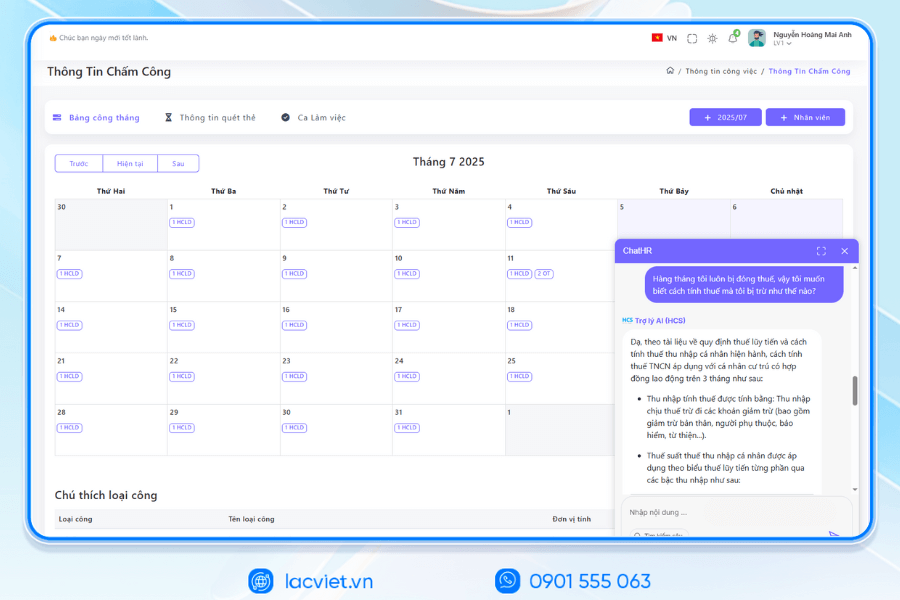

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

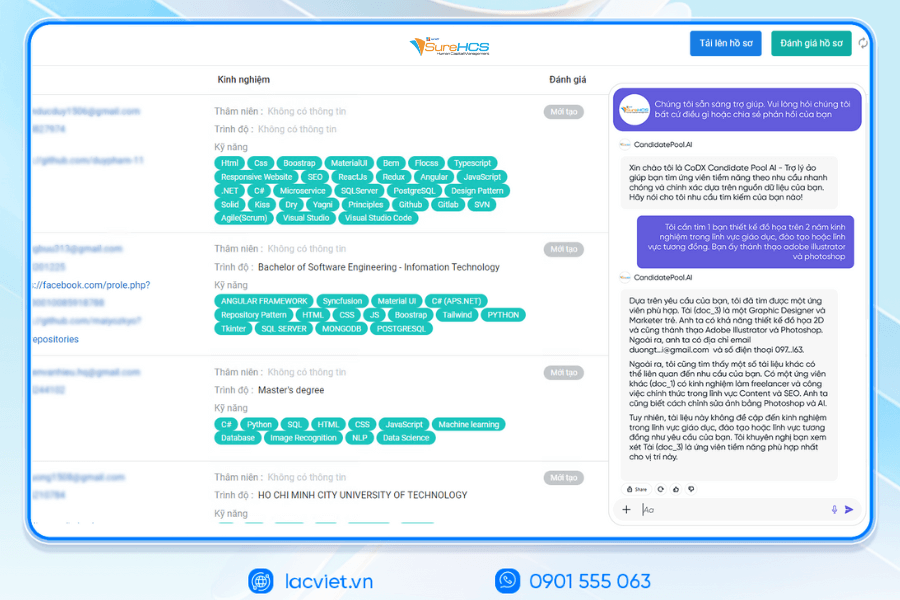

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile Successful Plastic, Long Thanh, Phu Hung Life, the airports of Vietnam (ACV), the enterprise division of SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to over 10,000 personnel

- Corporations, businesses, multi-subsidiary, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depths according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need to automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Thus, Lac Viet SureHCS C&B became the right choice for business want to optimize payroll management and insurance in a way, it helps HR to focus on the mission, strategic decisions based on data rather than processes, complex.