Although personal income Tax (PIT) was no longer too strange for the people of Vietnam, but there are still many who are not yet clear about definitions, accounting period, and the process of filing taxes online for personal income.

The following article SureHCS will sum up the information you need to know to PIT finalization online in an easy way and most convenient right here.

1.PIT finalization what is?

PIT finalization, including the synthesis and declaration of the amount of tax payable in the year, as well as a refund of tax overpaid and offset tax to the states next. This work is often individual made to ensure the full tax obligations and avoid the risk arising from failure to comply with regulations of the tax law.

2. Why need to perform PIT finalization?

The PIT finalization on time is very important to avoid administrative penalties from tax authorities. The individual does not make the declaration and payment of tax by the deadline will be penalized and not be repaid the amount of tax overpaid. Moreover, they also will not be applied mode offset on the tax return next.

3. The term PIT finalization

Information about accounting period, personal income tax specified in Article 44 Of the Law on tax Administration 2019. Accordingly:

- For organizations pay income: the accounting Period, the tax year are the slowest is the last day of the 3rd month from the end of the calendar year or financial year, and the slowest is the last day of the first month of the calendar year or fiscal year for the record tax year.

- For individual PIT finalization: accounting Period, the tax is later than the last day of the 4th month from the end of the calendar year.

- For business, personal and business tax filing according to the method of exchange: the deadline for filing tax exchange is later than August 15, 12 months of the preceding year, and in the case of new business, then the deadline for submission is 10 days from the date of commencement of business.

Because the day 30/04/2023 fall into the holiday season so time settlement tax year 2022 will be moved to the first working day after the holiday period. However, in the case of workers who delay filing tax settlement PIT, shall not apply penalties for administrative violations mining settlement tax deadline. (Clause 4, Article 28 circular 111/2013/TT-BTC).

4. Guide and settlement, personal income tax, PIT online

To PIT finalization online, you need to follow these steps:

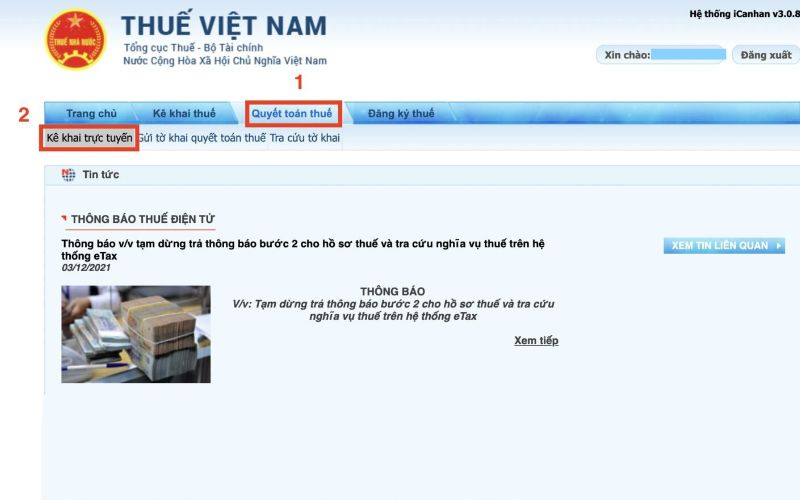

Step 1: Access system Electronic tax of the General department of Taxation and log into your account.

Step 2: Enter the tax code and test code to login.

Step 3: Select the item “tax declaration online” in the section “tax Settlement”.

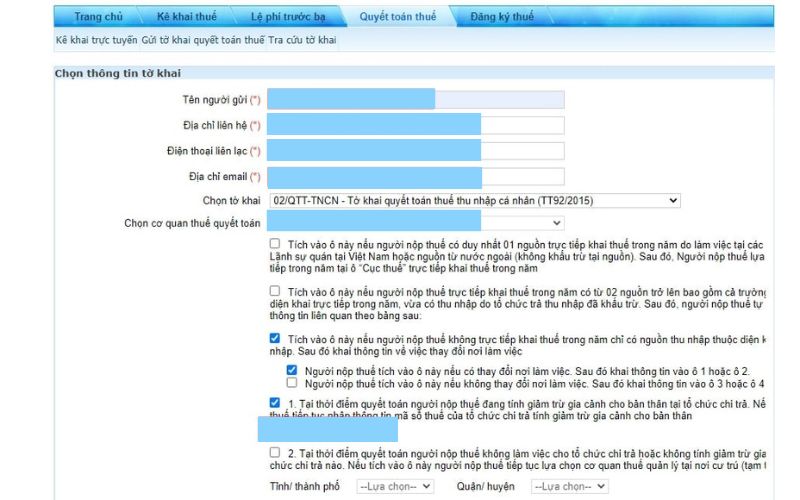

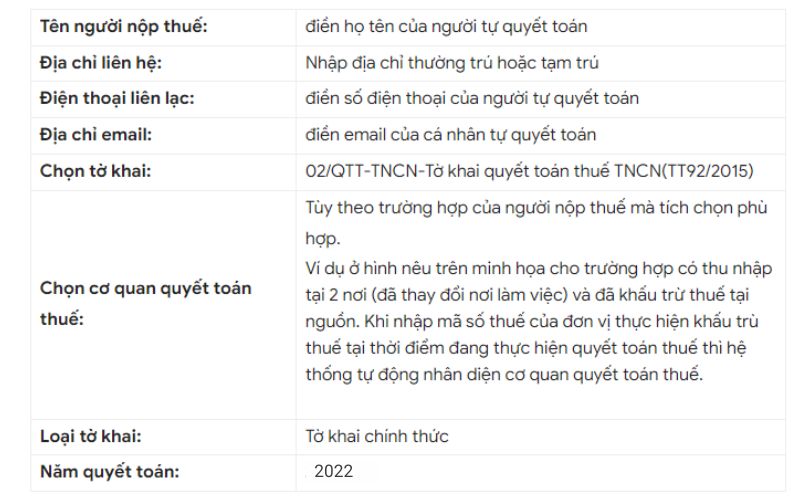

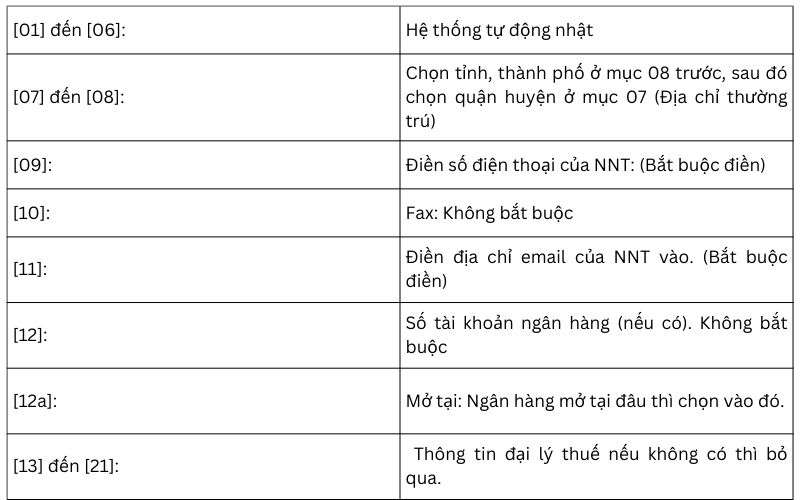

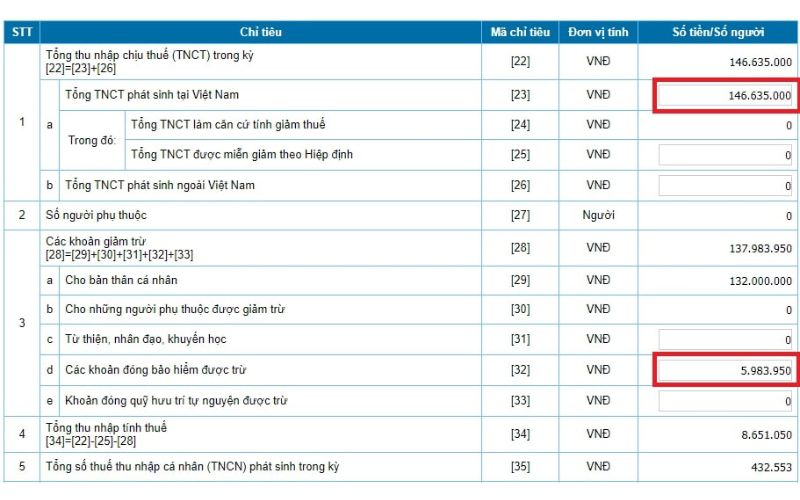

Step 4: Fill in the information tax declaration online.

Step 5: Select “Continue” to the declaration tax settlement.

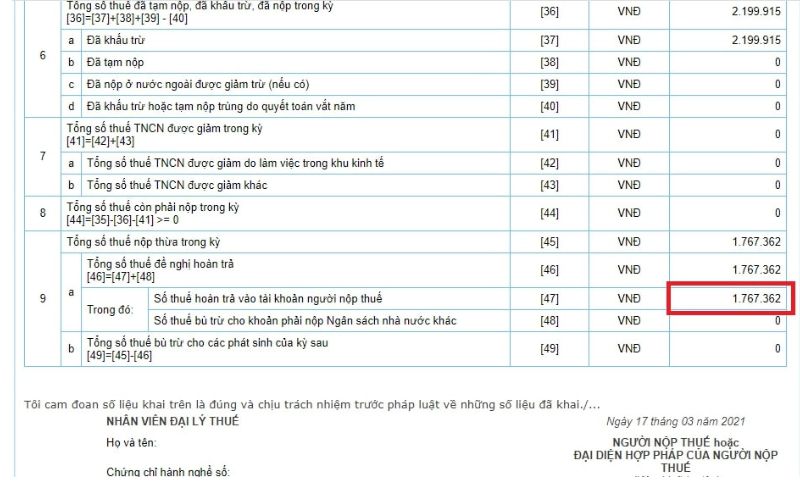

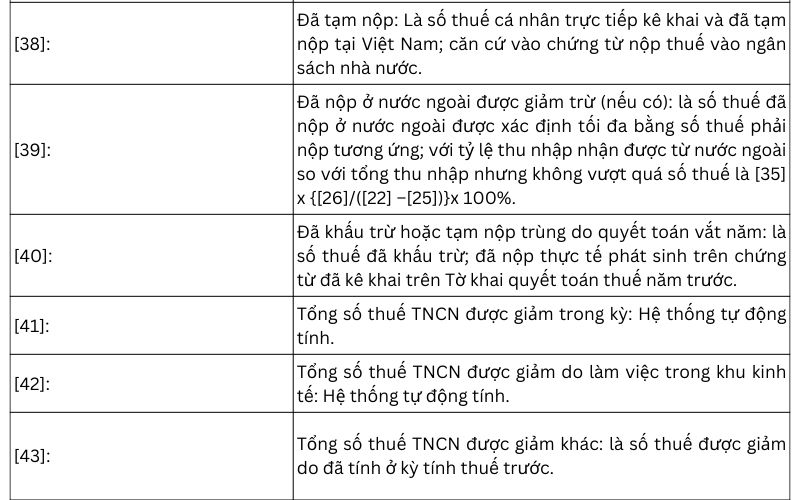

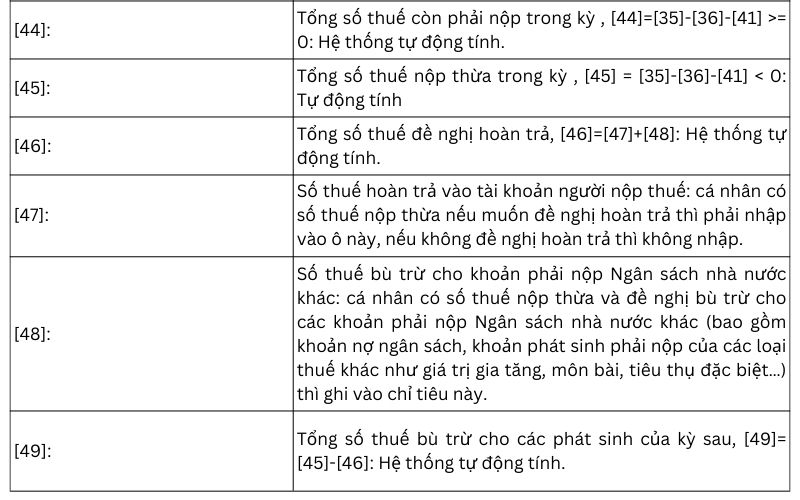

Specifically, the items in the tax return as follows:

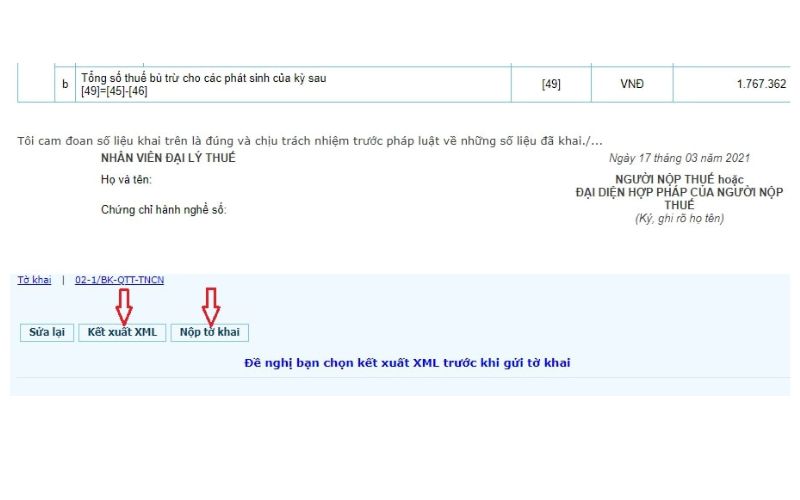

Step 6: After test and confirm the information entered, choose “export XML”.

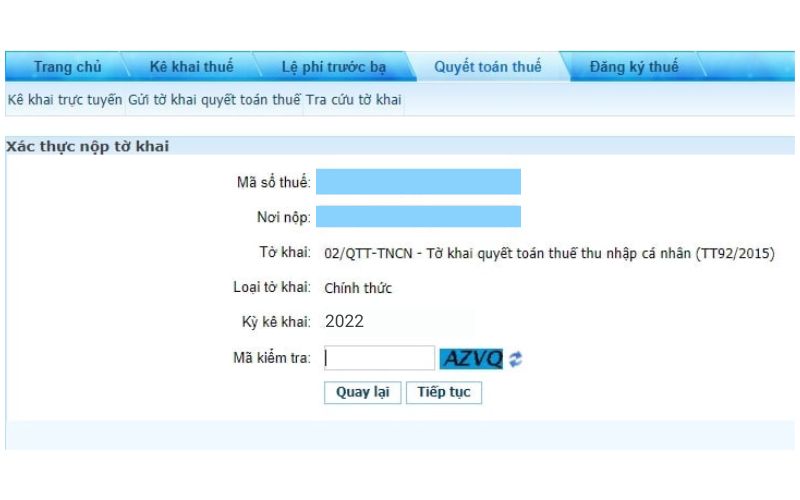

Step 7: Enter the test code to verify and select “Filing”.

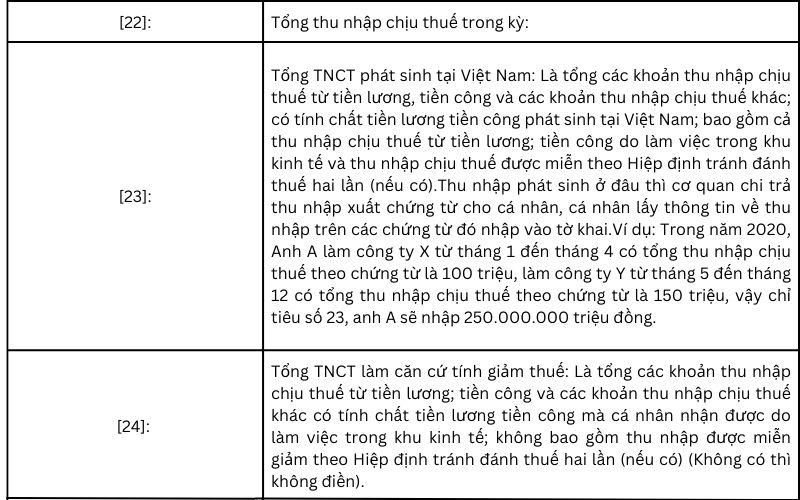

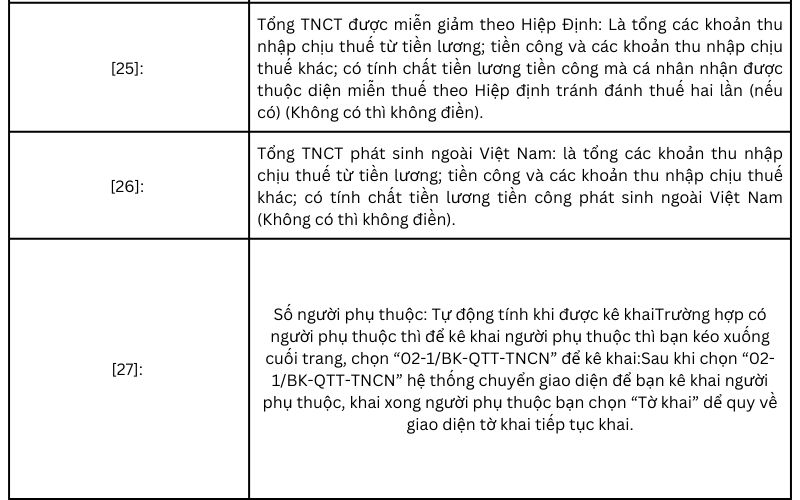

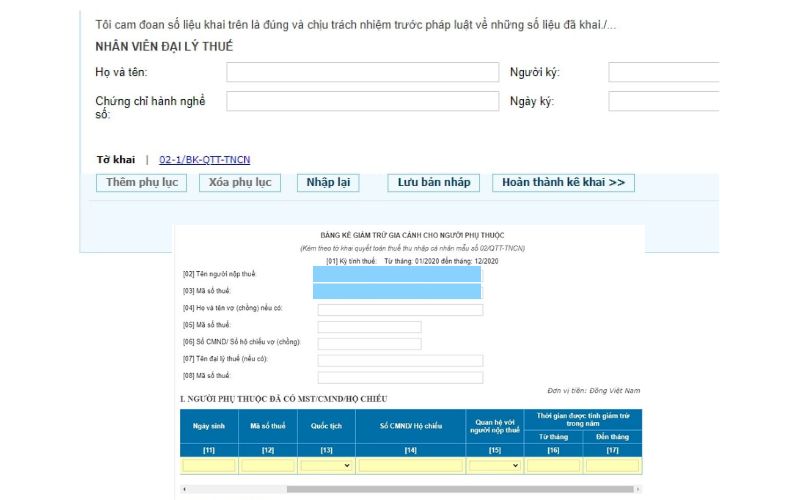

Step 9: In the declaration

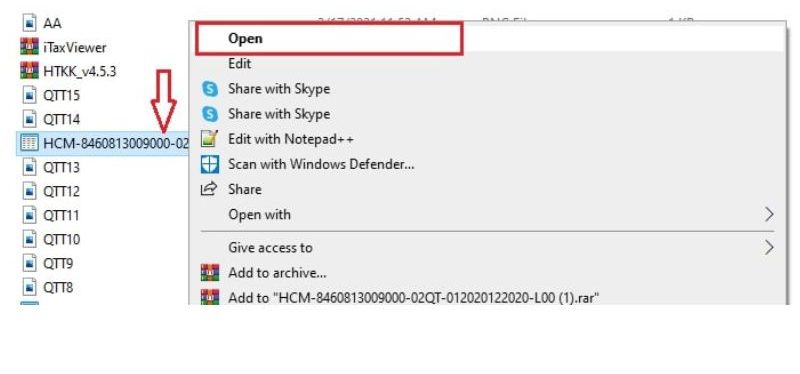

After selecting “export XML”, system will send about the file, you declare it in XML format.

You install the itax viewer to open the file the declaration in XML format –>> In —> Sign the tax declaration.

SOFTWARE SUPPORT SETTLEMENT TAX PERSONAL INCOME LV SUREHCS C&B

LV SureHCS C&B is software management modern welfare, help businesses automate and optimize processes, management salaries, bonuses, taxes, and insurance. With smart features, LV C&B support:

- History tracking pay: Manage the details of history salaries, bonuses, deductions for each employee, ensuring transparent and accurate.

- Calculate and deduct personal income tax: Automatically updates the latest regulations, support tax calculation and tax reporting according to the requirements.

- Synthetic and flexible reportingData : salary, bonus, insurance, personal income tax is synthesized correctly, to help businesses easily export reports periodically or as required for the relevant parts.

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business. Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable. Highlights: CONTACT INFORMATION: Hotline: 0901 555 063 Email: [email protected] | Website: https://www.surehcs.com/ Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

For more information and needs FREE CONSULTATION and DEMO EXPERIENCE don't hesitate to contact LAC VIET SUREHCS via hotline: 0901 555 063