To promote the working efficiency of employees, many businesses have made the payment of wages to workers (EMPLOYEES) under sticky wages and KPI upon completion of the work. So wages KPI have to social insurance (SOCIAL insurance), personal income tax (PIT) 't?

1. Salary KPI are SOCIAL not?

Paragraph 2 of Article 5 of the Law on SOCIAL insurance, 2014 stated:

“The SOCIAL imperative is calculated on the basis of the monthly salary of the EMPLOYEE.”

At the same time, according to the instructions in paragraph 2 of Article 17 of Decree 115/2015/ND-CP; monthly salary SOCIAL insurance is the salary, allowances and other additional payments under the provisions of the law on labor recorded in the labour contract (CONTRACT).

On the other hand, under the guidance in circular 59/2015/nd-CP tyeah date 01/01/2018 onwards; monthly salary SOCIAL insurance is the salary, allowance prescribed in clause 1 of this Article and the additional payments as prescribed in point a, clause 3, Article 4 circular 47/2015/BLDTBXH. However, this circular have lapsed from the date 01/01/2021 and be replaced by circular 10/2020/BLDTBXH. Accordingly, additional terms and other SOCIAL insurance contribution will be determined by weather c1 point c, clause 5, Article 3, circular 10/2020/TT-BLDTBXH:

“The additional account determined to be the specific amount along with wage agreements in the CONTRACT and paid regularly in each pay period;”

As such, salaries SOCIAL insurance of EMPLOYEES is defined as the sum of salary, allowance and the additional terms identified specific level and are paid regularly each pay period. Accordingly, salaries SOCIAL insurance contribution will be specific; stable and is paid in each pay. Meanwhile, wages KPI be paid according to the performance of work that EMPLOYEES work should not months how EMPLOYEE well received and the amount to be paid under the KPI of each month may also be different.

Thus, it is the earnings may be possible to determine the specific salary, but will not be paid regularly in each pay which depends on the level of completion of the work of EMPLOYEES. Can see, salary KPI in this case will not count towards the salary of SOCIAL insurance contribution for EMPLOYEES.

2. Salary KPI have to pay personal income tax not?

Base clause 2, Article 3 of the Law on personal income Tax 2007, revised 2012; salaries, wages and the account has high wages, salaries and allowances, subsidies are counted as income subject to personal income tax of EMPLOYEES.

Which, in point b clause 2 of this Article also stated allowances, subsidies under the salaries of public money that is not taxed PIT, including:

– Allowances, subsidies under the provisions of the law on preferential;

– Allowance for national defense and security;

– Allowances-toxic, dangerous for the industry, profession or work in the workplace has elements toxic or hazardous;

– Allowance attract, allowance area according to the rule of law;

– Subsidies unexpected difficulty, grants to labor accidents and occupational diseases; one-time allowance childbirth or adoption, subsidized by impairment of the ability of labor retirement pension once, the money dog, and monthly subsidies under other provisions of the law on SOCIAL insurance;

– Severance allowance, job-loss allowance;

– Subsidized nature of social protection and allowances; allowances and other non-salary; wages prescribed.

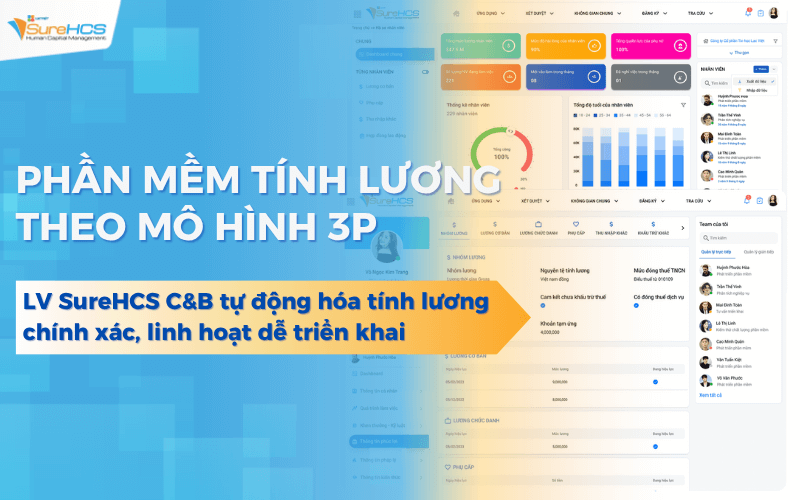

The classification and accurately calculate the account, this will require management system closely, transparent. Management software welfare LV SureHCS C&B helps enterprises automatically identify and calculate tax deductible, insurance in accordance with the regulations, at the same time to support reports, tax and insurance quickly, to help businesses comply with the law in an easy and effective.

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business. Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable. Highlights: CONTACT INFORMATION: Hotline: 0901 555 063 Email: [email protected] | Website: https://www.surehcs.com/ Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Salary KPI influence the working efficiency do not belong to the grant, allowance is for personal income tax. Therefore, salary KPI will also be added to total taxable income to personal income tax. If workers have a high income will have to pay personal income tax according to the regulations.

Under Vietnamese Law