Cost benefits for employees are always things that the business of addiction care. This is one of the ways of retaining talent in business. The benefits of this must be attractive, be appreciated that there must be reasonable budget business activity of the business. Such cost benefits for employees, such as how is the effect?

1. Expenses staff welfare, from where?

These costs are deducted from the budget and welfare of the business. Be calculated based on the sales expectations of the company in a certain period, the average is one year. The budget will be governed by: the price of the labor market, the sliding prices of market and planning staff development. After the calculation is finished, the fund salary and benefits will be divided into sections:

- Wages paid to employees

- The type of allowance often, such as: allowance job responsibilities, level of seniority, overtime....

- Lunch allowances, allowances for meals when increasing ca the event, the...

- The types of bonuses like: bonus based on sales, holiday bonus, employee birthday, birthday, company, award for staff excellence....

2. Business should spend how much for the cost of benefits for employees?

This could be the top concern in the business today. The selection, construction of the welfare regime to the appeal officer was hard, the calculation of the cost accordingly more difficult.

For this question there will be no answer “tailored” for it. There are a number of DN is attributed salary on the salary the employee and do not have additional benefits (deductions under the provisions of The labour Code). In general, this problem is also not wrong and have the plan simple math. However, COMPANIES still need further note the following points:

- Whether the salary is attractive enough to retain and attract talent when there is no welfare?

- Whether the extra cost for the incurred due to the level of wages of employees not?. Ex: insurance, health INSURANCE, UNEMPLOYMENT insurance, and personal income Tax

- Is there enough encourage, motivate employees, dedication and commitment to accompany the company compared with the general market does not?

Therefore, BUSINESSES should consider not only fund the salary for the salary. DN should supplement the budget construction of the welfare regime just logical, just ensure optimized budget pension fund. To encourage the spirit of work of employees.

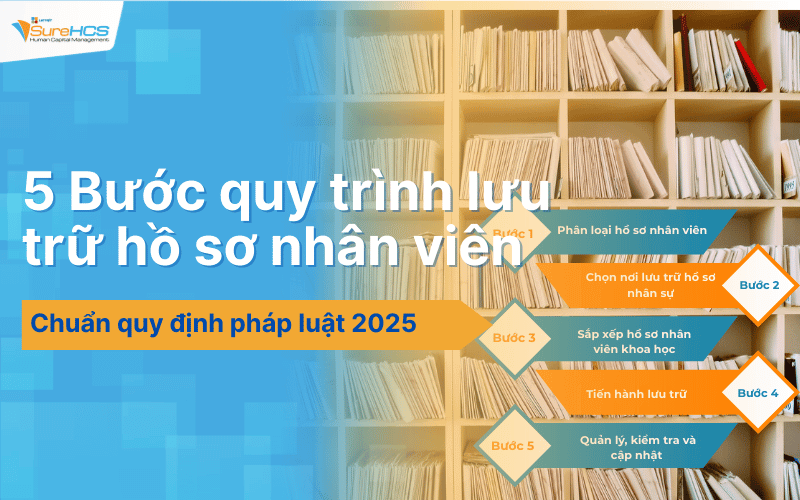

3. Optimize the cost of welfare for employees in the digital era?

In the industrial revolution 4.0 the problem “number conversion” cost benefits for employees is also a problem DN should be laid out. The calculation of the expenditure budget was difficult, the implementation process even more difficult. This is a really headache for the array C&B.

>>> See more: Solution document digitization

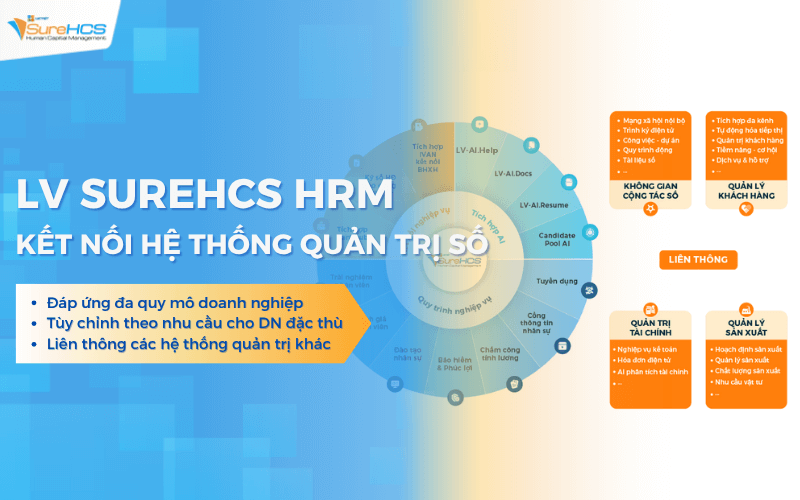

Use and put the system management software welfare LV SureHCS C&B in the timekeeping, payroll and management welfare policies bring to the great value for many COMPANIES. Staff C&B only need to manage and check the information input. The system will automate in the calculation of wages and divide the costs and benefits for each employee. According to particular business, or according to the principles previously installed. For example: year-end bonuses, rewards, business, meal allowance, cost of work, travel, overtime, etc.

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business. Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable. Highlights: CONTACT INFORMATION: Hotline: 0901 555 063 Email: [email protected] | Website: https://www.surehcs.com/ Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Cost of employee benefits should be optimized, besides, COMPANIES need to find the option to simplify the process by digital technology. If still hesitate, afraid to change only the budget salaries and benefits to pay for the wages fund will sometimes have “side effects” are not desired. The value of the budget are not maximize.

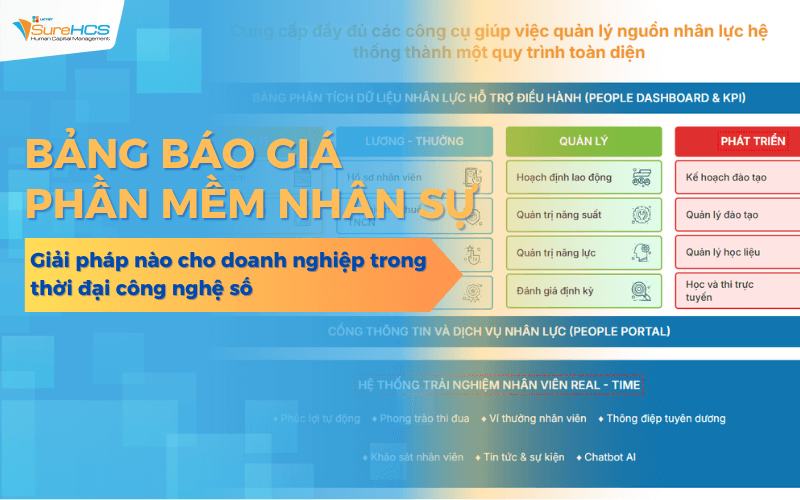

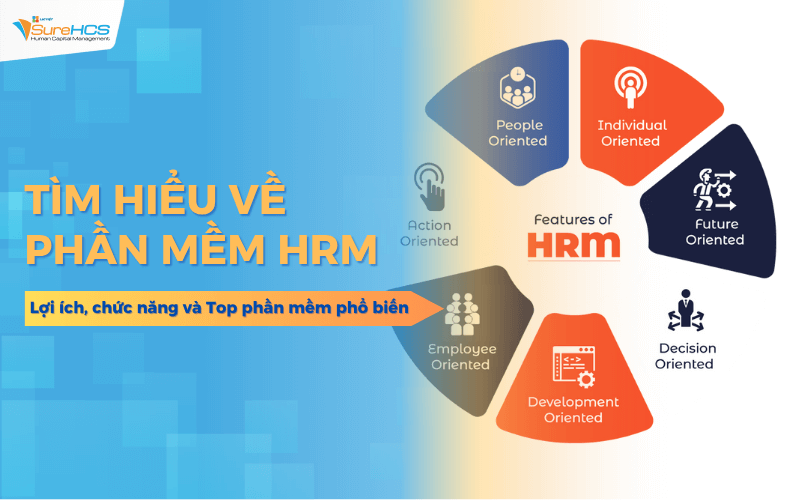

Software personnel management, comprehensive – SureHCS with in-depth features and the full process:

- Attraction – Recruitment – integration

- Attendance – income

- Rated capacity - productivity

- Training and capacity development

In particular, with the integration into the system SureHCS solution “attendance face recognition via Camera” and “Online learning – E-Learning” make SureHCS becomes superior in the market software personnel management today, helping COMPANIES improve the efficiency of hr management, increase labour productivity for employees, cost savings and manpower.