Code scheme of business Increase, Decrease, and change the conditions of closing, the base, the when declaring insurance, social insurance, medical insurance, unemployment insurance, labor accident and occupational diseases

1. Professional Report increased SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance, BHTNLĐ, BNN

| Code PA | Name embodiments | Content | Note |

| TM | Increase new no window |

|

|

| TC | Increased movement had a window, moving from other provinces to | ||

| TD | Rise to had a window, move in the province | ||

| ON (ts) | Increase after maternity leave |

|

|

| ON (om) | Increase after vacation, sick leave or leave without pay, long day | Additional services refund 4.5% of health INSURANCE if when you stay there arrears 4.5% (Code project) |

2. Professional Report reduced SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance, BHTNLĐ, BNN

| Code PA | Name embodiments | Content | Note |

| GH1 | Reduced (terminate the CONTRACT/ transfer work) |

|

|

| GH2 | Reduced (retired) | ||

| GH3 | Reduced (While on maternity leave, sick leave without pay) | ||

| GH4 | Reduced (Was death) | ||

| GC | Reduce transfer unit to another province | ||

| GD | Reduced to another place of the same province | ||

| KL | Reduced due to leave without pay | After reducing non-wage to supplement business increase 4.5% health INSURANCE from January stay up to expiration of the card (Code PA, TT) if the employee does not pay health INSURANCE cards. |

|

| TS | Reduced due to maternity leave |

|

Time to renew health INSURANCE cards for the unit, labor is on maternity leave be extended as usual. |

| OF | Reduced due to sickness | When reducing sickness which EMPLOYEES have not paperwork verification of sick leave, additional units business increase 4.5% health INSURANCE from holiday months to expiration of the card (Code schemes TT).Time to renew health INSURANCE cards for the unit, EMPLOYEE sick leave is extended health INSURANCE cards and arrears. |

3. Professional adjustment, titles, the level of SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance, BHTNLĐ, BNN

| Code PA | Name embodiments | Content |

| DC | Adjusted wage join |

|

| CD | Adjust titles | Do not change the number of receivable at year start tuning. |

| AD | Additional adjustments to increase the raw wage |

|

| SB | Additional adjustments reduce the raw wage |

|

| TT | Additional adjustments increase the number of receivable insurance, health INSURANCE |

|

| TU | Additional adjustments reduce the number of receivable insurance, health INSURANCE | |

| TN | Additional adjustments increase the number of receivable UI |

|

| GN | Additional adjustments reduce the number of receivable UI |

Declaration of SOCIAL insurance, health INSURANCE need to ensure accuracy and compliance with legal regulations and limit the errors in the submission process. The synthesis of data, calculate the close and reporting not only takes much time but also potential risks confusion, affect the rights of workers.

To support businesses in this work management software welfare LV SureHCS C&B provides solution automatically calculates the level of SOCIAL insurance, health INSURANCE, general data quickly and supports to export reports as required. Thanks to that, the business can declare the correct insurance, reduce errors and save time in the process benefits manager hr.

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business.

Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable.

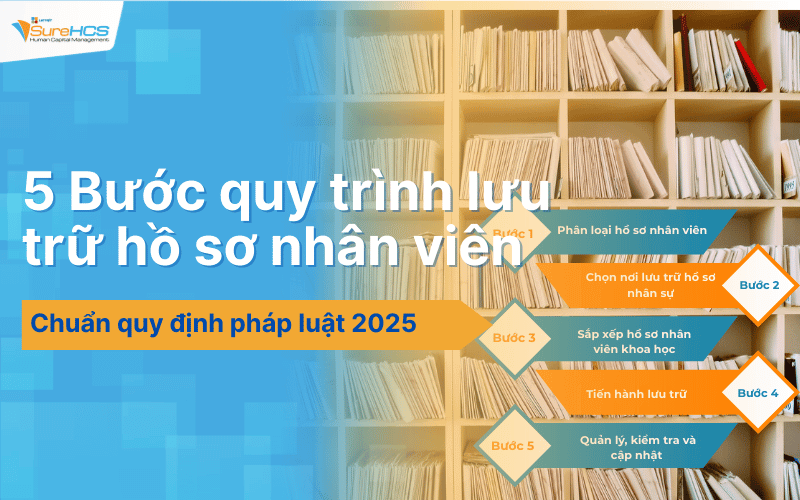

Highlights:

- Statistics structure, unlimited storage more 40 types of employee information; Information management, reward and discipline.

- System accurate timekeeping up to the minute, review, the flexible, the case of late, leaving early, forget to scan the card,...

- Automatically aggregate payroll costsbonus and temporary quotes, PIT finalization of monthly, year.

- Arrears access increases, additional adjustments, track throughout the process of SI.

- Welfare programs, flexible with 5 types of wage feelings.

- Integrated AI answered welfare policies, public – wage accurate.

CONTACT INFORMATION:

Hotline: 0901 555 063

Email: [email protected] | Website: https://www.surehcs.com/

Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

(According to EFY Vietnam)