Payroll software is a support tool for business process automation salary calculator for employees is based on attendance data, tax, insurance, allowances and internal regulations. The software helps to reduce errors, save time, ensure transparency, compliance with legal provisions on wages.

Payroll management to the accuracy, timeliness is one of the key factors to help businesses retain workers, ensure smooth operation. However, when enterprise scale expanding, the salary calculator in Excel or the traditional way easily lead to errors, delays, and even breaking the labor laws. That's why more and more entrepreneurs priority use payroll software to automate, improve management efficiency, while minimizing legal risks.

The article below of SureHCS synthesis, detailed reviews, top 10 apps, payroll best for you to select the right solutions to the needs of his business.

1. Overview of payroll software for business

1.1 software review what is?

Payroll software system is a technology designed to automate the entire payroll process for personnel in business. Instead of having to manipulate manually using Excel spreadsheets, this software allows businesses to set the wages, aggregate data, deductions, insurance, personal income tax and payroll accurately, quickly and transparently.

For example, If an employee working in shifts, have the number of days of work, overtime, vacation, different each month, the software will automatically collect data from time and attendance system, apply the formula was established to calculate the total salary, personal income tax, and the amount of money actually received and then reports sent to accounting, leadership browser.

1.2 Role in modern business

Payroll software not only helps businesses save time but also played a key role in improving effective personnel administration. Specific:

- Minimize errors: According to a survey by Deloitte, 52% error in wages incurred due to manipulation or spreadsheet is not synchronized. The user software control logic, calculations, minimizing confusion.

- Increase transparency: Employees can check the payroll tables, deductions, insurance, taxes right on the system, reduce complaints and increase trust in the hr department.

- Automate processes to repeat: Every month, the software will automatically synthetic, payroll, cumshot, file transfer, report the tax to reduce the burden of work for the accounting department and hr.

- Support compliance with laws: The payroll software quality is often updated according to the latest regulations on insurance, tax, minimum wage help the business limit legal risks.

1.3 Classification of payroll software

Currently, the payroll software is classified according to two criteria downloads:

According to the method of deployment

- Software payroll Cloud (clouds): be Running on the web platform or app, no need to install. The advantage is easy access anytime, anywhere, in accordance with the business has a team of dispersion or apply pattern to work remotely.

- Payroll software On-premise (installed at site): to Be installed on the internal server, control data better, but the investment cost and maintenance are usually higher than in accordance with large organizations requiring high security.

According to the scale business

- Small business: Need software easy to use, low cost, primarily serving the company – basic salary, often choose the software for free or according to the SaaS model.

- Medium business: higher requirements about the song, leave management, KPI should the software has the ability to customize the integration with attendance software.

Big business: Need powerful software can handle thousands of payroll each month, authorization details, high security, often deeply integrated with the ERP system or HRM comprehensive.

- Triển khai phần mềm chấm công vân tay toàn diện với Lạc Việt SureHCS

- Excel convert Net salary to Gross accurate, easy to carry

- Payroll software according to the product LV SureHCS C&B standardized wage for factory, workshop production

- Attendance software online to remotely LV SureHCS C&B flexible anytime, anywhere

2. 10 Phần mềm tính lương nhân sự nổi bật được ưa chuộng nhất 2026

With dozens of payroll software available on the market, choosing a suitable solution can make business confused. To help you easily compare, make a decision. Here is the quick review 10 apps payroll today's most prominent.

| STT | Software name | Feature highlights | Score limit | Package price |

| 1 | LV SureHCS C&B | – Payroll automatically according to the formula customizable deduction SOCIAL insurance, tax allowances. – Deeply integrated with the accounting system. – Allow payroll, multi currency. – Access payslips, contract through mobile. – AI assistant answer key book, automatic report. |

More suited to business medium/large due to complex features. | Cloud: few million/year; On-premise: quote on demand. |

| 2 | CoDX Payroll | – Supporting salaries-time exchange, according to the product titles. – Configure the allowances, bonuses, deductions. – Calculate personal income tax, SOCIAL insurance according to the tax declaration. – Send paycheck automatically via email. |

Should users have knowledge about configuring salary formula. | 20.000 VND/user/month. |

| 3 | MISA AMIS | – Automatically sync your data from attendance, KPI, revenue. – Payroll flexibility in shifts, KPI, sales. – Auto tax deduction, insurance. – Interface transparency, support, feedback from staff. – In-depth reports on salary. |

The relatively high price with startup, slow speed when big data. | 5.700.000 VND/year for 30 employees;

Expansion options. |

| 4 | Tanca | – Automatic synthesis of hours, deduct property tax. – Construction of the salary in each department/title. – Sync with accounting software, ERP. – Mobile App lookup wage at all times. |

A number of processes reward/OKR longer craft, delay sync. | 10K–40K VND/person/month depending on the package.

There is a trial version. |

| 5 | Paradise HRM | – Salary calculator-time product exchange. – Automatically receive data from the timekeeper. – Order of calculation of tax and SOCIAL insurance as prescribed. – Export payroll Excel, according to the department/states. |

Interface technique, no mobile app separately. | Free to install and use.

Download from official website. |

| 6 | BambooHR Payroll | – Sync your data from the system BambooHR. – Send payslips via internal platforms. – Customize the reports according to departments. – Support declaration tax in the united states. |

Only users in the ecosystem, BambooHR, not support English. | Contact quotes;

Only for customers BambooHR. |

| 7 | Patriot Payroll | – Scheduling, payroll, periodic payroll automatically. – Calculate federal tax, state in America. – Integrated internal accounting. – Report salary details. |

Does not fit the environment outside the U.s., process longer craft. | Basic: $ 17 + $ 4/person/month;

Full: 37 USD + 4 USD/person. |

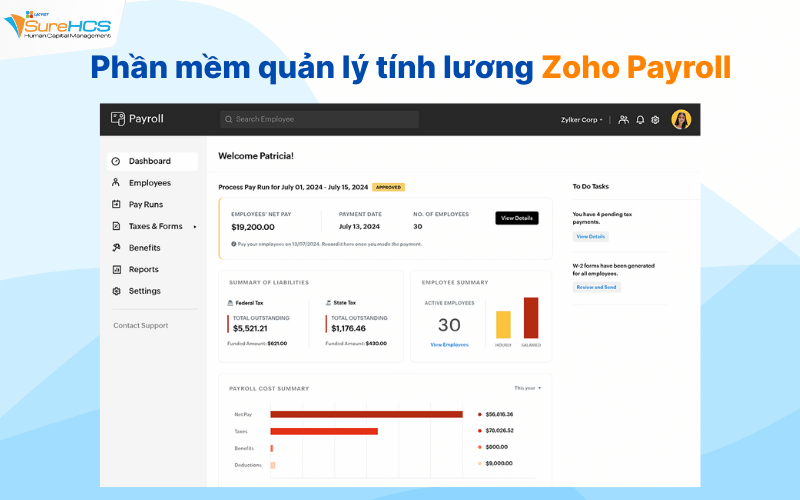

| 8 | Zoho Payroll | – Sync leave hours from Zoho People. – Handle the situation stay the refund. – Customize the structure of wages, deductions. – The employees to download payslips. |

Not support tax rules in Vietnam technical support slow. | 19 USD/month + $ 3/person;

Or pack 190 USD + 30 USD/person. |

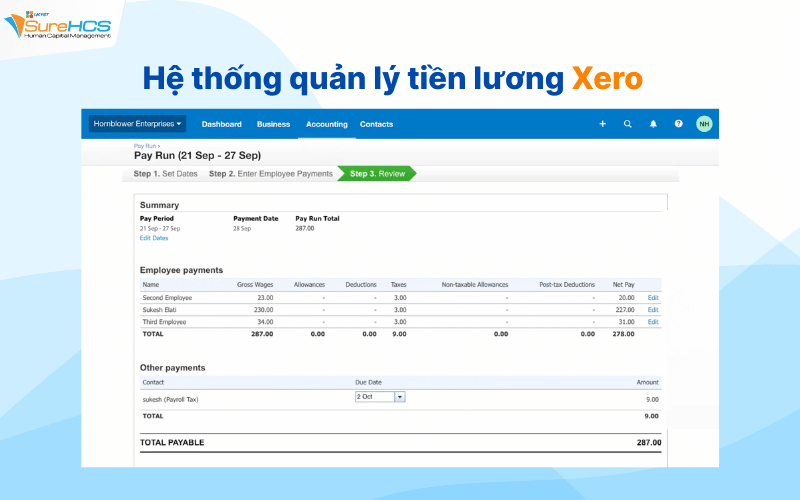

| 9 | Xero | – Payroll tax and SOCIAL insurance auto. – Update work time, vacation. – Employee lookup payslips online. – Full report serves on the audit. |

Not yet support English, high cost, less flexible. | Starter: 29 USD/month; Standard: 46 USD; Premium: 62 USD. |

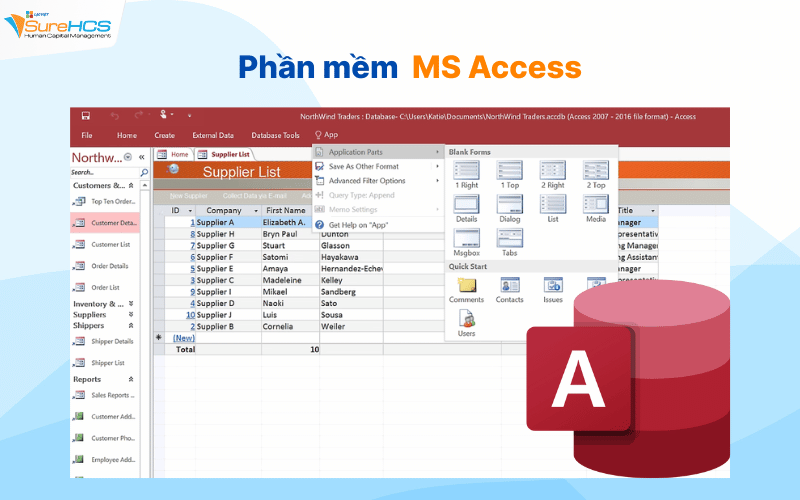

| 10 | MS Access Payroll Template | – Custom formulas luong query. – Link timesheets, hr, the coefficient of salary. – Export payslips, reports by month/quarter. – Self-control payroll process. |

Required to know SQL/Access, does not fit large business. | Cost depending copyright Office;

Custom internal or outsourced. |

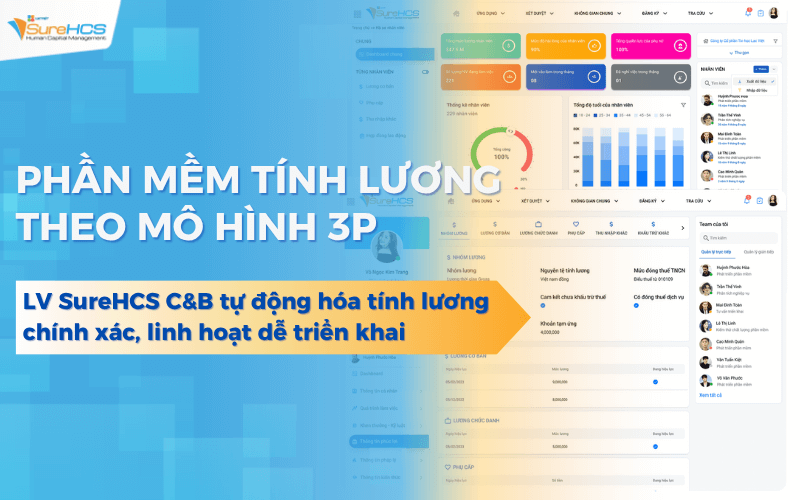

2.1 software payroll LV SureHCS C&B

LV SureHCS C&B là một trong những phần mềm tính lương tốt nhất về cung giải pháp tính lương và quản lý phúc lợi cho doanh nghiệp Việt Nam, được phát triển dựa trên hơn 27 năm kinh nghiệm triển khai phần mềm quản trị nhân sự cho hơn 1.000 doanh nghiệp. Đây không chỉ là công cụ tính lương tự động mà còn là nền tảng hỗ trợ xây dựng một chính sách đãi ngộ linh hoạt, đồng hành cùng doanh nghiệp trong hành trình nâng cao trải nghiệm nhân viên và phát triển văn hóa tổ chức.

Feature highlights

- Automatic salary calculation according to formula, customize, support deduction on personal income tax, SOCIAL insurance and other benefits. The system also automatically receive data clocking – overtime – leave without need to enter manually.

- Hr data is closely connected with payroll system and accounting module. After every pay period, the system automatically aggregate costs, create voucher, the switch to the accounting system, internal.

- Allow to set the formula for calculating the salary – bonus – allowance flexible according to each earnings. Support system, payroll, multi currency, in accordance with business with foreign elements or branch multi-national.

- Support set, control each type of fund in the structure of the wages fund, ensure transparency, optimize personnel costs.

- Allow staff access management information, compensation, benefits, contract labor, work history anytime, anywhere via mobile devices.

- Virtual assistant AI automatically answered to the frequently asked questions about salaries, benefits, leave policies, suggestions or to provide related documents such as form, process or contract.

- Automatic synthesis of accurate data on the salary, bonus, insurance, personal income tax, support export reports periodically or as required for the relevant parts.

Price

- Version Cloud (subscription flexible): Just from a few million/year, suitable for the small business – just need to deploy quickly and without infrastructure investment.

- Version On-premise (deployment on the spot): for businesses large-scale, need deep integration with internal systems or complex custom. Cost of deployment depends on the actual requirements, the scope of use.

LV SureHCS C&B is the solution to help businesses implement the policy benefits accurately and on time, bring satisfaction between employees and the business. Software help parts C&B is the majority of the time in comparison with the timekeeping, payroll manually. Besides, LV SureHCS C&B is also equipped with additional features to manage organization structure, staff profiles, and effectively manage the work helps businesses can admin staff overall rating is the performance of labor and decisions are most suitable. Highlights: CONTACT INFORMATION: Hotline: 0901 555 063 Email: [email protected] | Website: https://www.surehcs.com/ Office address: 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

2.2 management software, hr payroll CoDX Payroll

Payroll software CoDX Payroll is a component of the platform CoDX – ministry of solutions, hr management, comprehensive developed in Vietnam. Geared to the needs automate the payroll process in the business, medium, small, this software is optimized to operate and quick, and can be deployed even on mobile devices. With the ability to customize flexible, CoDX Payroll particularly suitable for the unit has policies pay complex, change frequently or are particular about the industry.

Feature highlights

- Support diverse method of calculating salary: from salary, duration, exchange days/month, by product, norm, unit prices, etc. to the calculation under the titles – all of which can be pre-selected or customized according to your business needs.

- Allows users to build structural elements of pay (bonus, deduction,...) formula calculated according to the internal policy, not limited by mould fixed.

- The software can create temporary quotes, personal income tax, monthly, PIT finalization end of the year, submit an insurance-based configuration tariffs due to users declare.

- Support payroll by pluralism currency for each employee or each item of income – a useful feature to enterprises with an international element or payment of foreign currency.

- Easily create table official salary, overtime, tables, statistics, tax list transfer – send payslips to the employees via email, company, or individual.

Restrictions

- Compared with the big names in the software industry personnel, CoDX are still in the phase of market expansion, should not have the government or large user community strong.

- Although easy to use, but to exploit all features highly customizable, user need to have basic knowledge about setting wages, formula, taxes to the proper configuration.

Price

20.000 VND/user/months – to fit with the budget of startup, SME or the company are digitized initial service personnel.

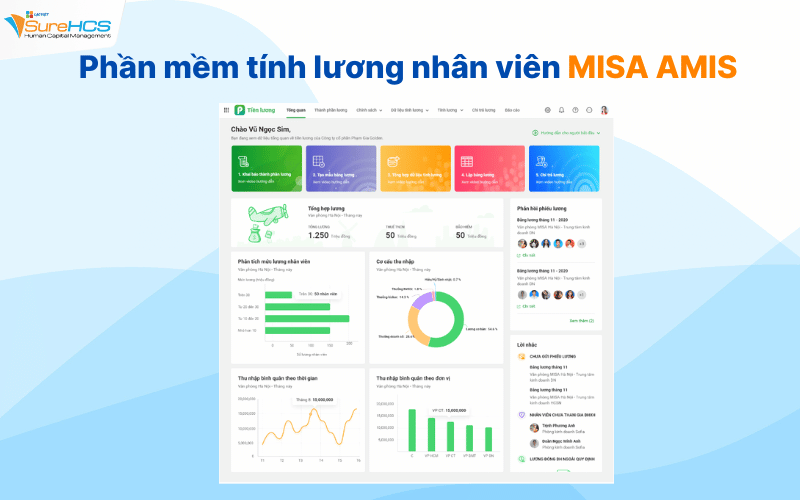

2.3 software payroll staff MISA AMIS

MISA AMIS salary is the solution developed by MISA – a-name reputation in the software industry business in Vietnam. Not only is a tool wages merely, AMIS was built as an “assistant personnel number” when fully integrated professional services related to wages – from attendance, performance, work insurance to personal income tax. Greatest strengths of software payroll MISA AMIS lies in the ability to link flexible with ecosystem accounting – sales – internal evaluation, help information, rotation smooth, minimize errors, optimize operating costs.

Feature highlights

- Automatic synchronization information from the distribution system related, such as attendance, revenue, KPI or deduction, which significantly shortens the synthesis time data input.

- Salary calculation according to formula flexible: user can apply Excel formula available or customized according to actual needs, including salary in ca, KPI's, sales or fixed salary.

- Automatically calculates taxes and insurance: AMIS support accounting, deductions on personal income tax, SOCIAL insurance, UNEMPLOYMENT insurance in accordance with your tariff latest report directly to authorities.

- Interface confirmed transparency: Employees can check and compare payroll, feedback, if there are errors, ensure transparency, proactive internal communication.

- Report – in-depth analysis: Businesses can track payroll costs overall welfare budget, public debt, wages, or effective use of funds salary through visual reports.

Restrictions

- Due to the volume of big data, integrated modules, the speed feedback can be slow when the system is operating at high power.

- The package uses the basic cost is relatively high, not really consistent with business super small or startup new establishment.

- A number of process characteristics has yet to be fully automatic, requires users to be adjusted manually when setting up formulas or special pay tables.

Price

- Trial: 14-day free with full features.

- Basic pack (30 tablets/30 user): 5.700.000 VND/year.

- Extension:

-

- Add 10 users: 1.500.000 VND/year

- 10 extra personnel records: 380.000 VND/year

- Big business: Can request a quote customized according to number of employees and business need to integrate.

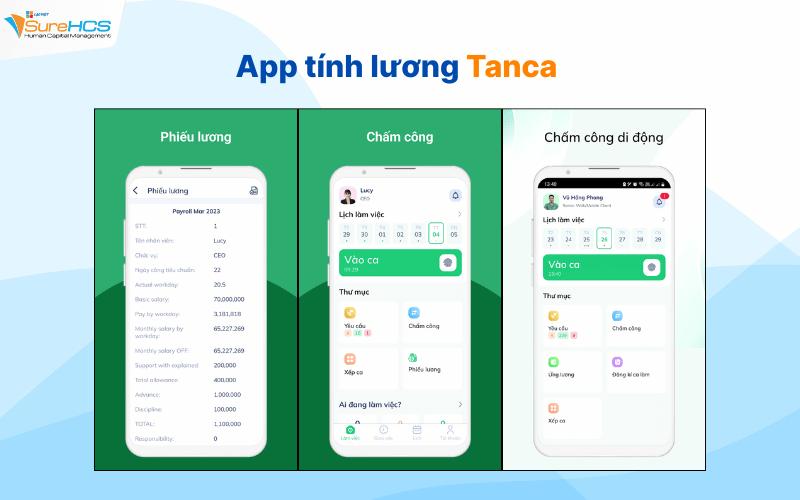

2.4 App payroll Tanca

Tanca is management platform integrated personnel attendance – payroll smart, designed especially for young entrepreneurs, small and medium scale, the work environment, flexible. With the combination of AI, mobile technology, the ability to customize high Tanca help digitize the complete process of management working calculator – salary calculator – tax calculation in a single platform. The mobile App is a huge plus point, allowing employees to lookup wages anytime, anywhere.

Feature highlights

- Support GPS, FaceID, camera, AI, machine fingerprint – all of which are synced automatically with payroll system.

- The system automatically aggregate hours, deductions, leave, allowance calculation, tax and insurance-based configuration salary in each department.

- Businesses can design the salary scale separately for each of the departments, titles, easily adjusted according to the internal policies or state regulation.

- From the ca – attendance – payroll – expense reports – send paycheck on phone, Tanca minimize manipulation crafts maximum.

- API enables integration with other systems such as accounting, ERP, CRM,... convenient extension.

Restrictions

- Some users reflect a system error or delay sync attendance data – salaries at rush hour.

- The complex process such as payroll, according to OKR, unexpected bonus or allocate payroll costs in the project also need to handle manually.

- The calculations related to paid time off, leave without pay, shift hasn't really optimal.

Price

Payroll software Tanca apply the policy to charge according to users, features, consistent with business needs flexible deployment according to the budget:

- Basic package: 10.000 VND/month/person – fit small business need to calculate the basic salary.

- Standard package: 15.000 VND/month/person – add feature analysis, and also the timekeeper.

- Professional package: 25.000 VND/month/person – integrated hr management, advanced reporting.

- Conversion package number: 40.000 VND/month/person – full API, authorization, advanced technical support priority.

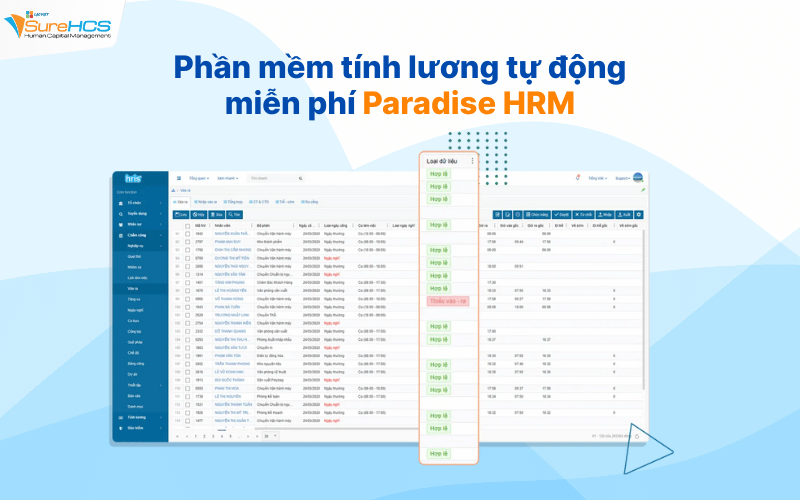

2.5 payroll software free auto Paradise HRM

Paradise HRM is a management software hr overall, especially optimized for service payroll – timesheets – insurance – PIT. With strong points is a free, multi-platform and fully integrated with essential features, Paradise HRM fit medium business, small or corporations with multiple branches need to sync data salary.

Feature highlights

- Supports salary, duration, salary, products, wages, exchange allowances. The system enables enterprises to manually adjust the formula according to each department.

- Automatic data processing from a timekeeper or the summary file, help reduce errors and handcrafted.

- Tracking the fluctuations, dependents, deductions, tax deduction automatically according to the regulations.

- Storage contract labor, noted the times increases wage jobs, moving parts, servicing, settlement at maturity.

- Allows to export payroll reports by states, according to the department, by cost or by location staff form Excel.

Restrictions

- The interface is still a technical nature, lack of intuitive, need time to get to know quite long.

- A number of advanced features such as integrated CRM, accounting or support attendance by AI is not yet available.

- Is the software not already have the mobile app specialized cause inconvenience when the pay by phone.

Price

Paradise HRM featured in model use for free:

- Installed on the internal server or download for free from the official website

Do not charge the end user license or module function - In accordance with the business want to save cost but still need a fully functional payroll management – human resources – INSURANCE – tax.

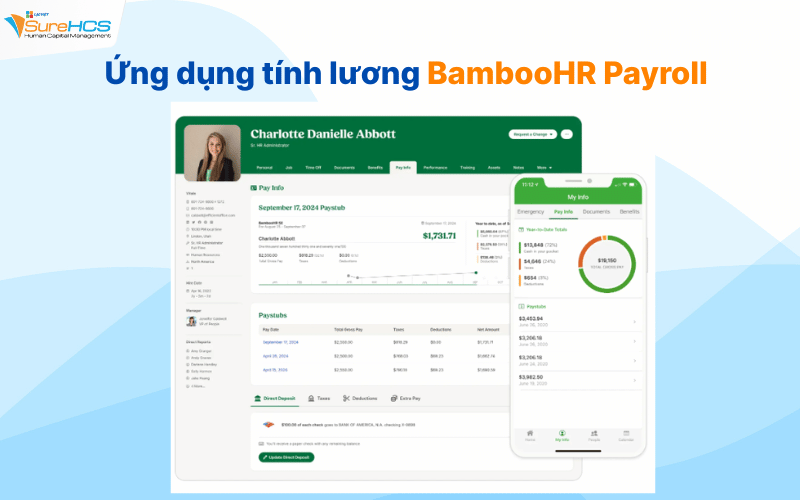

2.6 application payroll BambooHR Payroll

BambooHR Payroll is payroll software developed in the United States, directly integrated in the ecosystem, human resource management BambooHR. This solution is designed exclusively for the small and medium enterprises are using BambooHR, help simplify the process paid thanks to the ability to auto-sync data, personnel attendance.

Feature highlights

- Employee data such as hours worked, bank accounts, allowances – deduction is automatically taken from the hr system to payroll quickly.

- Support for the declaration and payment of tax as specified in the U.s., at the same time can tax reporting standards.

- Send payroll, payslips to employees via email or internal platforms.

- Integrated library report template with the ability to flexibly customized according to each of the departments, period.

- Allows to split the group payroll – business suit many different employees.

Restrictions

- The software only support customers who have used the platform BambooHR, not deployed independently.

- Design, function oriented to the business in the U.s. should not in accordance with the provisions salary – tax in Vietnam.

- The high cost, especially for small business or have custom needs, deep.

- Not support language English, cause difficulties in the process of use, and internal training.

Price

Contact to be providing quotes on demand each business.

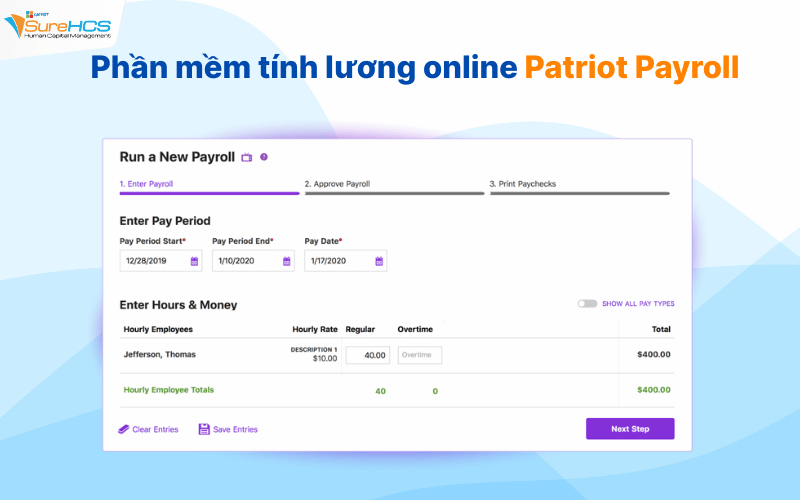

2.7 payroll software online Patriot Payroll

Patriot Payroll is a solution payroll online is designed specifically for small businesses in the Us. With friendly interface, cost, accessible, integrated smoother with accounting software with genuine software, payroll Patriot helps businesses save time in the process, pay salary and pay taxes. Special software in accordance with the organization does not have the financial department, in depth but still needs to ensure accuracy and compliance wage – tax.

Feature highlights

- Allows businesses to set up calendar paid periodically, automatically make a payment according to the schedule specified.

- Automatically calculate federal tax, state, local, according to the legal regulations of the united states.

- Provides two levels of service: Basic (Basic), Full (Full Service) – with the full version includes both declare and pay tax on behalf of the business.

- Tightly integrated with accounting software internal Patriot Accounting – bring the overall look of the budget, personnel costs.

- System detailed report, including history, pay wages, deductions, vacation time, account transfer and the payment receipt.

Restrictions

- Do not support the model tax or business outside the territory of the United States – this makes Patriot Payroll is difficult to deploy in Vietnam or the water system private law.

- No management function, working time, vacation, or work shift – better fit small business has simple needs.

- The processing of the task series as download data about employees sometimes difficult due to system limitations on the speed, interactive interface.

- Process transfer salary still requires some manipulation craft – take time if the scale personnel.

Price

Patriot Payroll provides the price of clear, easy to estimates for business:

- Basic Package: 17 USD/month + $ 4 for each employee.

- Package, Full Service: 37 USD/month + $ 4/employee – services include filing and payment of taxes automatically.

In addition, businesses can experience a free trial version for 30 days before deciding official use.

2.8 management software, payroll Zoho Payroll

Zoho Payroll is payroll software to ecosystems Zoho, towards those businesses are small-scale or medium-sized need a solution payroll simple, automatic, and synchronized with the process of hr management. When combined with Zoho People, the software brings a platform, payroll, comprehensive, in accordance with the foreign business or are active in the markets in which Zoho support.

Feature highlights

- Data on hours of work, vacation will be synchronized continuously, ensure the precision when calculating wages.

- Zoho Payroll handles all the situations, especially as hr jobs, refund for leave days not used, table setting wages settlement quickly.

- Business can adjust the salary structure to suit the peculiarities internal, including the bonuses, allowances or deductions custom.

- Profile information, employees, seniority, position,... will be perfectly in sync to payroll, minimize errors due to manual action.

- Employees can lookup download paycheck, track information, monthly salary in a transparent way.

Restrictions

- Some users reflect that feedback from technical department or customer care no really fast.

- Zoho Payroll not yet support professional salary in accordance with the law of Vietnam should not fit if the business needs to comply with the tax system in the country.

Price

Zoho Payroll provides two payment method flexible:

- Pay per month: 19 USD/month + $ 3/employee

- Pay yearly: 190 USD/year + $ 30/employee (to be discount equivalent to 2 months free usage)

2.9 System management salary Xero

Xero Payroll is a part in the ecosystem Xero accounting software – developed to serve the small and medium enterprises are looking for solutions, financial management, payroll, benefits, effective. Product is sourced from New Zealand, payroll software Xero Payroll featured with the ability to integrate with accounting, helping business save time in handling your payroll, track personnel costs, ensure the accuracy of declared personal income tax, insurance, deductibles required.

Feature highlights

- Xero Payroll can automate payroll, income tax, social insurance, the deduction based on the regulations in each country support.

- Businesses can set up cycle paid weekly, bi-weekly, monthly or according to the work shift.

- Automatic updates work time, vacation, maternity... from other software or file input data to ensure accurate payroll.

- Each employee is granted access to their paycheck in a safe and private on any device.

- Xero provides salary reports, personnel costs, payment history, condition, leave in a complete, easy service of the audit or financial decisions.

Restrictions

- No software language support English and has not integrated business tax – insurance in accordance Vietnam should not fit if you are a local enterprise.

- Xero Payroll to meet the professional standard, but not enough flexible if the business has the wage system complexity (bonus based on KPI, salary, according to the revenue, split shifts, overtime calculation coefficient,...).

- Compared with other software, Vietnam, the price of Xero belongs to the group, especially if scaling or need advanced features.

- Because not yet support English, so there can be big hurdle with the hr department – accounting tradition.

Price

Xero Payroll allows business users try it free for 30 days. Then, can choose one in three following packages:

- Starter – 29 USD/month: for small businesses, the demand payroll – accounting basic.

- Standard – 46 USD/month: includes more features on report automation.

- Premium – 62 USD/month: comprehensive Package, supports payroll enhanced and multi-currency suitable for companies with international operations.

2.10 salary software MS Access

Microsoft Access not software, payroll specialist, but it is tool is very favored by the small and medium business, especially the unit has a team of internal IT or desire to control data from the beginning to the end. With the ability to build database flexible design, business process, Access enables enterprises to create payroll system “tailored” for his own – from table employee data, formula for calculating the salary, to report in detail according to the needs.

Feature highlights

- Access allows the user to customize the entire formula for calculating the salary – from wages, hours, wages, securities to the account, bonuses, benefits, deduction – using query (query) expression logic.

- Attendance data, personnel information, the coefficient of salary can be closely linked together in just a file Access only.

- Optionally create the template payslip reports, statistical or aggregated by month, quarter, year, in accordance with the requirements of each department or board leadership.

- Because the system is self-developed or custom internal business proactive purely about data security and change process when needed.

Restrictions

- To build payroll system by Access, the user should have knowledge of databases, write SQL queries, use the calculation formula in the environment simple programming (VBA).

- When business grows, the number of employees increased or need to integrate with ERP systems, software, Access may not meet the processing speed automation as the specialized software.

- Microsoft does not provide support services intensive for user Access, should any technical issues must handle or hire out

Price

Initial costs come mainly from the purchase of the copyright of Microsoft Office (from 150 to 300 DOLLARS depending on the version).

The rest will depend on the custom level – if the business has employees, the internal understanding Access, the cost will be almost equal to 0; and if to hire programmer or external design, the cost can range from a few million to a few tens of million.

3. Why businesses should use the application payroll?

Salary calculator simple idea, but it is a “battlefield” prone to errors if no tools supports precision. Business whether small or big are faced with challenges such as complex data process cumbersome, pressure ensure transparency, the law. This is the reason increasingly more organizations choose the application software payroll instead of “hug” forever, Excel or handle manually.

Here are the compelling reasons why modern businesses should not ignore application payroll:

- Automate the entire payroll process: from the data, the basic salary coefficient, to calculate taxes, insurance, allowances, deductions... Instead of taking hours to synthesis of crafts, only need few click as accurate payroll.

- Minimize the risk of confusion thanks to the fixed formula, data closely linked, the ability to cross-check the high.

- Updated with new rules, automatically applied to the calculation formula, avoid violating the labor laws.

- Offers a range report: wage costs, according to the departments table analysis earnings, statistics, welfare... thus, leadership can make decisions payroll, budget, personnel, timely and efficient.

- Allow to set the authorization details – who is watching, who is correct, who will only be reported – help protect data on personnel, avoid unwanted leaks.

- The ability to connect with attendance system, hr management, accounting... create data flow throughout, sync, no need to enter manually many times.

4. Criteria to choose a payroll software good for business

Payroll software is a “support” powerful help businesses optimum operation, ensure that pay properly – enough – right term. However, between dozens of options on the market, where is the software really fit the needs of your business?

Below is 6 most important criteria need to consider before “at the money”:

- Meet the right business payroll reality of the business: Every business has a way of building structure different salaries: according to the products, KPIS, roses, shifts... A good software must allow the set recipe is flexibility, handles are many types of allowances, deductions, tax, insurance, the script peculiarities.

- High automation, reduce manual action: The software should have the ability to automatically connect data from time and attendance system, HRM or file import from Excel to create tables and payroll taxes. In addition, the software needs to support the operation automatically as the general public, calculate personal income tax, withholding, SOCIAL, print payslips...

- Friendly interface, easy to use: The user is hr, and accounting – these people not everyone knows about technology. So the software should be intuitive design, layout reasonable, detailed tutorial makes it easy to operate even with new people.

- Security capabilities decentralized clear: Salary is sensitive data, the best in the business. Software need to have a mechanism authorized by the role – who is viewing wage ai, who is editing the formula, who is in paycheck... at the same time must be able to periodically backup, against data loss.

- Report diversity, decision support: The software should provide the kind of reporting salary – bonus – benefits according to many, angle of view: by month, by departments, according to the individual, from time to time... to lead easily analyze the cost and take out adjustable fit.

- Software clocking by the face Lac Viet SureHCS exactly easy to deploy for any business model

- Timekeeping software geolocation GPS Lac Viet SureHCS personnel management, flexibility, accuracy, minute by minute each location!

- Regulation of salary bonus company according to The labour code latest now

- 11+ Sample timesheet excel by date simply the best

5. Related questions

In the search process payroll software suitable, many businesses fret ago series options: user software or a foreign country, should use the free version or free, select Excel or dedicated application? Below are the frequently asked questions and answers obvious:

5.1 Should use app payroll Vietnam or abroad?

Offshore software is usually about technology, modern interface and the ability to expand. However, many systems do not integrate available services salary peculiarities in Vietnam such as: regulations on SOCIAL insurance, personal income tax, the fund union settlement tax...on the Contrary, software, Vietnam has the big advantage is understood policy, local content, easy to customize according to specific enterprise have technical support in English.

If the business you are operating in Vietnam, priority software will be suitable, cost savings and development.

5.2 should use payroll software for free?

The app calculates paycheck free casual suit business, corporate, ultra-small – scale places the simple, no need for complex custom. However, when business began to grow, the use of free software easily lead to:

- Restrictions on advanced features (security, reports...)

- Not be updated timely according to the new policy

- The risk of data loss if there is no backup mode periodically

Free often comes with tradeoffs. If your business has more than 10 employees, or have many different incomes, consider using are free to ensure safety and efficiency.

5.3 There should be free salary calculator in excel?

Excel is familiar tools, flexible, easy to customization should be more business use in the early stages. However, Excel is not dedicated software payroll, there are major limitations:

- Depends on the make file (when off work the following is difficult takeover)

- Easy to flaws recipe if false manipulation

- Hard decentralized data security salary

- Take time synthetic data, difficult to control history adjustment

Salary calculator in Excel fits the early stages, but when the scale hr increased or need accurate – high security, let's turn to specialized software.

5.4 should use payroll software online?

Payroll software online (cloud-based) is a trend because:

- Access anytime, anywhere, does not depend office computer

- Constantly updated new policy from suppliers

- Automatic backup data, limiting the loss

- Easy to connect to the system, HRM, attendance, accounting and other

However, please select a reputable supplier has servers located in Vietnam, standard data security (SSL, ISO, authorization, backup...) to ensure the safety information.

Whether businesses are operating in Vietnam or international market, choosing payroll software fit will help standardize processes, reduce errors, save operating costs. Please consider carefully your goals and budget, scale business to make the most effective choice. If you need solutions payroll intensive, flexible according to the regulation of Vietnam, they can weigh LV SureHCS C&B.

CONTACT INFORMATION:

- Solutions talent management & Human resources comprehensive LV SureHCS

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: [email protected] – Website: https://www.surehcs.com/

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, ho chi minh CITY. Ho Chi Minh