Excel convert Net salary to Gross là công cụ không thể thiếu giúp doanh nghiệp và người lao động dễ dàng xác định mức thu nhập thực nhận hoặc tổng thu nhập trước thuế. Trong thực tế, nhiều người vẫn nhầm lẫn giữa lương Gross và lương Net khi nhận hợp đồng lao động hoặc đàm phán lương. Hiểu rõ cách quy đổi lương sẽ giúp bạn tránh được những hiểu nhầm không đáng có và đảm bảo quyền lợi cá nhân.

In this article Lac Viet SureHCS share table Excel template with formulas detailed to you for your convenience to calculate and apply now.

1. Tìm hiểu về lương Net và lương Gross

Trong thực tế nghiệp vụ trả lương, rất nhiều doanh nghiệp và người lao động nhầm lẫn giữa lương Net và lương Gross. Sự nhầm lẫn này không chỉ gây khó khăn khi thỏa thuận hợp đồng mà còn tiềm ẩn rủi ro về thuế, bảo hiểm, chi phí nhân sự. Vậy lương net là gì? Lương Gross là gì?

1.1 Lương Net là gì?

Lương Net là mức lương người lao động thực nhận hàng tháng, sau khi đã trừ toàn bộ các khoản bắt buộc theo quy định pháp luật. Đây là con số người lao động quan tâm nhất vì phản ánh trực tiếp thu nhập thực tế.

Thông thường, lương Net đã bao gồm việc khấu trừ:

- Các khoản bảo hiểm người lao động phải đóng: bảo hiểm xã hội, bảo hiểm y tế, bảo hiểm thất nghiệp.

- Thuế thu nhập cá nhân (nếu thu nhập đến mức chịu thuế).

Ví dụ: Một nhân viên được thông báo “lương Net 15 triệu đồng”. Con số này là số tiền thực tế người lao động nhận về tài khoản mỗi tháng. Tuy nhiên, để doanh nghiệp chi trả được mức lương Net này, chi phí thực tế sẽ cao hơn do còn bao gồm bảo hiểm và thuế đã khấu trừ trước đó.

Trong thực tế quản trị nhân sự, nếu doanh nghiệp chỉ nhìn vào lương Net mà không quy đổi ngược về Gross, rất dễ:

- Ước tính sai chi phí nhân sự

- Khó lập ngân sách tiền lương dài hạn

- Dễ xảy ra tranh chấp khi quyết toán thuế hoặc thanh tra lao động

1.2 Lương Gross là gì?

Lương Gross là mức lương trước khi trích các khoản bảo hiểm và thuế, thường được ghi rõ trong hợp đồng lao động. Đây là mức lương phản ánh đầy đủ nghĩa vụ tài chính giữa doanh nghiệp và người lao động theo pháp luật.

Lương Gross bao gồm:

- Lương thỏa thuận

- Các khoản phụ cấp chịu bảo hiểm, chịu thuế (nếu có)

- Là căn cứ để: Tính đóng bảo hiểm xã hội; Tính thuế thu nhập cá nhân; Xác định chi phí nhân sự hợp pháp

Phần lớn doanh nghiệp hiện nay lựa chọn thỏa thuận lương Gross khi ký hợp đồng vì:

- Minh bạch về nghĩa vụ bảo hiểm, thuế

- Dễ kiểm soát chi phí

- Hạn chế rủi ro khi cơ quan thuế hoặc bảo hiểm kiểm tra

Tuy nhiên, trên thị trường lao động, nhiều ứng viên vẫn ưu tiên đàm phán lương Net để “dễ hình dung thu nhập”. Đây chính là lý do doanh nghiệp cần đến bảng quy đổi lương Net sang Gross.

- 10 payroll software hr most striking 2026 popular

- Triển khai phần mềm chấm công vân tay toàn diện với Lạc Việt SureHCS

- Payroll software according to the product LV SureHCS C&B standardized wage for factory, workshop production

- Attendance software online to remotely LV SureHCS C&B flexible anytime, anywhere

2. Vì sao doanh nghiệp cần bảng quy đổi lương Net sang Gross?

Trong nhiều trường hợp tuyển dụng, doanh nghiệp thỏa thuận với ứng viên theo lương Net, nhưng về mặt pháp lý vẫn bắt buộc phải:

- Khai báo lương Gross để đóng bảo hiểm xã hội

- Tính và khấu trừ thuế thu nhập cá nhân đúng quy định

Nếu không có bảng quy đổi lương Net sang Gross chuẩn, doanh nghiệp thường gặp các vấn đề sau:

- Tính thiếu bảo hiểm hoặc thuế, dẫn đến nguy cơ truy thu, phạt chậm nộp

- Tính dư chi phí lương, làm sai lệch ngân sách nhân sự

- Phát sinh tranh chấp với người lao động khi quyết toán thu nhập

Bảng quy đổi đóng vai trò như một “bản đồ ngược”, giúp doanh nghiệp:

- Chuẩn hóa việc tính lương Net sang Gross

- Chủ động kiểm soát tổng chi phí tiền lương

- Đảm bảo minh bạch nhất quán giữa hợp đồng, bảng lương và kê khai pháp lý

Trong thực tế vận hành, nhiều doanh nghiệp vẫn sử dụng bảng excel quy đổi lương net sang gross hoặc file excel quy đổi lương net sang gross để xử lý nhanh. Tuy nhiên, nếu bảng này không được cập nhật kịp thời theo chính sách thuế/bảo hiểm mới, rủi ro sai lệch là rất lớn.

3. Nguyên tắc pháp lý khi quy đổi lương Net sang Gross

Quy đổi lương Net sang Gross không phải là phép tính tùy ý mà phải tuân thủ chặt chẽ các quy định của pháp luật lao động, thuế bảo hiểm.

3.1 Các khoản bảo hiểm bắt buộc ảnh hưởng đến quy đổi

Theo quy định hiện hành, người lao động và doanh nghiệp đều phải tham gia các loại bảo hiểm bắt buộc. Khi quy đổi lương Net sang Gross, cần phân biệt rõ:

- Phần bảo hiểm người lao động đóng: bị trừ trực tiếp vào lương Gross để ra lương Net

- Phần bảo hiểm doanh nghiệp đóng: là chi phí bổ sung, không ảnh hưởng đến lương Net nhưng ảnh hưởng trực tiếp đến tổng chi phí nhân sự

Việc xác định sai tỷ lệ hoặc sai căn cứ tiền lương đóng bảo hiểm là một trong những lỗi phổ biến nhất khi doanh nghiệp tự tính lương Net sang Gross bằng Excel.

Theo Bảo hiểm xã hội Việt Nam, tiền lương làm căn cứ đóng BHXH bắt buộc là tiền lương ghi trong hợp đồng lao động, bao gồm mức lương và các khoản phụ cấp theo quy định. Nguồn tham khảo chính thức: https://baohiemxahoi.gov.vn

3.2 Thuế thu nhập cá nhân trong quy đổi Net – Gross

Thuế thu nhập cá nhân là yếu tố khiến việc quy đổi Net – Gross trở nên phức tạp nhất. Thuế được tính theo biểu thuế lũy tiến từng phần, nghĩa là:

- Thu nhập càng cao, tỷ lệ thuế áp dụng càng tăng

- Mức thuế phải nộp phụ thuộc vào: Thu nhập chịu thuế; Các khoản giảm trừ gia cảnh; Số người phụ thuộc

Chính vì vậy, cùng một mức lương Net nhưng:

- Người có người phụ thuộc sẽ có lương Gross thấp hơn

- Người không có người phụ thuộc sẽ cần mức lương Gross cao hơn để đạt cùng lương Net

Theo Tổng cục Thuế, việc xác định đúng thu nhập chịu thuế và giảm trừ gia cảnh là yếu tố then chốt để tránh sai sót khi quyết toán. Nguồn tham khảo: https://www.gdt.gov.vn

3.3 Căn cứ pháp lý doanh nghiệp cần tuân thủ

Khi xây dựng và áp dụng bảng quy đổi lương Net sang Gross, doanh nghiệp cần bám sát các văn bản pháp lý sau:

- Bộ luật Lao động: quy định nguyên tắc trả lương, ghi lương trong hợp đồng

- Luật Bảo hiểm xã hội: quy định tiền lương làm căn cứ đóng bảo hiểm

- Luật Thuế thu nhập cá nhân, các văn bản hướng dẫn

Việc tuân thủ đúng các căn cứ này không chỉ giúp doanh nghiệp tránh rủi ro pháp lý mà còn nâng cao tính chuyên nghiệp trong quản trị tiền lương, đặc biệt khi quy mô lao động ngày càng mở rộng.

Trong giai đoạn doanh nghiệp phải quản lý đồng thời chi phí nhân sự, tuân thủ pháp luật và nâng cao trải nghiệm người lao động, việc quy đổi lương Net sang Gross không còn đơn thuần là một phép tính kỹ thuật. Đây là bài toán quản trị đòi hỏi độ chính xác cao, khả năng cập nhật chính sách liên tục, tính nhất quán trên toàn hệ thống.

4. Bảng Excel quy đổi lương Net sang Gross cụ thể chuẩn cho doanh nghiệp

If EMPLOYEES get salary gross, then calculate the net salary will be calculated as follows:

Net salary = Gross Salary – (SI + health INSURANCE + UI) – PIT (if available)

In which:

– Rate deduction SOCIAL insurance contribution from wages of EMPLOYEES is determined as follows:

(Base: Decision no. 595/QD-BHXH)

|

Rate quotes close the types of compulsory insurance |

|||

|

Retirement and survivorship (SI) |

Unemployment insurance (UI) |

Health insurance (health INSURANCE) |

Total |

|

8% |

1% |

1,5 % |

10,5% |

– Personal income tax: EMPLOYEE only payable as income tax and is calculated according to the following formula:

|

PIT = |

(Total income – |

The account is free |

– |

Deductions) |

x Tax rate |

To better understand this formula, the EMPLOYEE can refer to the example illustrated below:

You A sales staff for company X with a Gross salary of 30 million vnd/month. In January, he will have to extract close the account the following currencies:

* The payment of SOCIAL insurance

– SOCIAL: 30 million x 8% = 2.4 million at

– UI: 30 million x 1% = 300,000

– Health INSURANCE: 30 million x 1.5% = 450,000 vnd

So the total amount you must extract to the type of compulsory insurance/month is:

2,4 million + 300,000 + 450,000 vnd = 3,15 million

*On personal income tax

Pursuant to Article 1 of resolution 954/2020/UBTVQH14 and Article 20 of the Law on personal income Tax, each EMPLOYEE be reduced as follows:

– Circumstance for myself: 11 million/month.

– Reduced dependents: 4.4 million vnd/month/person.

– The compulsory insurance, voluntary pension funds, charitable contributions.

Suppose mr. A may 01 dependents, in January you A non-charitable donations, humanitarian PIT in the month of you A be roughly calculated as follows:

– Taxable income = Gross income – The account is free – deductions =

30 million – 3,15 million – 11 million to 4.4 million = 11,45 million

PIT of A is calculated according to the following:

+ Tier 1: income tax calculator to 05 million, tax rate of 5%:

05 million × 5% = 250,000

+ Tier 2: income tax on 05 million to 10 million, tax rate of 10%:

(10 million – 05 million) × 10% = 500,000

+ Tier 3: income tax on 10 million to 18 million, tax rate of 15%:

(11,45 million – 10 million) × 15% = 217.500 dong

Total personal income tax = 250.000 + 500.000 + 217.500 = 967.500 dong

Thus, the Net salary that he received are:

Net Salary = 30 million – 3,15 million – 967.500 copper = 25.882.500 dong

5. Vì sao không nên quy đổi lương thủ công bằng Excel?

Thực tế, rất nhiều doanh nghiệp hiện nay vẫn sử dụng bảng excel quy đổi lương net sang gross trong quy trình tính lương do chi phí thấp và dễ triển khai ban đầu. Tuy nhiên, khi quy mô nhân sự tăng lên hoặc chính sách pháp luật thay đổi, phương pháp này bộc lộ nhiều hạn chế.

Thứ nhất, rủi ro sai công thức rất cao.

Việc tính lương Net sang Gross liên quan đồng thời đến bảo hiểm bắt buộc, thuế thu nhập cá nhân theo biểu lũy tiến. Chỉ cần sai một ô công thức, nhầm tỷ lệ bảo hiểm hoặc áp dụng sai mức giảm trừ gia cảnh, toàn bộ bảng lương có thể bị sai lệch. Trong thực tế tư vấn, nhiều doanh nghiệp chỉ phát hiện lỗi sau khi quyết toán thuế, dẫn đến truy thu phạt chậm nộp.

Theo Tổng cục Thuế, các sai sót liên quan đến kê khai và tính thuế thu nhập cá nhân là một trong những lỗi phổ biến nhất khi thanh tra thuế tại doanh nghiệp.

Thứ hai, khó cập nhật khi chính sách thay đổi.

Chính sách về:

- Mức lương tối thiểu vùng

- Tỷ lệ đóng bảo hiểm

- Mức giảm trừ gia cảnh

đều có thể thay đổi theo từng giai đoạn. Khi sử dụng Excel, bộ phận nhân sự phải tự rà soát lại toàn bộ công thức, cập nhật từng file, từng phiên bản. Nếu doanh nghiệp có nhiều chi nhánh hoặc nhiều nhóm nhân sự, nguy cơ áp dụng sai phiên bản bảng quy đổi là rất lớn.

Theo Bảo hiểm xã hội Việt Nam, việc xác định sai tiền lương làm căn cứ đóng BHXH có thể dẫn đến truy thu nhiều năm. Nguồn tham khảo: https://baohiemxahoi.gov.vn

Thứ ba, mất nhiều thời gian nhưng không tạo ra giá trị gia tăng.

Thay vì tập trung vào các công việc mang tính chiến lược như xây dựng chính sách lương thưởng, giữ chân nhân tài hay tối ưu chi phí nhân sự, bộ phận C&B lại phải dành nhiều giờ mỗi tháng chỉ để:

- Kiểm tra file

- Soát công thức

- Giải thích lại cách tính lương cho người lao động

Ở góc độ quản trị, đây là chi phí thời gian rất lớn nhưng không mang lại lợi thế cạnh tranh cho doanh nghiệp.

- Software clocking by the face Lac Viet SureHCS exactly easy to deploy for any business model

- Timekeeping software geolocation GPS Lac Viet SureHCS personnel management, flexibility, accuracy, minute by minute each location!

- Regulation of salary bonus company according to The labour code latest now

- 11+ Sample timesheet excel by date simply the best

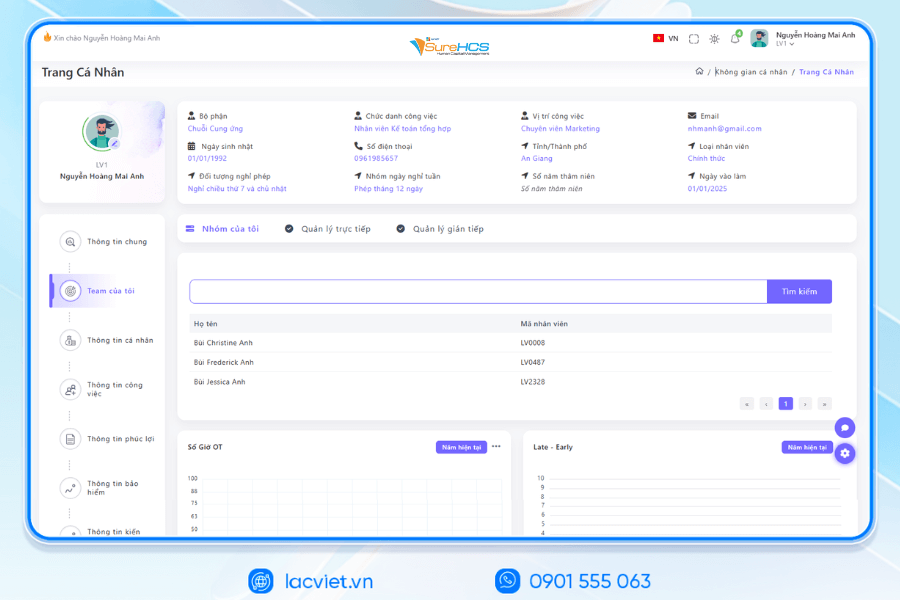

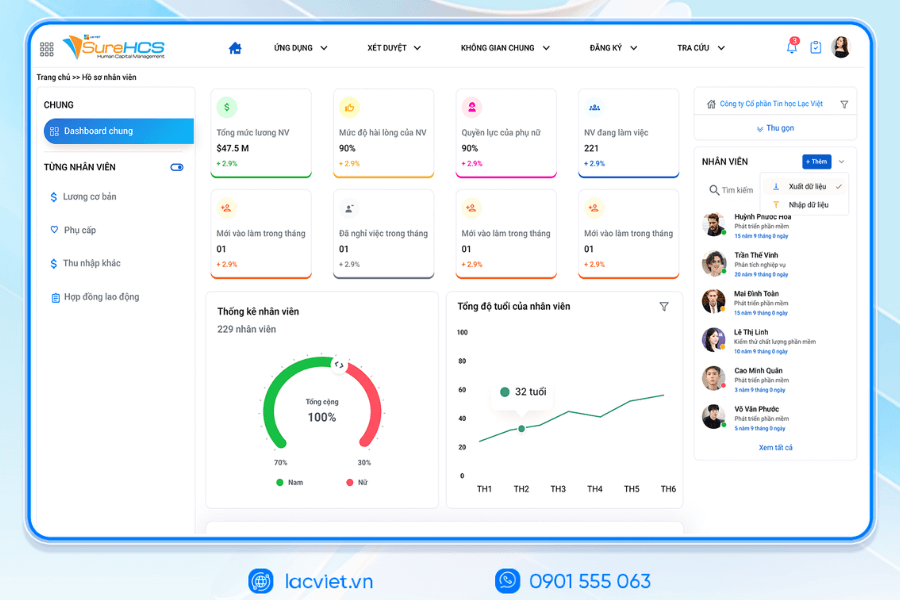

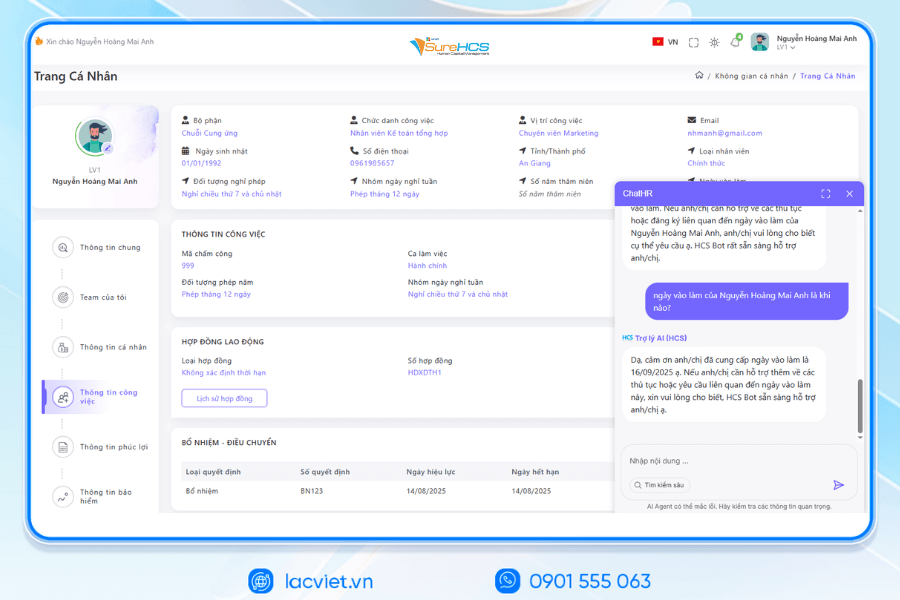

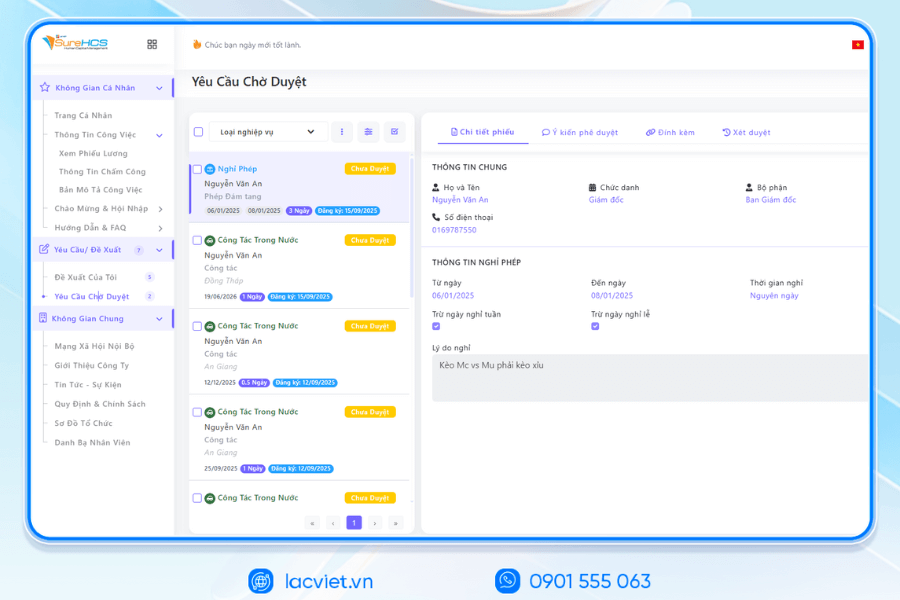

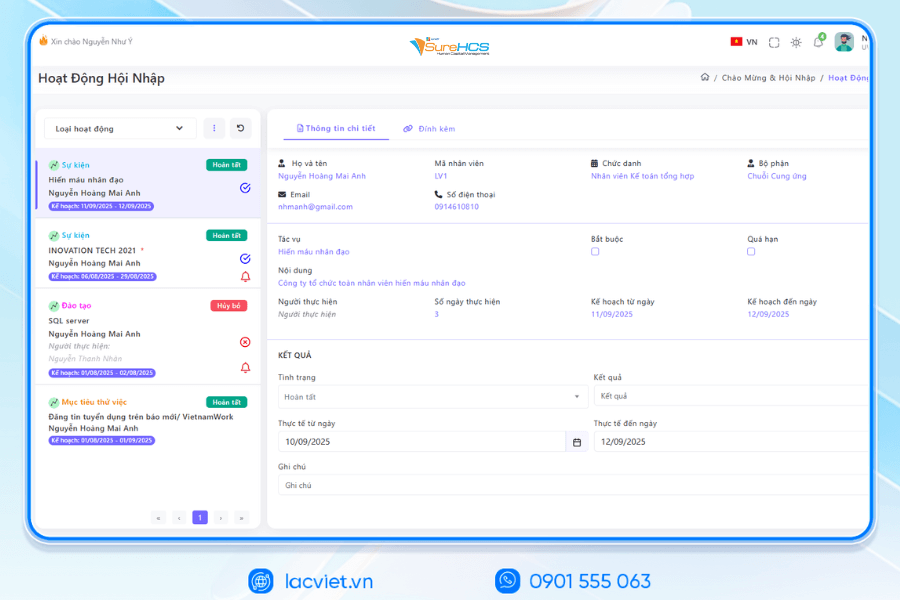

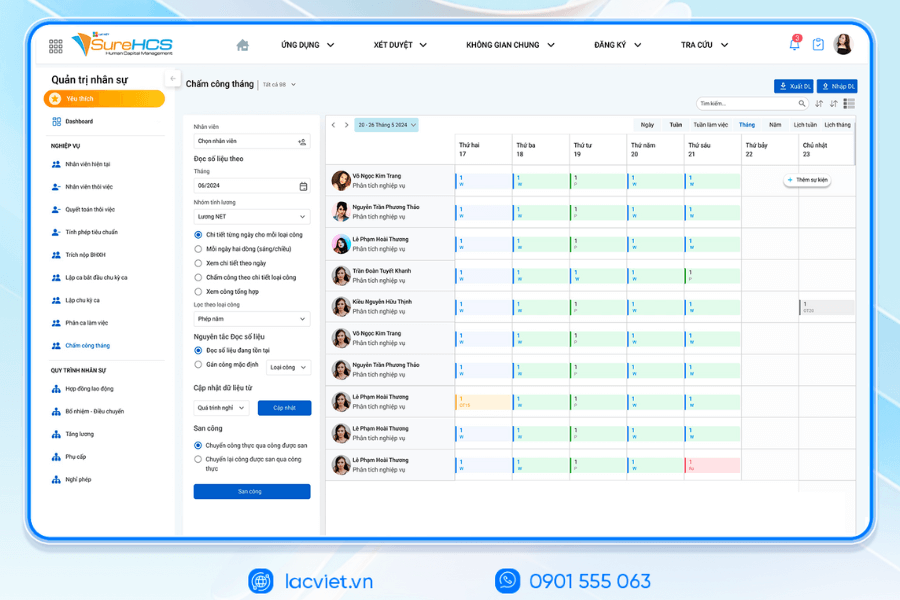

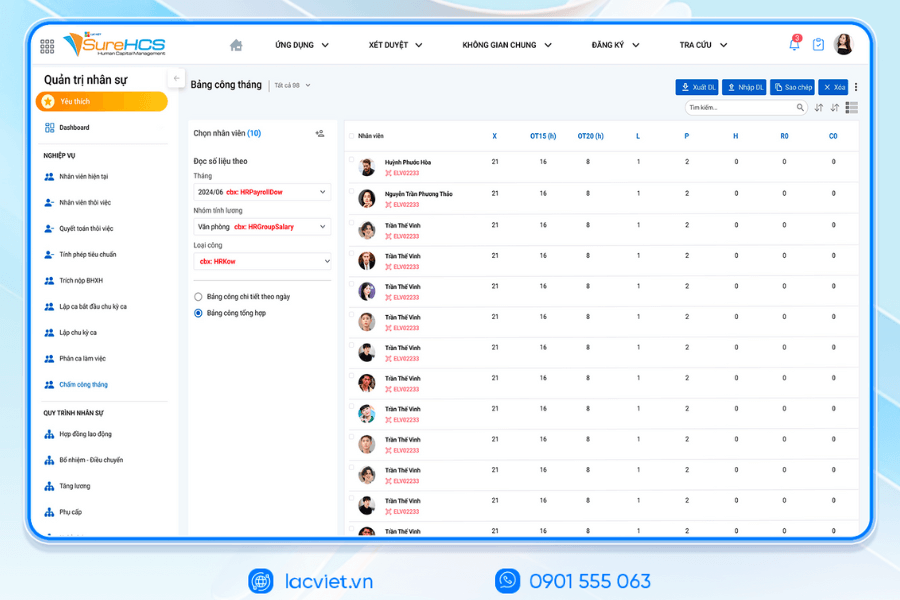

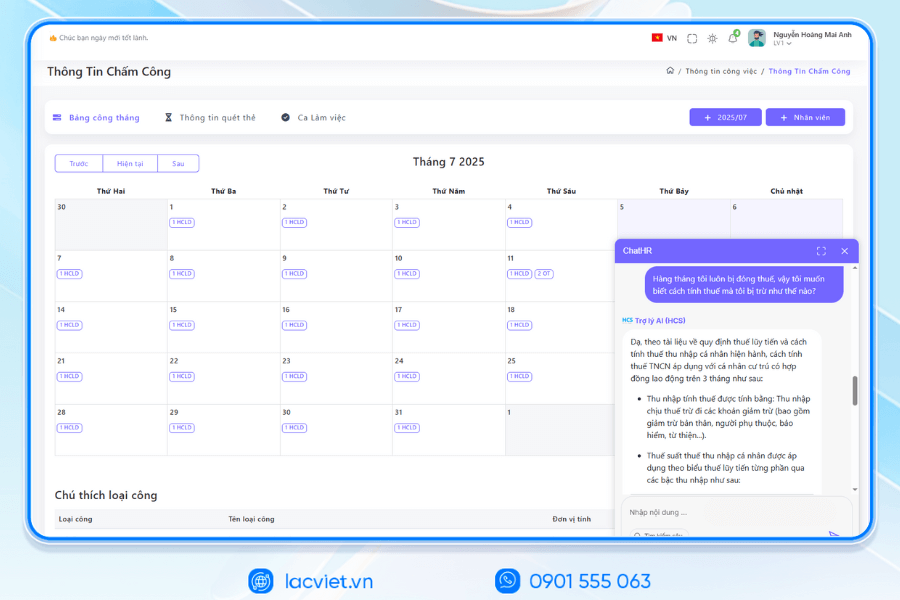

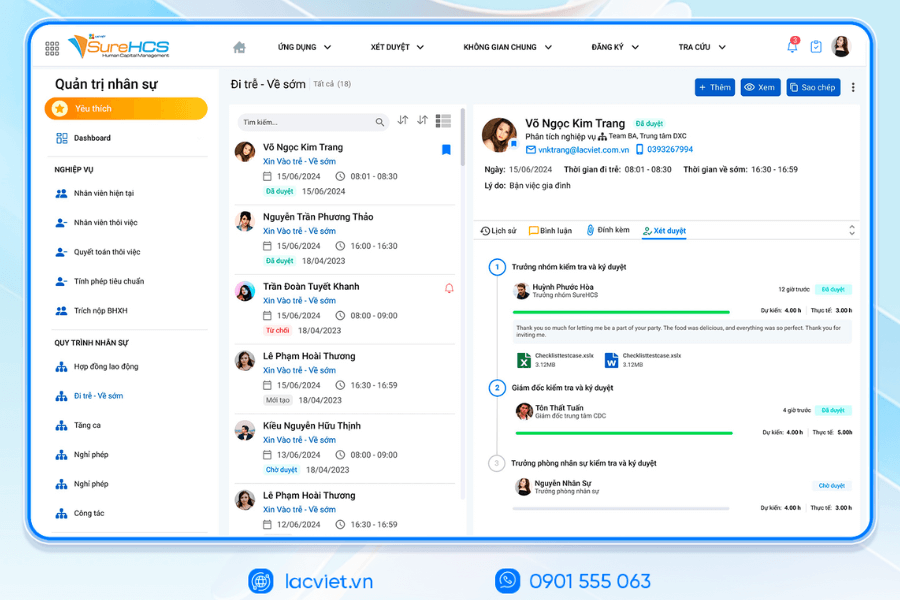

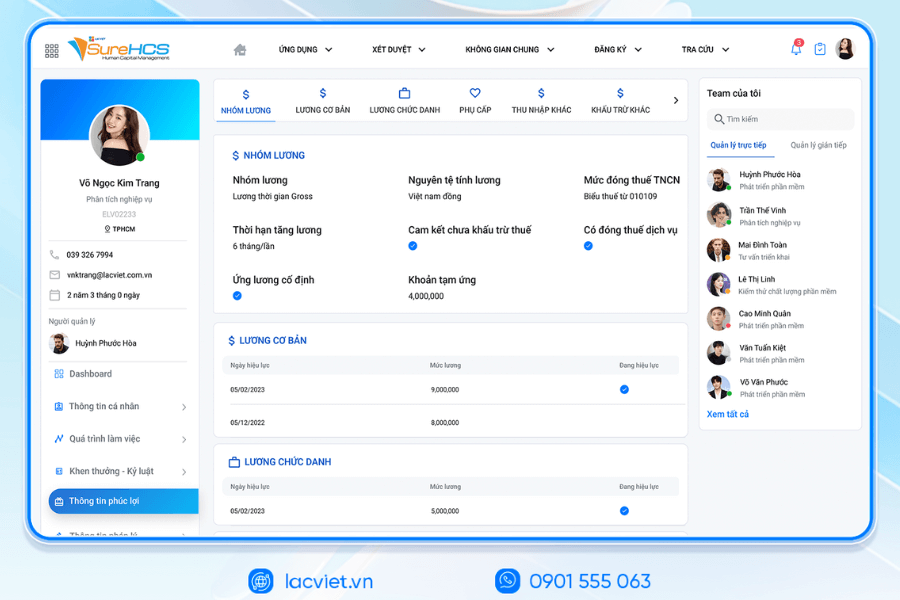

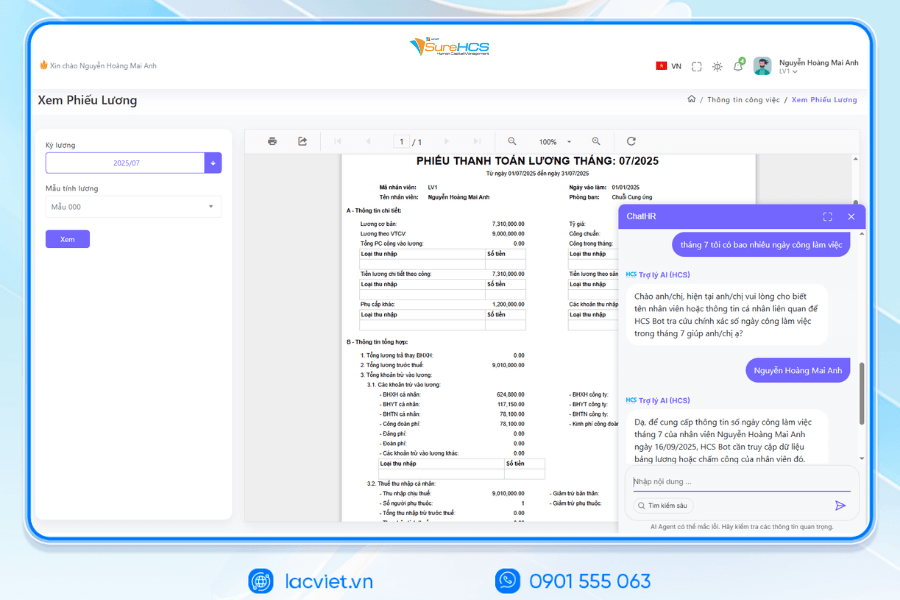

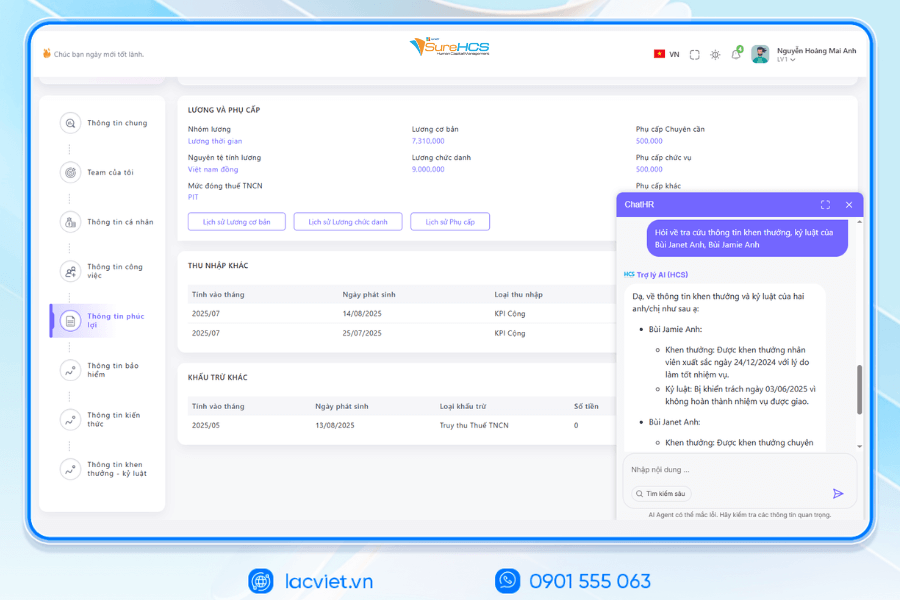

6. Phần mềm chấm công tính lương LV SureHCS hỗ trợ quy đổi tự động

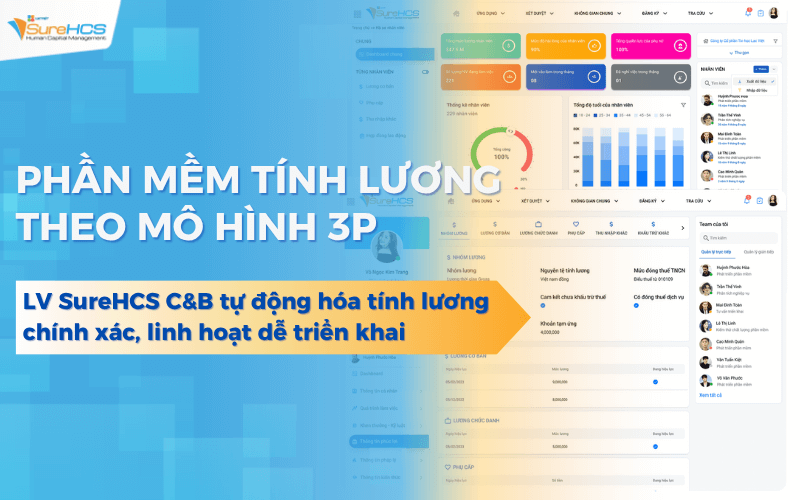

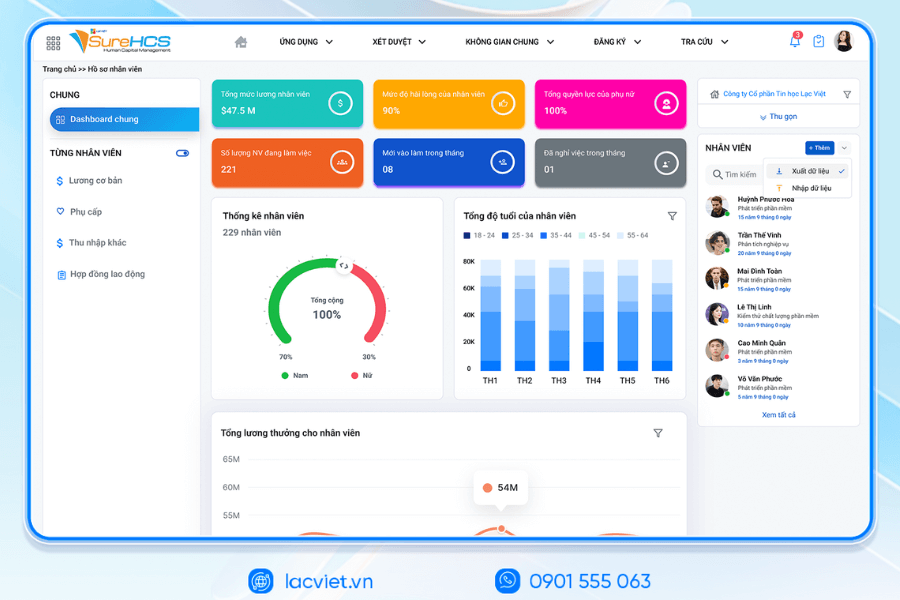

Để giải quyết triệt để các vấn đề trên, ngày càng nhiều doanh nghiệp lựa chọn tự động hóa việc quy đổi lương Net – Gross thông qua phần mềm chấm công – tính lương LV SureHCS

Giá trị lớn nhất mà LV SureHCS mang lại không chỉ là “tính đúng”, mà là tính đúng một cách bền vững có thể mở rộng.

Thứ nhất, tự động tính Net – Gross chính xác nhất quán.

Phần mềm cho phép thiết lập sẵn các quy tắc tính lương theo quy định pháp luật. Khi nhập mức lương Net hoặc Gross, hệ thống tự động:

- Phân tích các khoản bảo hiểm, thuế

- Áp dụng đúng biểu thuế lũy tiến

- Cho ra kết quả nhất quán cho toàn bộ nhân sự

Điều này giúp doanh nghiệp loại bỏ hoàn toàn rủi ro sai công thức thường gặp khi tính thủ công bằng Excel.

Thứ hai, tự động cập nhật chính sách bảo hiểm, thuế.

Thay vì phụ thuộc vào việc nhân sự có cập nhật kịp thời hay không, phần mềm được thiết kế để điều chỉnh theo các quy định mới nhất về:

- BHXH, BHYT, BHTN

- Thuế thu nhập cá nhân

- Mức giảm trừ gia cảnh

Khi chính sách thay đổi, doanh nghiệp không cần làm lại bảng quy đổi lương Net sang Gross từ đầu, mà chỉ cần cập nhật cấu hình một lần cho toàn hệ thống.

Thứ ba, kết nối dữ liệu chấm công, hợp đồng, hồ sơ nhân sự.

Khác với file Excel rời rạc, phần mềm tính lương hoạt động trên một hệ thống dữ liệu tập trung:

- Dữ liệu chấm công ảnh hưởng trực tiếp đến thu nhập

- Thông tin hợp đồng quyết định mức lương đóng bảo hiểm

- Hồ sơ nhân sự xác định người phụ thuộc, thời điểm áp dụng thuế

Nhờ đó, việc quy đổi lương Net sang Gross không còn là một bước riêng lẻ, mà nằm trong một quy trình khép kín, giảm tối đa sai sót do nhập liệu thủ công.

Ở góc độ doanh nghiệp, lợi ích mang lại là rất rõ ràng:

- Kiểm soát chính xác tổng chi phí tiền lương

- Giảm rủi ro pháp lý về thuế, bảo hiểm

- Nâng cao tính minh bạch, giúp người lao động dễ hiểu và tin tưởng vào cách tính lương

Thay vì phụ thuộc vào bảng excel quy đổi lương net sang gross, doanh nghiệp chuyển sang một giải pháp bền vững hơn phù hợp với yêu cầu quản trị hiện đại và quy mô nhân sự ngày càng lớn.

CONVERT THE NUMBER OF PERSONNEL WITH COMPREHENSIVE LAC VIET SUREHCS

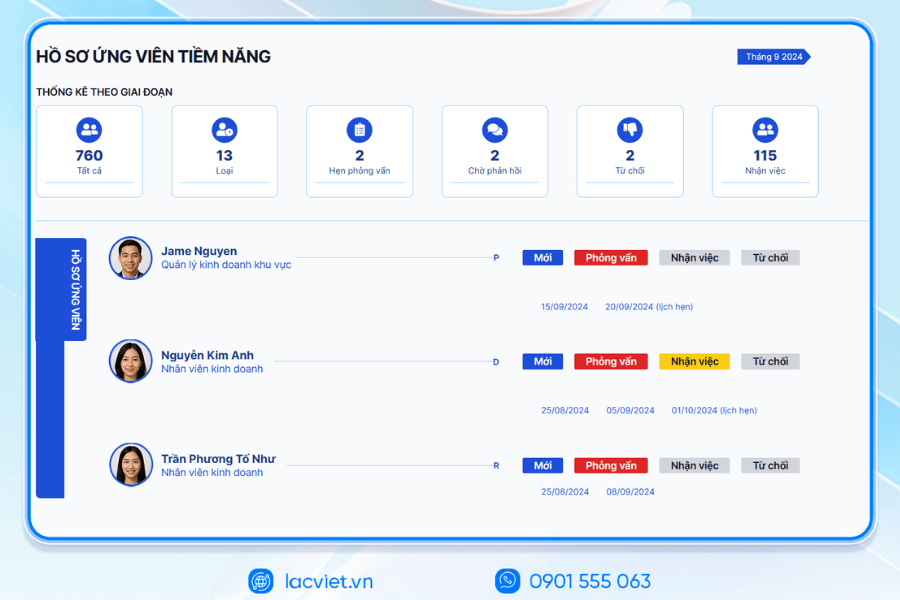

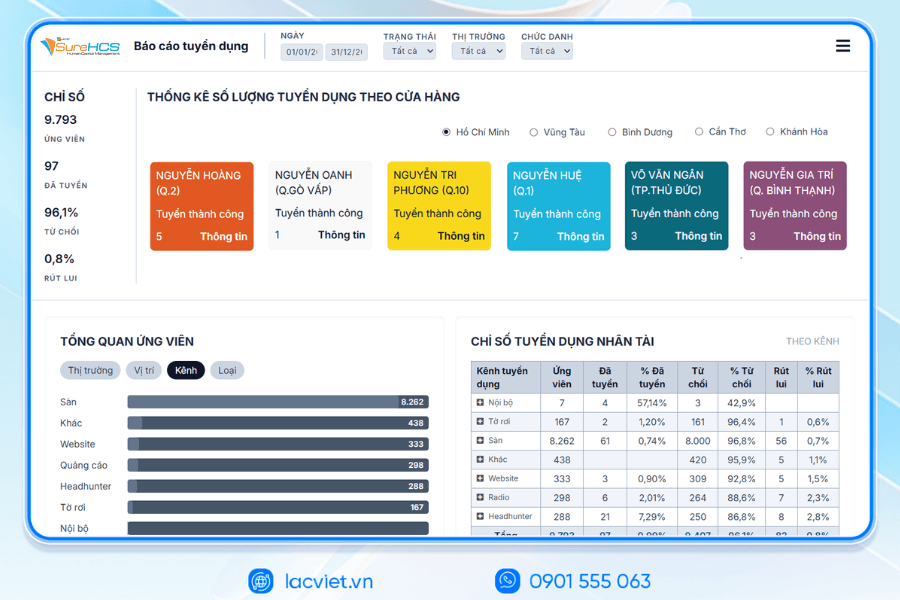

LV SureHCS is the solution in hrm comprehensive (HRM) is developed by Lac Viet from 1998, now serves more than 1,000 businesses in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013. Platform help of optimized every aspect from recruitment to employment, improve the experience of staff and effective management of resources.

Feature highlights:

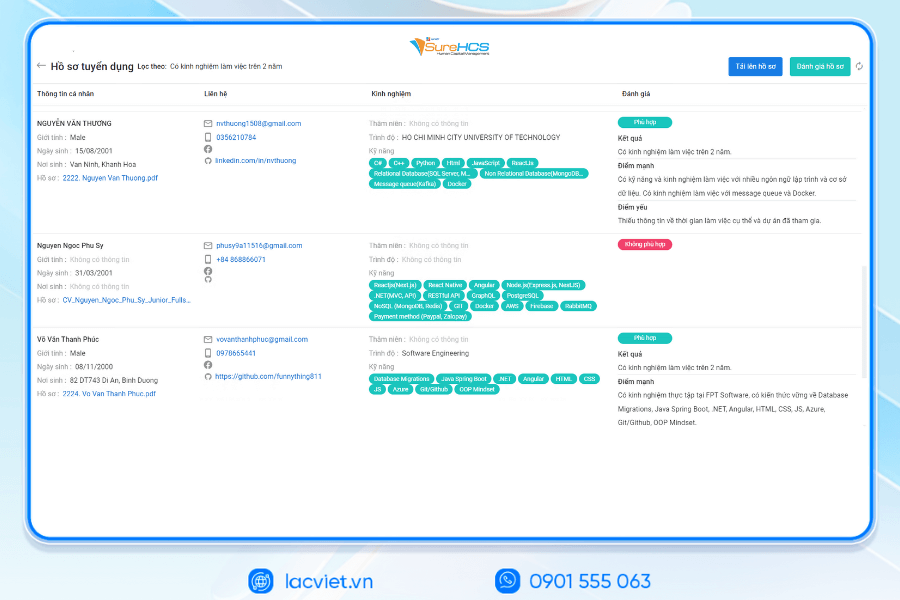

- Candidate Pool AI + AI Resume: automatic dissection CV any format, search for suitable candidates instant, a 70% increase quality, reduce recruitment time significantly

- Timekeeping software – payroll – C&B auto: integrated benefits, overtime, insurance, export report, payslip correct for business scale up to 10,000 employees

- Experience hr – wallet reward – ranking behavior – survey periodically: internal management, honor, mounted staff in real time.

- Assessment and capacity development: KPI/OKR flexibility, feedback 360°, the proposed route train personalization according to the evaluation results

- Internal training & LMS integrated AI: learning anytime, anywhere, content management, multi-modal with personalization from AI

- Dashboard BI + AI Advisor: real-time reports, suggestions leadership decisions based on data resources.

INTEGRATED AI ACCELERATION CONVERTER OF PERSONNEL

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

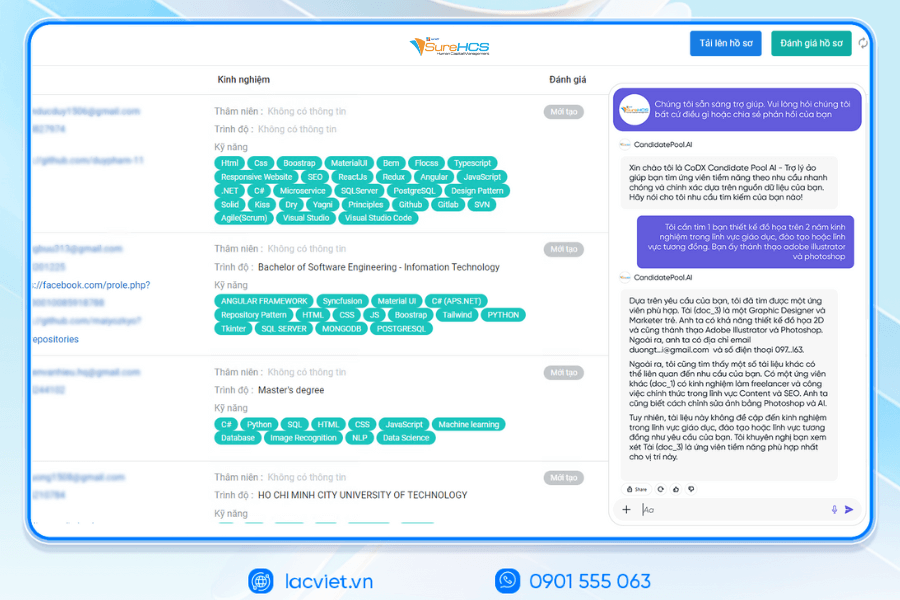

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS ARE DEPLOYING LV SUREHCS

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SIGN UP TO RECEIVE DEMO NOW

BUSINESS IS WHAT WHEN DEPLOYING SOFTWARE LAC VIET SUREHCS?

- Comprehensive solutions from A‑Z cover the entire process of HR from recruitment, profile, attendance, payroll, benefits, training, reviews, experience staff

- Highly customizable & flexible connection to suit any scale, industry, easy to connect with ERP, finance, office of chemical

- Save cost & performance enhancement help to lose 40-60% of the cost of operating personnel, retain talent, improve the work efficiency

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: [email protected] | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Hope with detailed instructions and Excel convert Net salary to Gross be shared in the article, workers and businesses would be easier in determining the salary matching, transparent and strictly regulated. The use of support tools such as software-payroll – benefits manager LV SureHCS C&B will help businesses automate the process of calculation, withholding and reporting quickly and accurately. Don't forget to download Excel sheet for free here to apply now on the monthly salary.